SHADOW BANKING HAS AGAIN MASKED RISK THROUGH DEBT RATINGS, COLLATERAL TRANSFORMATION & CLO'S,

A PUBLIC SOURCED ARTICLE FOR MATASII (SUBSCRIBERS-RESEARCH & PUBLIC ACCESS ) READERS REFERENCE

MATA: DRIVERS - CREDIT

12-22-18 - "Is This 'Tinder For Corporate Credit' The Latest Harbinger Of A Debt Implosion?"

MATASII TAKEAWAYS:

- Wells Fargo and JPM are presently stuck with more than $400 million in Leveraged Loan paper that they will need to keep on their books until they can find a buyer - an "end-of-credit-cycle" behavioral phenomenon,

- Falters,

- Concerns about 'fallen angels',

- Leveraged loans,

- Consumer credit,

- Subprime auto loans,

- Student debt and

- Myriad other facets of the US's exaggerated pile of consumer and corporate debt have come rushing back,

- The massive agglomeration of debt that has occurred in various sectors of the US economy since the financial crisis has remained safely out of sight for years as low interest rates ensured that any struggling borrowers could easily roll their debt at rock-bottom costs,

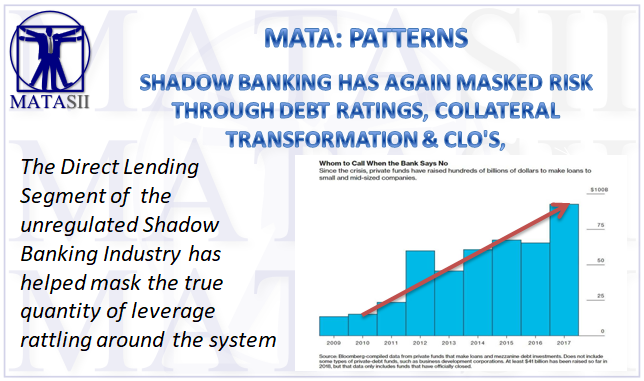

DIRECT LENDING (a Segment of SHADOW BANKING Industry) - Use of Leveraged Loans

Has helped mask the true quantity of leverage rattling around the system

- INVESTORS: A shortage of debt offering a decent yield provided the spark for the private-credit industry to grow from a niche market,

- LENDERS:

- The Direct Lending industry is rapidly approaching $1 trillion in assets, bearing yields between 7% and 9% (analysts expect the market to hit the $1 trillion mark by 2020),

- They hold out all-in yields of 7 percent to 9 percent, sometimes much more. That compares to an average 4.3 percent for the typical investment-grade corporate bond,

- During the QE era, investors struggled to find even speculative-grade debt yielding more than 5%.

- Wall Street has churned out almost $20 billion of collateralized loan obligations that transform those often risky loans into securities rated as high as triple-A.

- BORROWERS: "They’re hooked on deal flow and willing to pay,"

LENDER EXAMPLES

- OWL ROCK CAPITAL PARTNERS: —A New York firm founded by Blackstone, KKR and Goldman Sachs veterans—has amassed $9.5 billion of assets since it started in 2016.

- DEBTMAVEN: A "Tinder for corporate credit."Service connects lightly vetted borrowers with similarly lightly vetted lenders so that they can make deal magic with minimal fuss (and maximal risk). In barely two years, more than 470 different potential lenders have signed up to his match-making web site, DebtMaven. For a small fee, he connects them with smaller companies looking for money.

RISKS

- "It has the seduction of offering the appearance of both higher returns and stability, because

- it doesn’t have to mark-to-market, and

- it doesn’t trade,"

- "Some companies are over-banked and over-levered and (lending) prices are likely to move substantially if there is a problem."

- The risks—for investors and companies alike—will likely grow as interest rates keep climbing. And they’ll be more acute for small and midsize businesses that borrowed heavily in good times.

- Lenders will soon feel the sting of recession (i.e. Borrowers won't be able to pay lenders & the leveraged rates)

- The boom will probably end like the others: with finger-pointing and litigation.

- "There will be recrimination and litigation, and cries of 'I was fooled'. 'I didn’t have the information' and 'You took advantage of me,"--- "When, in fact, the data, as with the mortgage crisis, was right in front of our faces."

Is This 'Tinder For Corporate Credit' The Latest Harbinger Of A Debt Implosion?

As recently as October, desperate yield-chasers seemingly couldn't get enough of leveraged-loan paper, until a dramatic and sudden collapse in demand left Wells Fargo and JPM stuck with more than $400 million in loans that they will need to keep on their books until they can find a buyer, a phenomenon that prompted one credit strategist to muse about "end-of-credit-cycle" behavior. As we've been warning for a while now, the massive agglomeration of debt that has occurred in various sectors of the US economy since the financial crisis has remained safely out of sight for years as low interest rates ensured that any struggling borrowers could easily roll their debt at rock-bottom costs. But as interest rates rise and the global economy falters, concerns about 'fallen angels', leveraged loans, consumer credit, subprime auto loans, student debt and myriad other facets of the US's exaggerated pile of consumer and corporate debt have come rushing back.

In a profile that shows just how desperate - and therefore, reckless - investors became as yields dropped during the post-crisis period, Bloomberg this week published a stunning profile chronicling the rise of the direct-lending industry. Featured in the profile was a company called DebtMaven, which is trying to create what its founder, Jordan Selleck, described as a "Tinder for corporate credit." His service connects lightly vetted borrowers with similarly lightly vetted lenders so that they can make deal magic with minimal fuss (and maximal risk).

