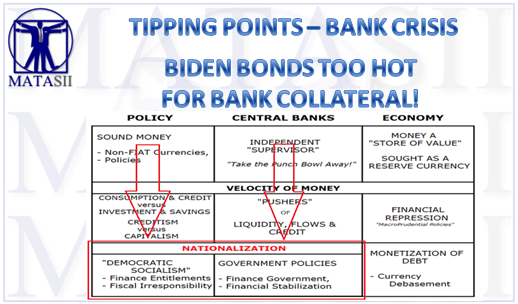

Gordon T Long Global Macro Research | Macro-Technical Analysis TIPPING POINTS US BANKING CRISIS BIDEN BONDS TOO HOT FOR BANK COLLATERAL! The net of the current banking crisis is that: 1 – Biden’s Spending => 2 – Inflation => 3 – Exploding Yields => 4 – The Instability of Banks’ Core Stabilizing Asset […]

GTL MATA

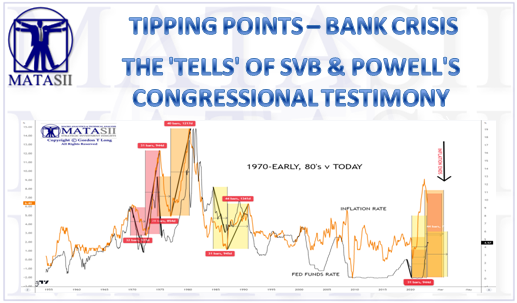

THE ‘TELLS’ OF SVB & POWELL’S CONGRESSIONAL TESTIMONY

Gordon T Long Global Macro Research | Macro-Technical Analysis TIPPING POINTS US BANKING CRISIS THE ‘TELLS’ OF SVB & POWELL’S CONGRESSIONAL TESTIMONY When the US’ 16th largest bank fails with $169B in uninsured deposits not covered by FDIC on a total asset base of $200B, markets panic! The collapse of the Silicon Valley Bank […]

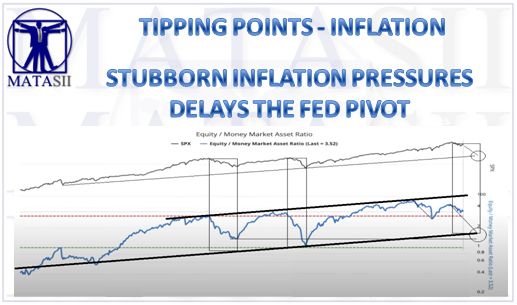

STUBBORN INFLATION PRESSURES DELAYING FED PIVOT

Gordon T Long Global Macro Research | Macro-Technical Analysis TIPPING POINTS INFLATION PRESSURES STUBBORN INFLATION PRESSURES DELAYING FED PIVOT Weakening Inflation is not sticking to the script by coming down relatively quickly. Instead it is universally stubbornly coming in higher than expectations and actually increasing on a M-o-M basis. This isn’t just a US […]

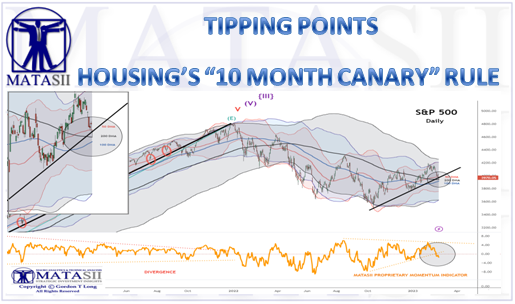

HOUSING’S “10 MONTH CANARY” RULE

Gordon T Long Global Macro Research | Macro-Technical Analysis TIPPING POINTS HOUSING & EMPLOYMENT HOUSING’S “10 MONTH CANARY” RULE The US Housing sector is one of the pillars of the US Economy. When the US Housing sector experiences serious disruption it can be expected to result in earning contraction in ~10 months. Housing is […]

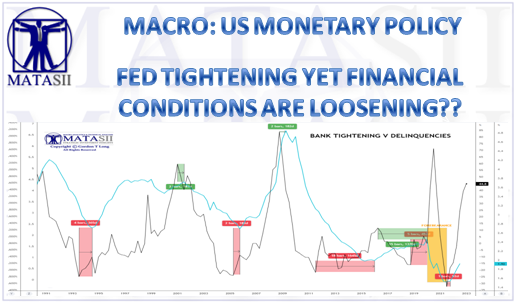

FED TIGHTENING YET FINANCIAL CONDITIONS ARE LOOSENING??

