Problems in China are looming on top of an already very tenuous and misunderstood situation in the US Financial Markets. Additionally, Federal Reserve Policy has made the situation even more combustible!

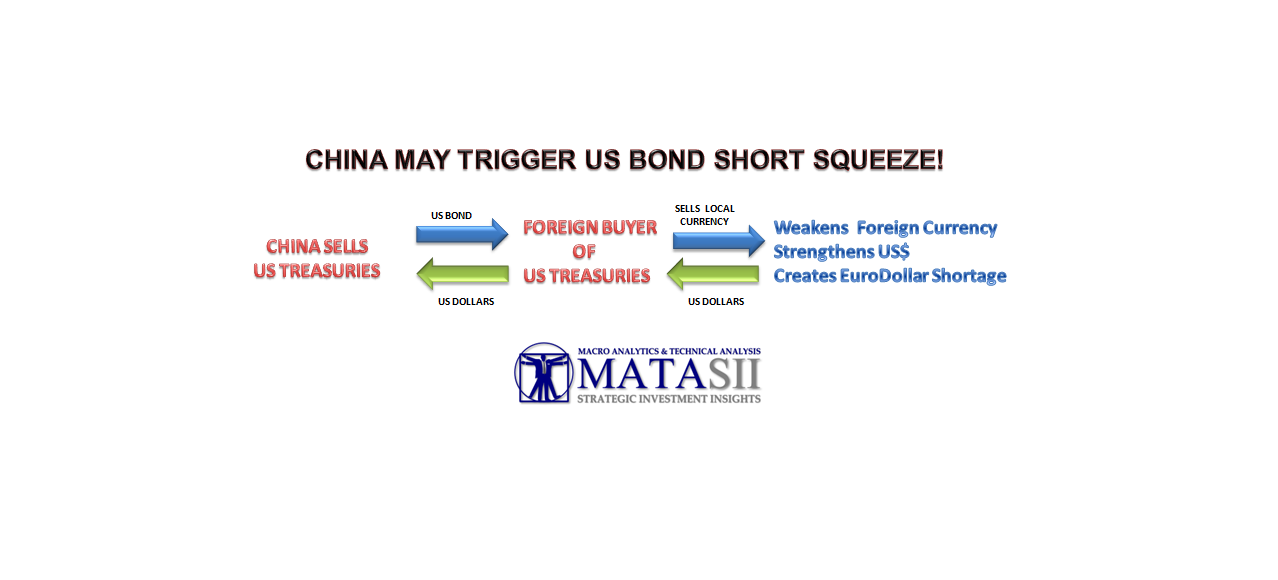

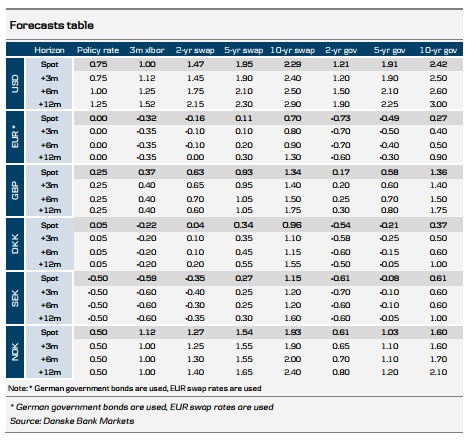

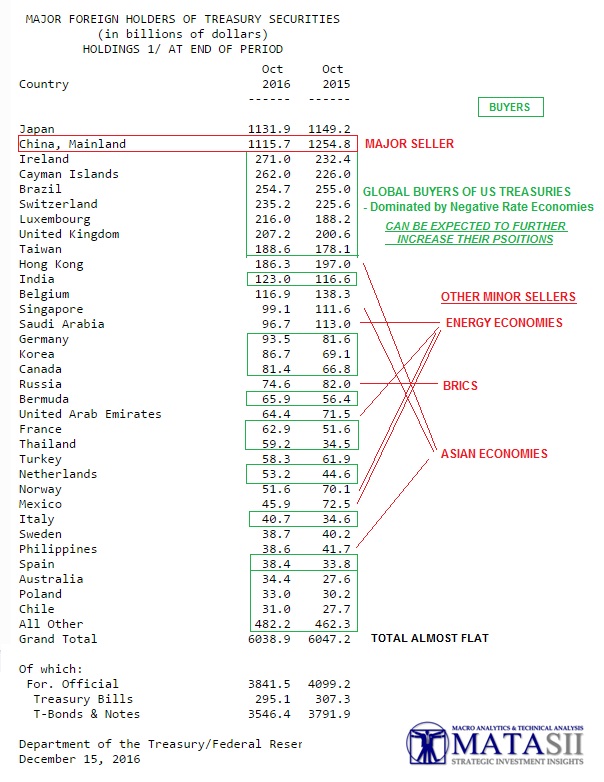

As a result of a Trump Victory inspired bond market massacre there are now few places that a yield starved world can presently find better risk-adjusted yields than in US Treasuries. With China now being forced to sell their FX Reserves and thereby creating the much needed supply so eagerly craved by foreign investors, it is also further depleting an already restricted EuroDollar pool required to buy this supply. There are consequences of this combination of shifting global economic pillars.

