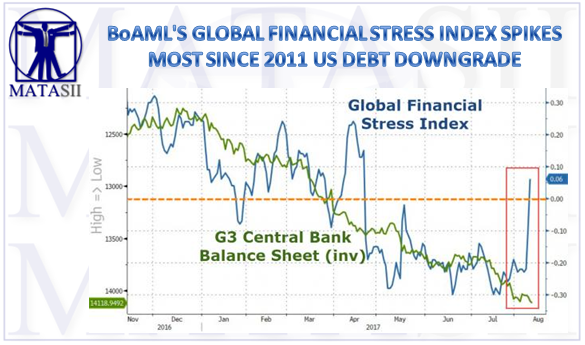

BoAML'S GLOBAL FINANCIAL STRESS INDEX SPIKES MOST SINCE 2011 US DEBT DOWNGRADE

For the first time in four months, BofAML's Global Financial Market Stress index has turned positive - signalling more market stress than normal.

As the spat between North Korea and the U.S. worsened, a measure of cross-asset risk, hedging demand and investor flows awakened from its torpor (after spending 78 straight days below zero - with stress below normal).

The problem the world faces is... did the world's central bank money-printing safety net just lose its plunge protection power?

For context, this is the biggest spike in the Global Financial Stress Index since the US ratings downgrade in August 2011 - and a bigger shock than the August 2015 China devaluation...

Sunday night futures should be fun: potential war with North Korea, potential war with Venezuela, trade war with China, and civil war looming at home.