Gordon T Long Global Macro Research | Macro-Technical Analysis MACRO US MONETARY POLICY FED TIGHTENING YET FINANCIAL CONDITIONS ARE LOOSENING?? One of the objectives we have in writing this weekly newsletter is to share with you our macro and market insights. We thought it important to address a confusion we are hearing on how […]

“TOLL BOOTHS” NEAR COMPLETION

Gordon T Long Global Macro Research | Macro-Technical Analysis MATA RISK “TOLL BOOTHS” NEAR COMPLETION Perhaps most troubling to me currently is the precipitous drop in real disposable income, which fell over $1 trillion in 2022. For context, this is the second-largest percentage drop in real disposable income ever, behind only 1932, the worst year […]

SHIFTING MULTI-POLAR PILLARS

Gordon T Long Global Macro Research | Macro-Technical Analysis MACRO GLOBAL GEO-POLITICS SHIFTING MULTI-POLAR PILLARS In this month’s UnderTheLens video (right), we outlined six major Macro Themes for 2023. One of these themes was the mounting Geo-Political pressures associated with the fallout of the shift to a multi-polar world. A development we first wrote […]

WEALTHION: A MACRO SITUATIONAL ANALYSIS OF THE MARKETS

WEALTHION: A MACRO SITUATIONAL ANALYSIS OF THE MARKETS INTERVIEW: 1 Hour, 3 Minutes Debt Crisis To Trigger Hard Landing & Painful Recession? The US has a debt problem. It has grown its debt far faster than the national income for decades. Over time, this has ballooned the annual fees in interest that the US must […]

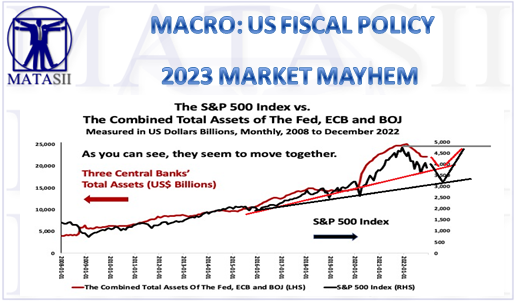

2023 MARKET MAYHEM

Gordon T Long Global Macro Research | Macro-Technical Analysis MACRO US FISCAL POLICY 2023 MARKET MAYHEM 2500 years ago, Aristotle wrote that “virtue” is the balance between Courage and Prudence. That is the challenge of our questionably virtuous elected legislative politicians in addressing the 2023 Debt Ceiling fight. The Debt Ceiling has become a […]

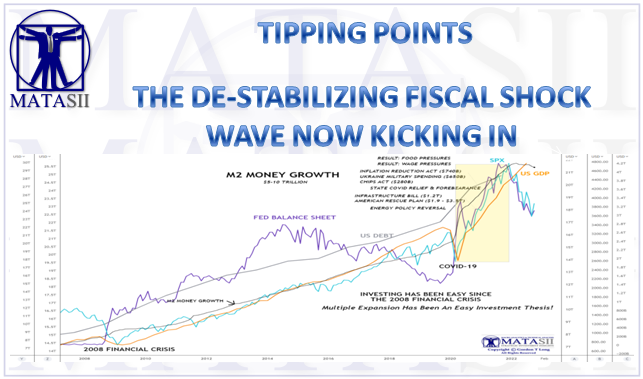

THE DE-STABILIZING FISCAL SHOCK WAVE NOW KICKING IN

Gordon T Long Global Macro Research | Macro-Technical Analysis TIPPING POINTS MARKET RISK THE DE-STABILIZING FISCAL SHOCK WAVE NOW KICKING IN The spending and public policies implemented under the auspices of a Coivd-19 recovery are only now being felt. Rather than achieving their intended purpose, they are resulting in a de-stabilizing shock to the […]