THE COMING DEBT CEILING DEBACLE??

The Debt Ceiling debate was deferred for two years in 2019 with a bipartisan deal that expires July 31. The debt in 2019 was $984B. The Biden Budget for 2021 is expected to be $3 Trillion as the wrangling and brawling resumes.

This calls into question if the enacted debt legislation has any meaning at all? We all expect it to be simply a theatrical show primarily used to give the false impression of a responsible government managing our tax payments! However, it could quickly become much more! The Debt Ceiling debate this time may be a galvanizing event like 2011 for weakness in the US Dollar and a possible US credit downgrade!

|

THERE ARE UNINTENDED CONSEQUENCES! THERE ARE UNINTENDED CONSEQUENCES!

Monetary Malpractice and Political Mismanagement have consequences as Charles Hugh Smith & I recently outlined in the video: “It Always Ends The Same Way!“.

WHEN IS TOO MUCH SPENDING TOO MUCH?

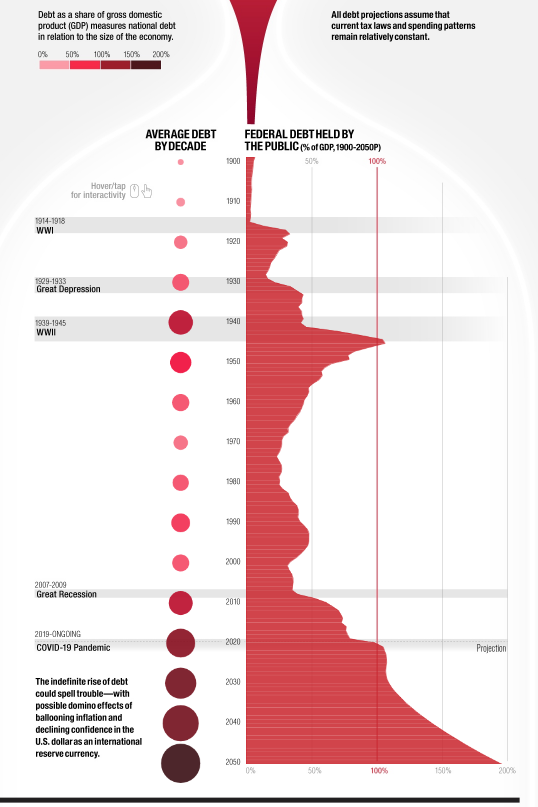

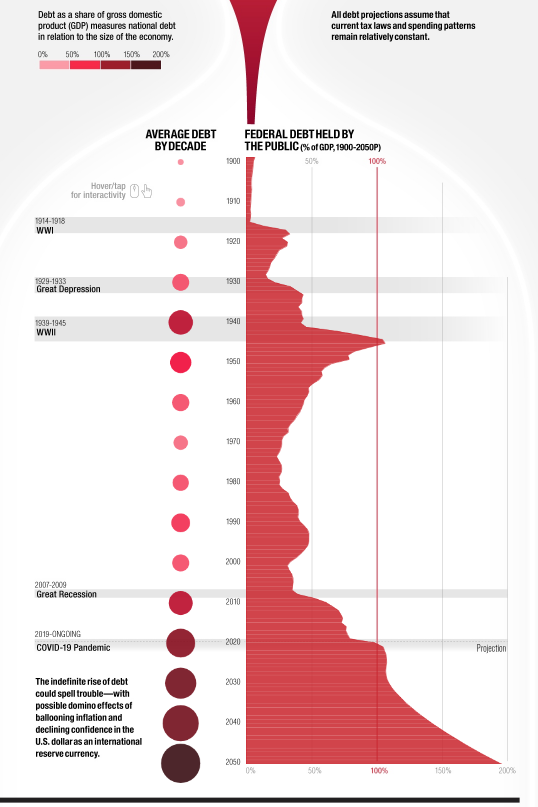

The Washington Political Class presently geared up to borrow and spend on a scale that America has not seen since we had to fight and win World War II. Our debt burden would break all records, eclipsing even the 1940s (Interactive Chart: right, and Biden’s Budget below).

