FUNDAMENTALS: MARKET NO LONGER DIFFERENTIATES "GOOD COMPANIES" FROM "BAD ZOMBIE COMPANIES"

$20 trillion in global liquidity has turned:

- Bears into bulls,

- Shorts into longs,

- Rendered the distinction between "bad" companies and "good" companies irrelevant as far as share prices are concerned, and

- Driven cross-asset volatility so low that banks are now clamoring for a piece of the cryptocurrency pie.

BAD COMPANIES VERSUS GOOD COMPANIES

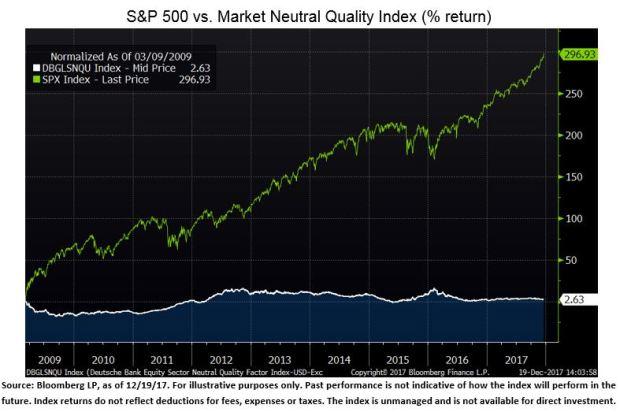

The following chart comes courtesy of Epsilon Theory's Ben Hunt via "The Heisenberg".

(Bloomberg, Ben Hunt)

Here's Ben explaining what that is:

The green line is the S&P 500 index. The white line below is a Quality Index sponsored by Deutsche Bank. They look at 1,000 global large cap companies and evaluate them for return on equity, return on invested capital, and accounting accruals … quantifiable proxies for the most common ways that investors think about quality. Because the goal is to isolate the Quality factor, the index is long in equal amounts the top 20% of measured companies and short the bottom 20% (so market neutral), and has equal amounts invested long and short in the component sectors of the market (so sector neutral). The chart begins on March 9, 2009, when the Fed launched its first QE program.

You should immediately understand what Ben is trying to convey there. The rising tide of central bank liquidity has lifted all boats. The "quality-ness" of a given company is now meaningless.

The "quality" stocks in your portfolio have risen, but so has everything else. The QE dynamic (supercharged by buybacks and passive flows) is indiscriminate. As Ben goes on to note:

Central banks don’t care about rewarding 'good' companies. In fact, if they care about anything on this dimension, they care about keeping 'bad' companies from going under.

In addition to underscoring the point I've made repeatedly about how QE is part and parcel of what I've variously described as the "wave" dynamic, that last quote also betrays one of the unintended consequences of QE and accommodative monetary policy more generally. Namely that while it is designed to be inflationary, it is in some cases deflationary because it creates zombie companies whose supply stays on the market when it should be purged (think: U.S. shale and oil prices).

One more thing on that chart and those quotes. That is another case where you should think long and hard about who it is you're implicitly arguing with if you are steadfastly refusing to acknowledge the impact of $20 trillion in central bank liquidity on risk assets. If you don't know Ben, you should familiarize yourself - he's one smart guy.