IN-DEPTH: TRANSCRIPTION - GLOBAL RISK - TIPPING POINTS UPDATE

COVER

It is Wednesday July 24th, 2019 I'm Gord Long.

As is normally the case, we have a lot of charts for us to go through, so therefore we will pass over some of them quickly BUT leave you to examine them further at your leisure.

You will need to open your viewer to full screen viewing or you will not be able to see some of the detail I will be discussing in the charts.

A REMINDER BEFORE WE BEGIN: DO NO NOT TRADE FROM ANY OF THESE SLIDES - they are for educational and discussions purposes ONLY.

AGENDA

This month I would like to update our Tipping Points as part of our Tri-Annual Global Risk Developments.

As such I would like to discuss the areas highlighted here.

SLIDE 5

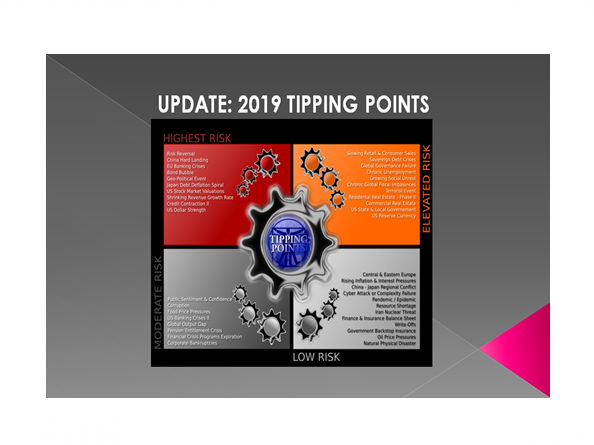

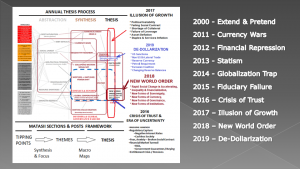

At mid year we felt it was time to update our 2019 Tipping Points.

As has become the pattern over the last 10 years we continue to see the overall number of Tipping Points increasing.

The bottom line for this is problems are not being resolved but rather are being papered over by our leaders while the problematic "cans" continues to be “kicked-down-the-road”!

The number of Tipping Points has been increased by six this year to a total of 50. When we first started this research methodology there were less than half this number which in itself is quite telling!

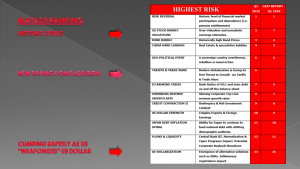

SLIDE 6

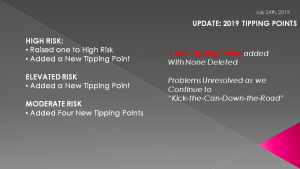

The high risk category also continues to rise in number. Both a new Tipping Point and an addition to the overall number of Tipping Points is number 6: Tariffs and Trade Wars.

Modern Globalization is facing its first threat to growth via Tariffs and Trade Wars with the actions of US President Donald Trump. It has been close to 100 years since the last period when tariffs and trade war were perceived as effective policy initiatives. Time will tell if its proven record of failure is different this time.

At number 13 is “De-Dollarization”. The Weaponization of the US dollar via sanctions is forcing increasing numbers of countries to reduce their US dollar reserve holdings and look for safer alternatives. As we spelled out in this years Thesis paper we believe this trend will have profound global ramifications over the next 10 years as the dollar as the global reserve currency and the US Treasury Bond as the global “risk free” datum become fragile and no longer offer the global financial security they once had.

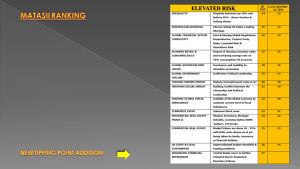

SLIDE 7

Our 2012 Thesis paper on “Financial Repression” outlined the Macroprudential Economic policies that have come to be labeled “Financial Repression”. It fostered me co-founding the Financial Repression Authority and its web site which tracks these developments. QE, QQE, MMT et al have taken Global Economic thinking & policies into completely untested and dangerous waters. We have added “Advancing Financial Repression” as a new Tipping Point since we foresee even more bazaar policies in an attempt to forestall an inevitable fiat currency collapse

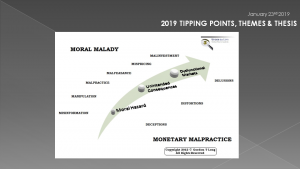

SLIDE 8

The damage these reactive policies is doing in underpinning the capitalist system is something I have personally been writing on since the Financial Crisis and can only be described as “Monetary Malpractice’!

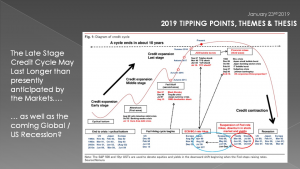

SLIDE 9

But the central bankers in my opinion are still early in using tools to extend and manipulate the economic, business and credit cycles in an effort to stop an over-leveraged economy from collapsing as the Debt Super-Cycle comes to an end.