The nonpartisan Congressional Budget Office estimated in January 2020 that annual budget deficits will exceed $1 trillion, and that the debt—then hovering at $17.2 trillion—would more than double as a share of the economy over the next 30 years. These numbers don’t take into account $65 trillion of unfunded liabilities for Social Security and Medicare. The CBO now projects that, under current law, the deficit will reach $1.9 trillion in 10 years and the debt will skyrocket from 102% to 202% of GDP within 30 years.

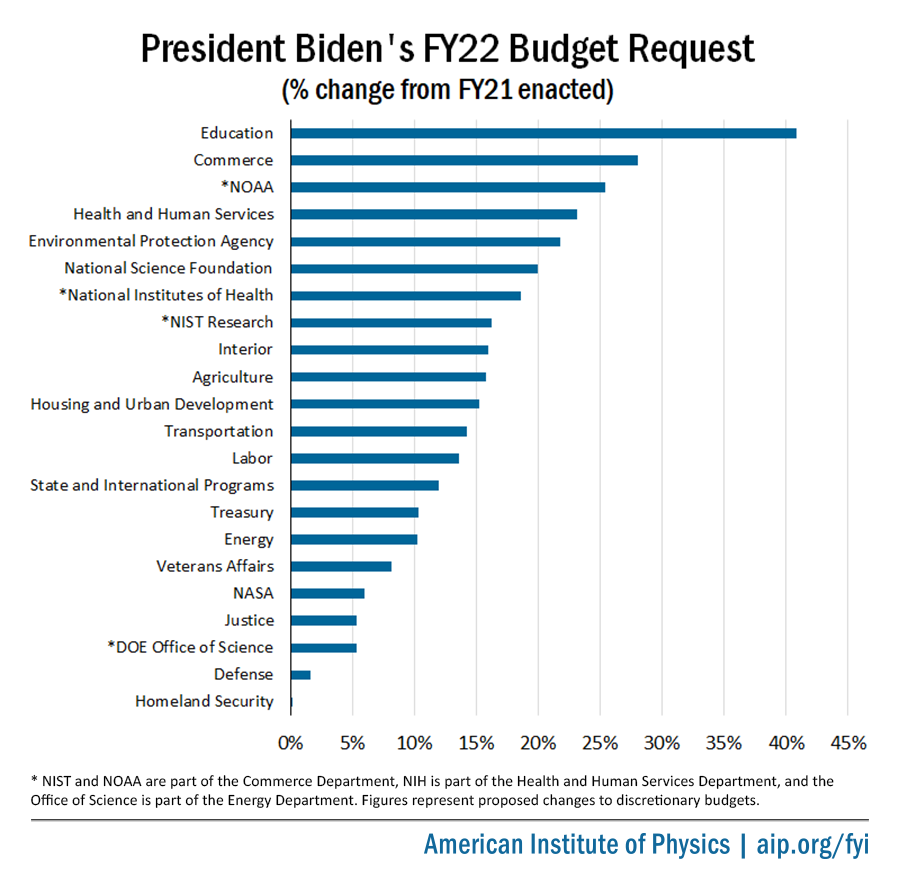

The words “current law” are critical as the CBO forecasts only what will happen should government make no changes in spending and tax policies. But President Biden has already proposed $5 trillion (above) in additional spending over the next 10 years, much of it for new or expanded entitlements, labeled “infrastructure” and “investment.”

|

|

|

A SHOWDOWN AT “OK CORRAL”

Strap in your seat belts for a month long round of brinkmanship over federal spending and the national debt.

Senate GOP leader Mitch McConnell is already vocalizing his disdain for the Democratic legislative spending wish list as he appears to have thrown down the gauntlet of resistance by describing it as: “a million mediocre socialist daydreams, from electric car subsidies to work-discouraging welfare programs to Washington-directed childcare plans.”