The Obama administration had been quite successful in orchestrating and limiting Treasury supply, thereby assisting the Fed in driving yields lower! That is all potentially about to rapidly change. In fact, the match may have already been lit!

AN EXTREMELY TENUOUS SITUATION

Though US Bond Yields are likely to head higher later in the year as Trumponomics unfolds, there are some serious and unexpected imbalances that must be corrected in the near term.

The imbalances have all the ingredients for a short squeeze which triggers a classic equity-bond "rotation".

PRESENTLY BEING MADE MUCH WORSE BY FED POLICY!

IN A NIRP WORLD (~$12T)

THE RISK-ADJUSTED, DOLLAR DENOMINATED US TREASURY HAS SUDDENLY BECOME THE HOLY GRAIL!

MEANWHILE MONEY IS FLEEING CHINA ANYWAY IT CAN - DESPITE FUTILE CAPITAL CONTROL ATTEMPTS.

CHINA IS TRAPPED AND IS NOW BEING FORCED TO SELL US FX RESERVES

Reserve requirements are being lowered alongside falling FX reserves. These are coordinated in order to mitigate negative effects from changes in the domestic money supply.

Goldman calculated the true amount of Chinese FX outflows and ZeroHedge reported:

Goldman found that Beijing has continued to mask the full extent of its capital flight, which in November spiked to $69 billion (well above the reported, currency adjusted number of $34 billion). Furthermore, it found that "since June, this data has continued to suggest significantly larger FX sales by the PBOC than is implied by FX reserve data."

Even more troubling, Goldman calculated that cumulatively since August 2015 through November 2016, FX outflow totaled roughly US$1.1 trillion, while implied FX sales suggested by PBOC’s FX position (headline reserves after adjusted for currency valuation effect) were approximately US$630bn (US$540bn), indicating that the real rate of reserve depletion was nearly double that represented by PBOC reserve data.

Exhibit 1: FX outflow picked up to US$69bn in November

Why would China try to misrepresent the full extent of its currency outflows?