SLIDE 10

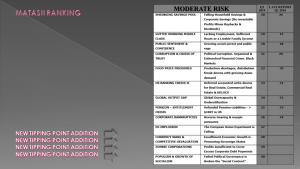

In the area of moderate risk we have added four new Tipping Points at numbers 37 through 40.

#37: The European Union experiment is proving to be a failure with cracks and political discourse evident across the EU. We believe the EU Banking system is in a perilous situation (#7 Tipping Point) and will only add to separation like Brexit, Italian fiscal compliance issues, emergence of anti-EU political parties and tax revolts like the yellow jackets in France.

#38: Insufficient Global Economic growth is pressuring sovereign states to resort to competitive currency devaluations. This will only get worse.

#39: The growth of Zombie Corporations is unparalleled in history. When 10-20% of global corporation now have to borrow to pay the interest on their over leveraged balance sheets we know something is seriously wrong. Bankruptcy of one corporation can have a contagion effect. Bad debt would have to be written off. Instead of “Too Big to Fail” we now have “Too Many to Fail”!

#40: The electorate across the globe are losing confidence in the system and their political leadership. Failed political Governance has broken the unwritten “Social Contract” between the electorate and their political ruling class.

SLIDE 11

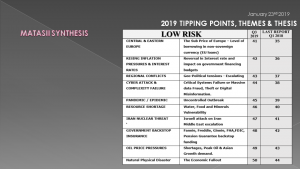

The Low Risk Tipping Points had no changes but are all only simmering and any one could erupt at any time.

SLIDE 12

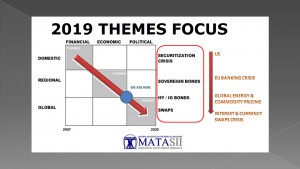

We have been showing this matrix since the Financial Crisis in 2008. At that time we were in the top left box where the Financial Crisis was primarily a US Housing driven crisis but had profound global consequences because the US was still the global economic leader. That has changed in the last 10 years.

Tipping Point have been mutating and growing to become not only regional but global in nature.

We still believe as we did when we first constructed this grid that the ~600T OTC, Unregulated Global Interest & Currency SWAPS market will someday be the Tipping Point that leads to a global fiat currency collapse.

SLIDE 13

That day is still in the future but is increasingly assured that it is coming.

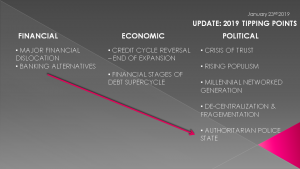

Crisis of Trust in political leadership & governance, rising populism, more authoritarian policies are all political problems we didn’t have 10 years ago.

Not only are the Tipping Points moving from country level to global in nature but from Financial to Political in nature.

Both trends mean future crisis will be significantly more problematic, complex and devastating destructive.

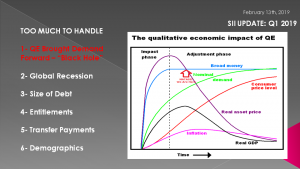

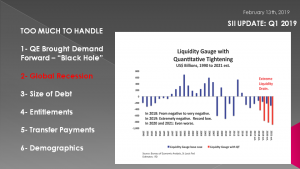

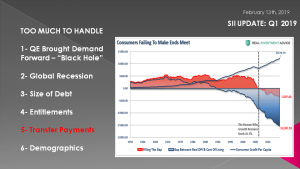

SLIDE 14

We have to face the reality that years of easy money has only brought demand forward leaving a black hole of slowing consumption and over capacity ahead.

SLIDE 15

We kicked the can down the road for so long that many believe the business cycle is dead and recessions won’t occur because of monetary and fiscal actions that can be taken. That is a notion that will soon be left on the trash heap of flawed thinking.

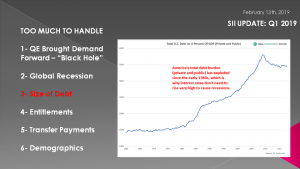

SLIDE 16

As a result of debt growing faster than our underlying economy, America’s debt as a percent of GDP soared from just over 150% in the early-1980's to approximately 350% in recent years. This higher debt burden is the reason why our economy simply cannot handle interest rates as high as they were before 2008. The debt super-cycle is coming to an end under its own weight.

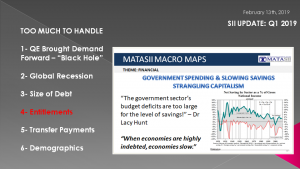

SLIDE 17

We have an $84T unfunded entitlements problem in the US and a $210T Fiscal Gap. Globally underfunded pensions and entitlements amount to close to $400T. These are inextinguishable debt obligations that will create profound financial, economic and political changes in there inevitable resolution.

SLIDE 18

We have built western economies where consumer spending in our new Creditism system (versus our prior Capitalist System) is now dependent on government transfer payments to continue to exist.

We have a gutted dependent middle class that soon will no longer be able to be supported by the existing taxation system.

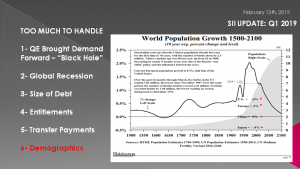

SLIDE 19

Global population growth is falling with profound implications towards growth of consumption and economic viability of existing social policies.