THE BATTLE LINES HAVE BEEN DRAWN

On June 9th Senator Rick Scott led Senators Ted Cruz, Mike Braun, Marsha Blackburn, Ron Johnson, John Barrasso, Joni Ernst and Tommy Tuberville in introducing the Federal Debt Emergency Control Act to rein in Washington’s out-of-control spending and provide a concrete path forward to tackle the nation’s nearly $30 trillion debt. The Federal Debt Emergency Control Act is endorsed by the National Taxpayers Union, the Council for Citizens Against Government Waste, Americans for Tax Reform, Americans for Prosperity, FreedomWorks, and Club for Growth.

|

|

|

|

The Federal Debt Emergency Control Act:

-

- Requires the Office of Management and Budget to declare a “Federal Debt Emergency” in any fiscal year where the federal debt exceeds 100% of that year’s Gross Domestic Product (GDP).

- This emergency designation would trigger several provisions to help control and reduce the federal debt to levels below 100% of GDP, including:

- Terminating any obligated funding from the American Rescue Plan Act, and any previous stimulus bills, and sending it back to the Treasury General Fund immediately for deficit reduction.

- Requiring all legislation that increases the federal deficit, as determined by the Congressional Budget Office, to carry its own offsets. If it does not, the legislation shall be considered out of order and will require at least two-thirds of all Senators to vote to increase federal debt before even being able to consider the bill.

- Fast-tracking any legislation that would reduce the federal deficit by at least 5 percent over ten years.

SENATOR COMMENTS STATUS OF BILL

SENATOR RAND PAUL: VIDEO: Senator Rand Paul — Does anyone still care about the National Debt… – CITIZEN FREE PRESS

SECRETARY YELLEN’S COUNTER STRATEGY – TASKED WITH GETTING DEBT CEILING APPROVAL

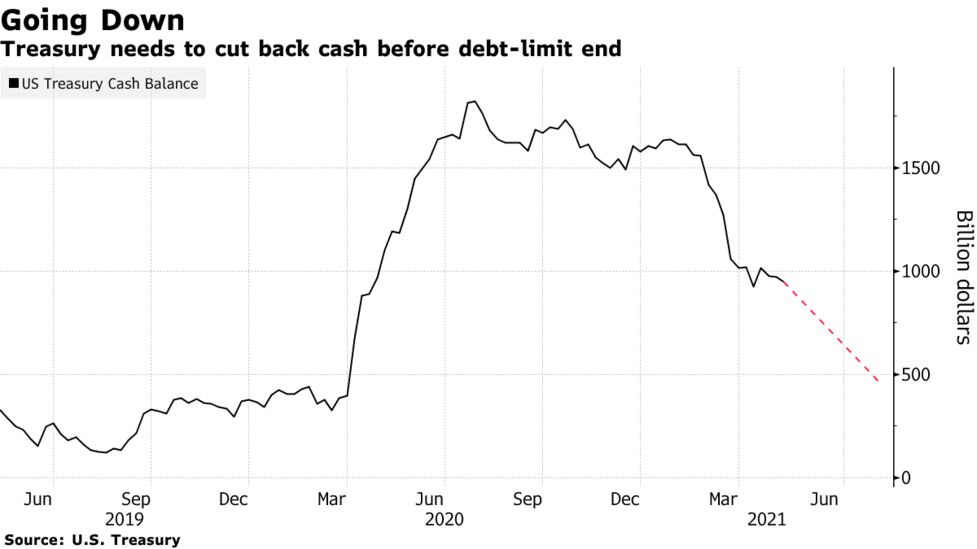

As we illustrated in our previous newsletter,Treasury Secretary Janey Yellen, who is tasked with shepherding the Debt Ceiling negotiations through Congress has intentionally cut the Treasury General Account to such a level in anticipation that it will leave congress with no choice but to pass either an extension (likely) or Biden’s Budget (unlikely). It appears she will have it below $500B by July 31st (see below).

|

|

|

CONCLUSION

To put the coming debacle in perspective we must not forget that it is on top of $24 trillion dollars in COVID related debts that have been generated globally, while the U.S. Federal Reserve balance sheet has doubled over the same period to $8 trillion with increasing rates of liquidity injections flushed into the Too Big to Fail banks since September 2019.

