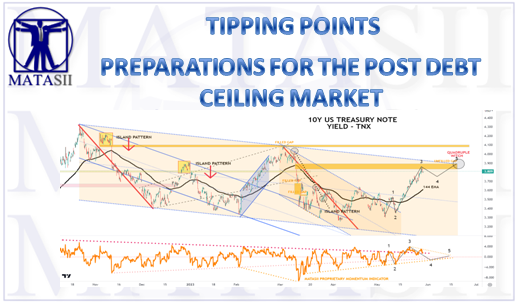

Gordon T Long Global Macro Research | Macro-Technical Analysis tipping points BOND MARKET PREPARATIONS FOR THE POST DEBT CEILING MARKET The current Debt Ceiling wrangling will soon be resolved with the result being (as always) a dramatic increase in the debt ceiling. The establishment of a US debt ceiling has long been meaningless other […]

TP Bond Bubble

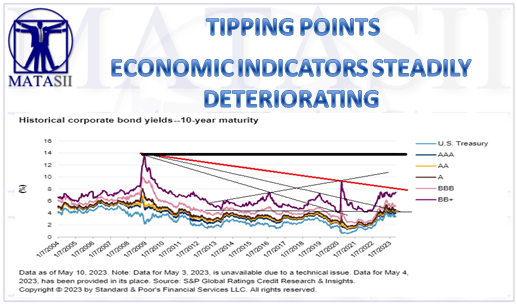

ECONOMIC INDICATORS STEADILY DETERIORATING

Gordon T Long Global Macro Research | Macro-Technical Analysis tipping points BOND MARKET ECONOMIC INDICATORS STEADILY DETERIORATING This week we do a deep dive into the deluge of economic indicators to see if there is consistent message signalling the realities of an imminent US Recession. THERE WAS! The only good news we witnessed was […]

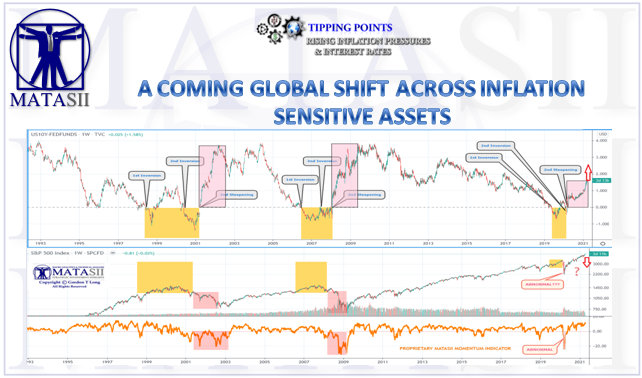

A COMING GLOBAL SHIFT ACROSS INFLATION SENSITIVE ASSETS

Gordon T Long Global Macro Research | Macro-Technical Analysis TIPPING POINTS RISING INFLATION A COMING GLOBAL SHIFT ACROSS INFLATION SENSITIVE ASSETS We have been arguing that though Inflation pressures are clearly with us, many of the underlying drivers are associated with bottlenecks in the ‘just-in-time’ (no inventory) global supply chains restarting from Covid-19 lock-downs. […]

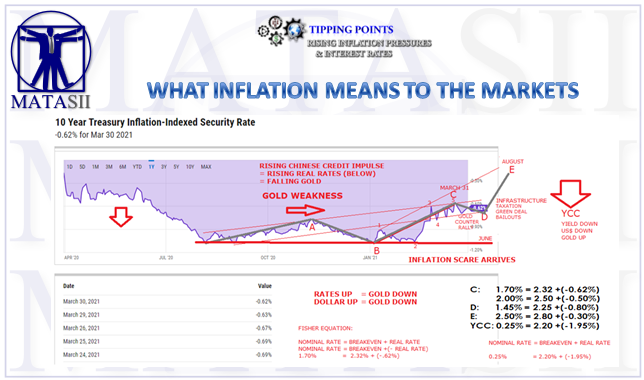

WHAT INFLATION MEANS TO THE MARKETS?

Gordon T Long Global Macro Research | Macro-Technical Analysis TIPPING POINTS RISING INFLATION WHAT INFLATION MEANS TO THE MARKETS We are presently caught in what has become a manic concern that inflation is approaching like a looming tidal wave. There is little doubt that Inflation continues to grow and broaden in scope. However, the […]

WHAT DO REAL YIELDS TELL US ABOUT YELLOW & BLACK GOLD?

