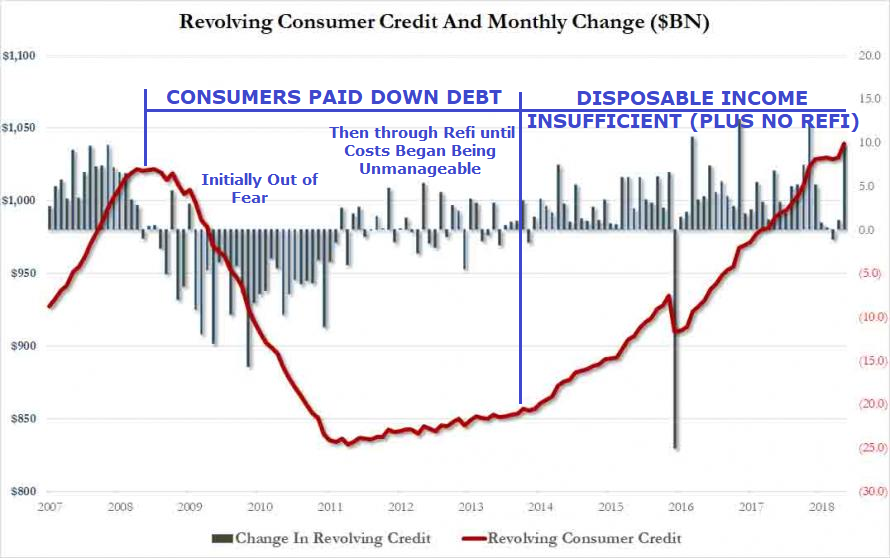

CONSUMER CREDIT GROWTH SUSTAINING CRUMBLING REAL DISPOSABLE INCOME

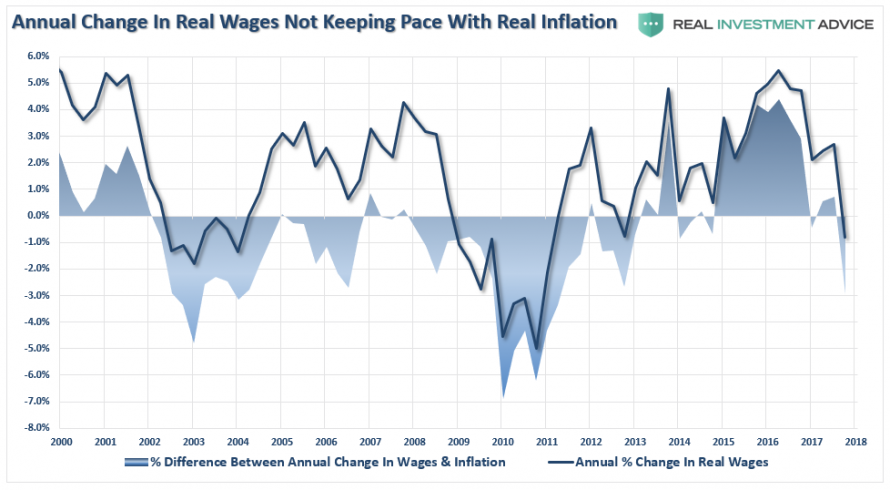

Here is what is happening...

Here is what US consumers have been forced to do....

It is now getting worse - fast!

It doesn't take a "rocket scientist" to see the problem!!

-- SUPPORTING SOURCE: 07-09-18 ZeroHedge - "Consumer Credit Explodes Higher As Credit Card Debt Hits New All Time High" --

After a sharp slowdown in the growth of US consumer credit in the last month of 2017 and in the first 4 months of 2018, in May, consumer credit exploded higher, soaring from $10.3BN in April to $24.6BN in May, smashing expectations of a $12BN monthly increase.

This was the biggest beat of recently subdued expectations going back all the way to July 2011.

Looking at the components of the spike, some $14.8BN came from non-revolving, or student and auto loans, well above last month's $9.2BN and the highest number going back to November 2017, pushing total non-revolving credit to a record $2.858 trillion ...

... but it was revolving credit that impressed, soaring by $9.8 billion, the biggest monthly increase since November, and one of the highest monthly increases on record.

The sharp monthly jump ended the recent period of skittish credit card spending with a bang, and pushed the total revolving credit to a new all time high of $1.39 trillion.

While there is no immediate explanation for the spike in credit spending by US consumers whose savings rate is already near record lows, it may have to do with greater confidence in the economy and the capital markets. It may also explain the resilience of the US economy in the second quarter which according to high-frequency indicators has now shifted over into Q3.

As usual, the question is whether this burst of credit-card funded optimism is a one-time event, or if US consumers have once again unleashed a debt-fueled spending spree. If the latter, it will likely sustain personal consumption well into the third quarter, however with the obligatory giveback when households receive their surprisingly high credit card statement, which thanks to rising rates, now also happen to carry the highest interest rates since the financial crisis.