As a consequence, consumer price inflation has already risen by 4.2% in 12 months. Based on the obvious reality of $28 trillion of totally unpayable U.S. debt, sustaining a $1.2 quadrillion derivatives bubble time bomb alongside the breakdown of supply chains and a dysfunctional green infrastructure program pushed by Biden, the runaway threat of inflation and even hyperinflation is firmly (or should be) on everyone’s mind!!

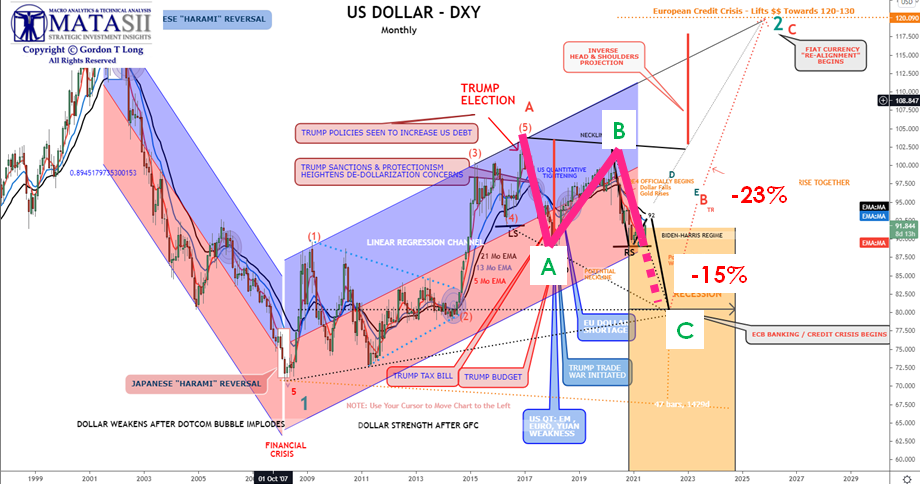

As we pointed out in this month’s UnderTheLens video it is clear to us at MATASII.com that the current US Administration has decided that the sacrificing of the US Dollar is required. They are attempting to set the stage now so that it will be a controlled weakening versus what may turn in to a rout!

|

|

|

Effective short term pressures continue to raise the US Dollar in preparation for expected weakness ahead.

|

|

We expect Dollar weakness to be “contained” to a 15% draw-down.

|

|

|

“America is in a debt crisis. Our nation is barreling toward $30 trillion in debt – an unimaginable $233,000 in debt for every family in America. It’s a crisis caused by decades of wasteful and reckless spending by Washington politicians. Now, President Biden is continuing this way of governing by pushing for trillions in wasteful spending, raising the U.S. federal debt by 60% to $39 trillion and the debt-to-GDP ratio to 117% in 2030, the highest level ever recorded in American history. Spending beyond our means has consequences. We’re already seeing rising inflation, which disproportionately hurts the poorest families, like mine growing up.

That’s why today, I am leading my colleagues in introducing the Federal Debt Emergency Control Act to rein in Washington’s out of control spending. This includes preventing Washington politicians from mindlessly spending by requiring that two-thirds of the Senate vote to increase the debt before approving any bill. I look forward to every fiscally responsible Republican and Democrat working with me to quickly pass the Federal Debt Emergency Control Act.”.

Senator Rick Scott (R:Fl)

|

|

THERE ARE UNINTENDED CONSEQUENCES!

THERE ARE UNINTENDED CONSEQUENCES!