Gordon T Long Global Macro Research | Macro-Technical Analysis STRATEGIC INVESTMENT INITIATIVES COMMODITIES – HARD ASSETS WHAT DO REAL YIELDS TELL US ABOUT YELLOW & BLACK GOLD? Today, official Inflation Breakeven is the forecast that is derived from the difference between the yields on inflation-linked and fixed bonds of a given maturity or as […]

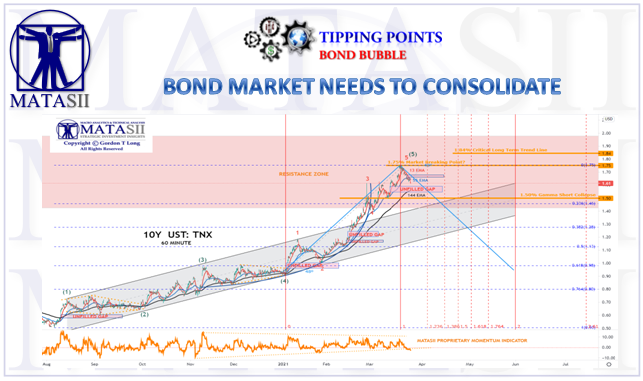

BOND MARKET NOW NEED TO CONSOLIDATE

Gordon T Long Global Macro Research | Macro-Technical Analysis TIPPING POINTS BOND BUBBLE BOND MARKET NEEDS TO CONSOLIDATE BOND MARKET NEEDS TO CONSOLIDATE The historic lift in bond yields has rapidly changed the investment landscape. Bond holders have experienced ~3.7% losses so far in 2021. It has been one of the worst year-beginning starts […]

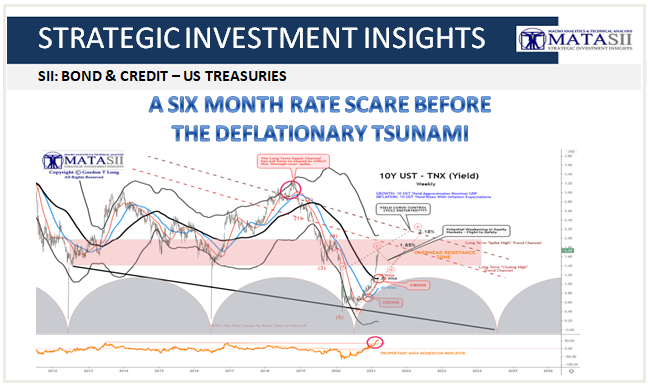

A SIX MONTH RATE SCARE BEFORE THE DEFLATIONARY TSUNAMI

Gordon T Long Global Macro Research | Macro-Technical Analysis STRATEGIC INVESTMENT INITIATIVES BONDS & CREDIT IS THIS A RATE SCARE RATHER THAN A ‘TRANSITORY’ INFLATION SCARE? What exactly are we afraid of? It was always a safe bet that there would be an inflation scare at some point early this year. Just the base […]

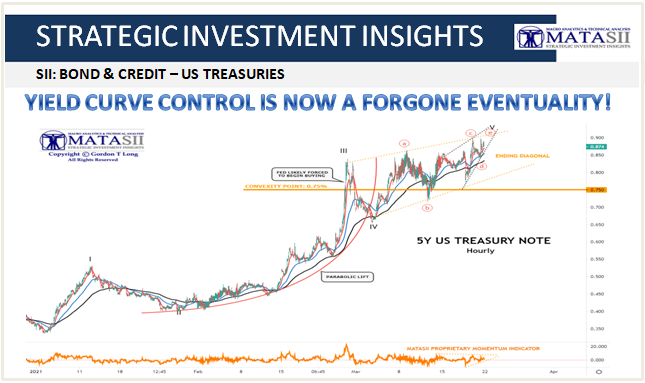

YCC IS NOW A FORGONE EVENTUALITY!

Gordon T Long Global Macro Research | Macro-Technical Analysis STRATEGIC INVESTMENT INITIATIVES BONDS & CREDIT YCC IS NOW A FORGONE EVENTUALITY! You can only play so many games before you are often trapped in a situation of your own creation. This is the situation the Fed finds itself in. Nothing makes this clearer than […]

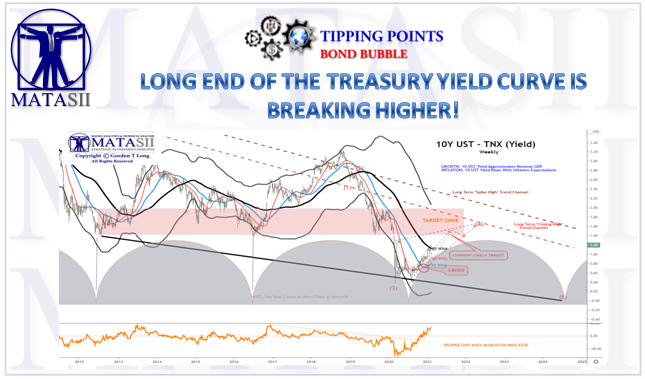

LONG END OF THE TREASURY YIELD CURVE IS BREAKING HIGHER!

Gordon T Long Global Macro Research | Macro-Technical Analysis TIPPING POINTS BOND BUBBLE LONG END OF THE TREASURY YIELD CURVE IS BREAKING HIGHER! Right on-time US Treasury Yields are spiking higher, as we have been warning of in prior newsletters. As we outlined, this Is a result of the correlation since 2008 with the […]