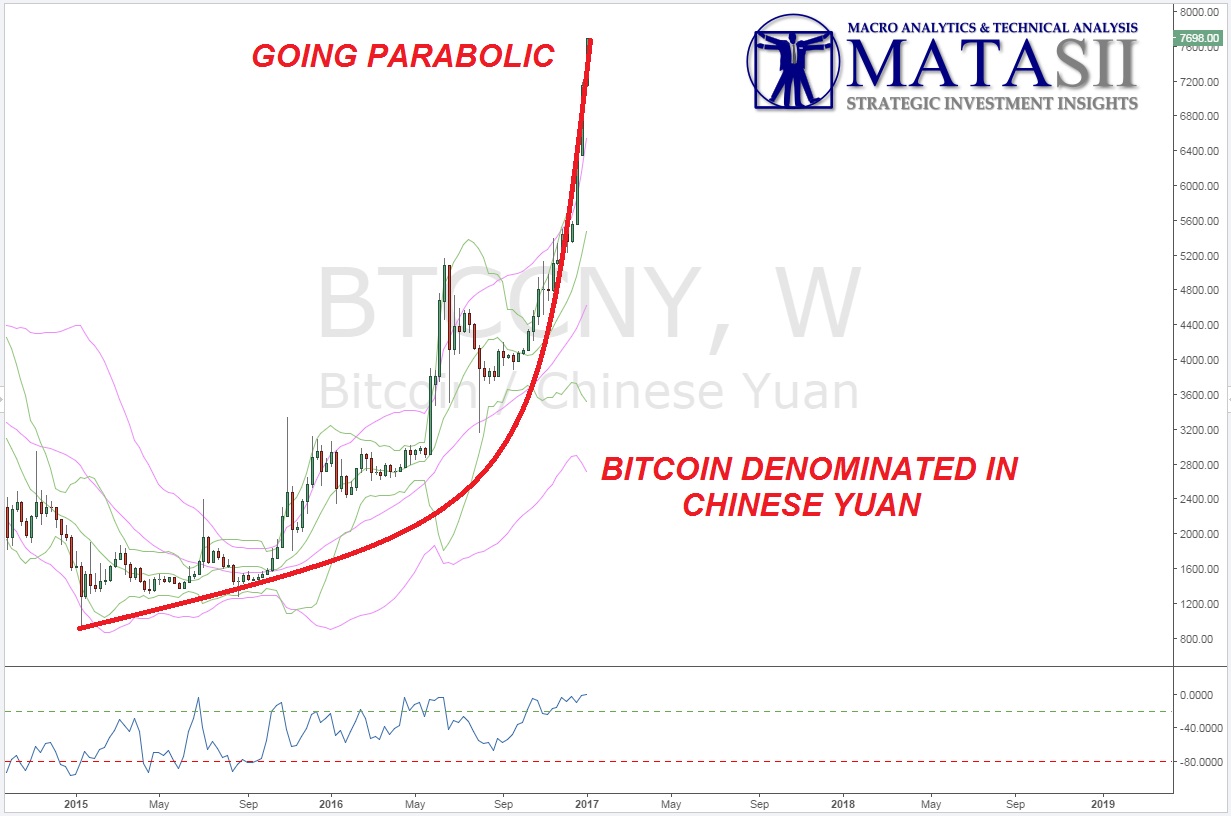

Simple: it is an ongoing attempt by the PBOC to not precipitate the feedback loop of even further panicked selling of Yuan, even greater purchasing of Bitcoin, even more outflows, and thus, even more reserve depletion.

And while we have yet to obtain the December FX data from SAFE, overnight the PBOC reported that in December China's reserves fell a further $41.1 billion, exactly in line with expectations, reducing China's total reserves to $3.01 trillion, the lowest number in six years, and just fractionally above the $3 trillion cited by various analysts as the key support level below which any further capital outflow would become self-reinforcing. According to a statement by SAFE on Saturday, the December decline in FX reserves was mainly because the central bank supplied funds to maintain balance in the foreign exchange market and the depreciation of non-U.S. dollar currencies. For the full year of 2016, the SAFE said the central bank’s effort to stabilize the yuan was the key reason for the drop in reserves.

That said, when considering the discrepancy with SAFE data, it is likely that the true level of Chinese reserves is now well below $3 trillion, as a simple correlation with China's plunging Yuan demonstrates.

To be sure, China will likely take additional measures to keep its foreign-currency stockpile from slipping too far below the key $3 trillion mark - or whatever the real level of reserves is - to avoid further hurting investor confidence and spurring further declines in the yuan, according to economists at major banks cited by Bloomberg.

CHINA'S MERCANTILE, EXPORT LEAD STRATEGY MAY HAVE NO OTHER WAY OUT IN THE NEAR TERM!

You may want to read a more technical analysis we recently published entitled: A BROKEN BOND BOUNCE BECKONS!

We stress this is a near term situation only, because longer term the more supply that comes to market the lower US Treasury prices and the higher the yield to move them!

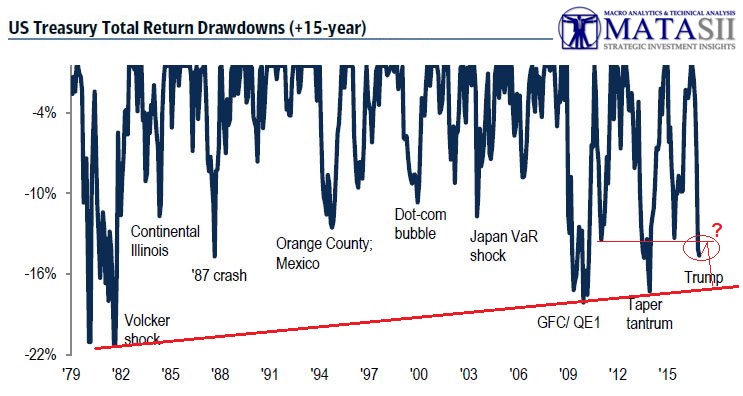

Minimally though we need to correct this draw-down somewhat:

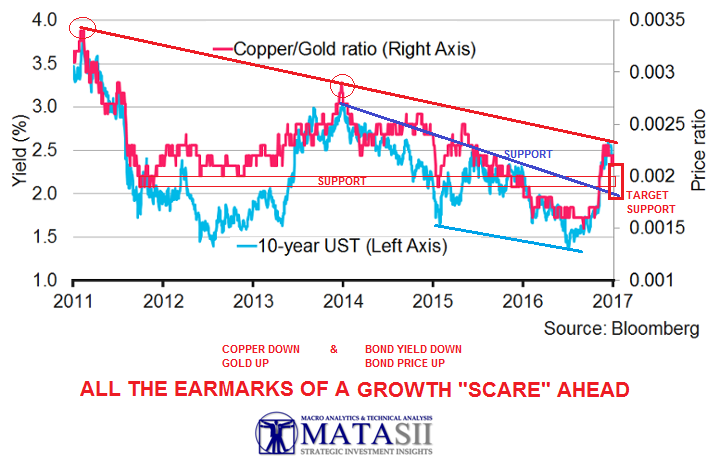

ALL THE EARMARKS OF A "GROWTH" SCARE AHEAD