In barely two years, more than 470 different potential lenders have signed up to his match-making web site, DebtMaven. For a small fee, he connects them with smaller companies looking for money.

"They’re hooked on deal flow and willing to pay," Selleck says of his lenders. "It’s grown at a crazy pace."

That pace is now raising red flags among regulators and central bankers, who fret that the direct-lending industry is helping to fuel a global credit bubble that’s leaving the economy increasingly vulnerable. Reaching for anything that pays decent returns, investors have been pouring money into all sorts of risky assets. Not since the heady days of 2007, when private credit was a relative backwater, have the rewards for holding riskier debt like junk bonds seemed so meager.

During the QE era, investors struggled to find even speculative-grade debt yielding more than 5%.

This shortage of debt offering a decent yield provided the spark for the private-credit industry to grow from a niche market...

So why is private credit so beguiling? One word: yield. A decade of central bank stimulus caused it to evaporate in the usual places, such as the debt of blue-chip corporations. If everything goes according to plan, loans from private lenders are usually more lucrative than those to bigger companies. They hold out all-in yields of 7 percent to 9 percent, sometimes much more. That compares to an average 4.3 percent for the typical investment-grade corporate bond.

...to one that's rapidly approaching $1 trillion in assets, bearing yields between 7% and 9% (analysts expect the market to hit the $1 trillion mark by 2020).

And unsurprisingly, as this segment of the US shadow-banking market expands, banks are finding a way to get in on the action, using - what else? - the same types of collateralized loans that became "weapons of financial mass destruction" during the crisis.

Even the financial engineers are getting to work. So far this year, Wall Street has churned out almost $20 billion of collateralized loan obligations that transform those often risky loans into securities rated as high as triple-A.

Meanwhile, the surging demand for private credit has transformed startups like DebtMaven into titans overnight.

The frenzy has turned lending startups into heavyweights almost overnight. Owl Rock Capital Partners—a New York firm founded by Blackstone, KKR and Goldman Sachs veterans—has amassed $9.5 billion of assets since it started in 2016.

Money raised by Owl Rock found its way to the outskirts of Charlotte, North Carolina, where it helped fund the buyout of Carolina Beverage Group by Cold Spring Brewing Co., a craft-beer producer owned by private equity firm Brynwood Partners. Owl Rock’s financing amounted to almost $45 million.

TransPerfect Global Inc., a New York-based language-service company, borrowed about $262 million from Owl Rock to help one of its founders buy out the shares of the other after they had a falling out. That debt pays more than 9.5 percent. They’re among loans Owl Rock has arranged for companies with typical earnings before interest, taxes, depreciation and amortization of $10 million to $250 million annually.

So it's hardly surprising that the industry is raising red flags, and regulators are beginning to take an interest.

That pace is now raising red flags among regulators and central bankers, who fret that the direct-lending industry is helping to fuel a global credit bubble that’s leaving the economy increasingly vulnerable.Reaching for anything that pays decent returns, investors have been pouring money into all sorts of risky assets. Not since the heady days of 2007, when private credit was a relative backwater, have the rewards for holding riskier debt like junk bonds seemed so meager.

But it might already be too late. Because with the Fed expected to raise interest rates for the fourth time this year on Wednesday, the pressure on small and medium-sized companies, which represent the bulk of borrowers, is intensifying. And because these loans don't trade publicly and aren't priced to market, it's difficult for lenders and investors to tell where the pressure points lie.

The risks—for investors and companies alike—will likely grow as interest rates keep climbing. And they’ll be more acute for small and midsize businesses that borrowed heavily in good times.

"It has the seduction of offering the appearance of both higher returns and stability, because it doesn’t have to mark-to-market, and it doesn’t trade," Steve Vaccaro, chief executive officer of CIFC Asset Management, says of private credit. "But some companies are over-banked and over-levered and prices are likely to move substantially if there is a problem."

Others have been more blunt with their warnings. Dan Zwirn, chief executive officer at Arena Investors, a New York firm that lends to firms less able to access conventional sources, says the boom will probably end like the others: with finger-pointing and litigation.

"There will be recrimination and litigation, and cries of 'I was fooled'. 'I didn’t have the information' and 'You took advantage of me," Zwirn says. "When, in fact, the data, as with the mortgage crisis, was right in front of our faces."

If nothing else, the rise in private-lending echoes fears of the shadow-banking industry in China, which critics say has helped mask the true quantity of leverage rattling around the system.

And while investors and shadow lenders are piling in to these risky loans, traditional banks are raising their credit standards as fears that a recession might be looming in 2020 continue to percolate, according to Reuters.

This suggests that lenders will soon feel the sting of recession, even if losses haven't started cropping up yet and the economic fundamentals appear (relatively) strong.

Bank executives acknowledge that the U.S. economy is probably in the final stages of a long recovery from the 2007-09 global financial crisis. But they say that until credit metrics start to deteriorate meaningfully, there is no reason to boost reserves or slash customer financing.

"There is a big disconnect at this point in time between the market technicals and what we’re really seeing on the ground," Citigroup Inc (C.N) Chief Financial Officer John Gerspach said at an industry event last week. "The fundamentals still look very good."

The notion that fundamentals look "good" isn't entirely true. But regardless, consumers and lenders will soon need to figure out whom they trust more: the economy, which appears to be in good shape (at least on the surface), or the market?

We know where Stanley Druckenmiller stands. And if more consumers and lenders follow his lead, that could create serious complications for opaque private credit markets which, thanks to an unintended side-effect of QE, is now large enough to pose a systemic risk.