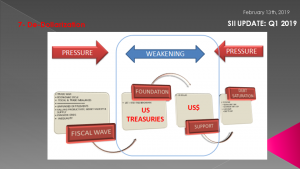

SLIDE 20

The shift of the world from a Uni-Polar world with US economic, political and security leadership is being replaced with a multi-polar world in the context of a New World Order. This will challenge the bedrock that our global financial systems have been built on and are still dependent on.

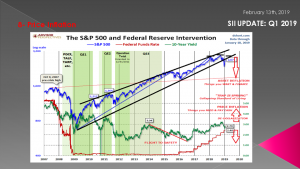

SLIDE 21

We have been living in an era of Globalization and deflation since the turn of the century and the entry of China’s 1.2B workers into the World Trade Organization.

Soon the deflation we have come to depend on regarding Manufactured Goods will slow and possibly reverse. Domestic based Services will become the producer of real Inflation.

Slow growth and inflation engendered in the term “Stagflation” is likely ahead in the years to come where the debt leverage increasing numbers of financial market bubbles will have to be worked off.

SLIDE 22

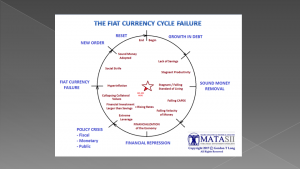

It is too early yet but all indication are that our 2010 Thesis will be entitled “Fiat Failure”.

We have consistently been 3-5 years ahead. Hopefully this will again be the case and give our subscribers time to prepare.

SLIDE 23

The Fiat Currency Failure cycle we put together years ago UNFORTUNATELY continues to track almost exactly as predicted. It is like train on a track with only one destination.

SLIDE 24

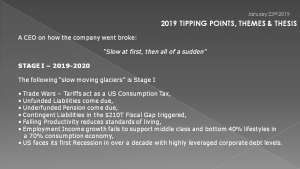

A CEO in describing how his company went broke said: “Slow at first, then all of a sudden”

That is the stage we are currently in;

STAGE I – Likely through this year and next.

The following “slow moving glacier” is what to expect.

- Escalating and broadening Trade Wars & Tariffs which continue to act as a US Consumption Tax,

- Unfunded Liabilities coming due,

- Underfunded Public & Private Pension coming due,

- Contingent Liabilities as part of the $210T Fiscal Gap being triggered in countries that have been dependent on US largess,

- Falling Productivity improvements lowering standards of living as buybacks continue to redirect capital away from productive assets and into Financial Engineering,

- Employment Income growth continuing to devastate the middle class and bottom 40% lifestyles within a US 70% based consumption economy,

- The US facing its first Recession in over a decade with historic levels of leveraged corporate debt.

SLIDE 25

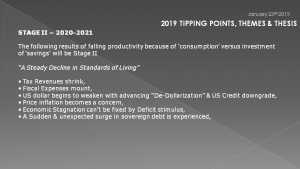

STAGE II – Likely between late 2020-2021

The US and most developed economies will experience a “A Steady Decline in Standards of Living”

- Tax Revenues will continue to shrink,

- Fiscal Expenses will mount,

- US dollar will begin to weaken with advancing “De-Dollarization” & US Credit downgrade,

- Price inflation will become a real concern,

- We will realize that Economic Stagnation and Stagflation can’t be fixed by Deficit stimulus,

- We will experience a sudden & unexpected surge in sovereign debt levels which can't be financed,

SLIDE 26

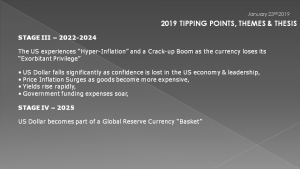

STAGE III – Between 2022-2024

The US begins to experience “Hyper-Inflation” and a Crack-up Boom as the currency loses its “Exorbitant Privilege”

- US Dollar falls significantly as confidence is lost in the US economy & leadership,

- Price Inflation surges as goods become more expensive,

- Yields rise rapidly,

- Government funding expenses soar to unmanageable levels,

STAGE IV – 2025

In a massive global re-balancing the US Dollar becomes part of a Global Reserve Currency “Basket”

Of course all this is premised on us not experiencing a "Shooting War" which is often a result of these sorts of financial, economic and political dislocations!

SLIDE 27

With 50 Tipping Points it can fairly confidently surmised that something is going to destabilize an unbalanced and fragile global "house of cards'!

SLIDE 28- TRUMP

In closing, as I always remind you – remember the answer will be to print more money.

It is the only answer politicians will ever agree on. Until No one wants it or Trusts It!

Invest accordingly.

SLIDE 33 - - DISCLAIMER & WRAP

I would like take a moment as a reminder

DO NO NOT TRADE FROM ANY OF THESE SLIDES - they are for educational and discussions purposes ONLY.

As negative as these comments often are, there has seldom been a better time for investing. However, it requires careful analysis and not following what have traditionally been the true and tried approaches.

Do your reading and make sure you have a knowledgeable and well informed financial advisor.

So until we talk again, may 2019 turn out to be an outstanding investment year for you and your family.

Thank you for listening