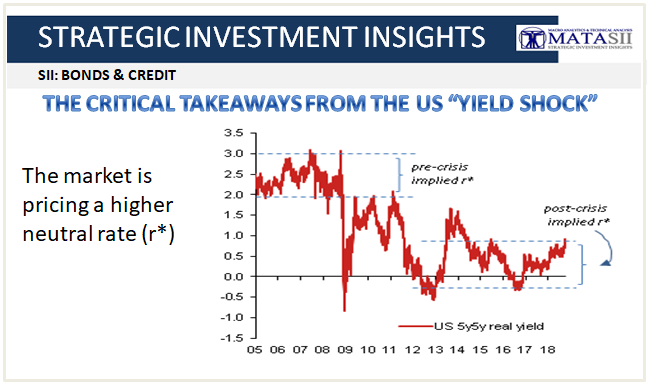

THE CRITICAL TAKEAWAYS FROM THE US "YIELD SHOCK"

KEY MESSAGES

- The market is pricing a higher neutral rate (r*),

- Euro real yields have also moved,

- The real story could be higher Japanese 10 Year yields

Many are likely to claim credit for calling the recent surge in UST 10yr yields. Not only that, but the reason for the move will vary...

Some will say it was due to:

- Strong US data or

- Hawkish Fed or

- Return of Term Premia or

- Technical Factors such as:

- Heavy corporate issuance or

- Mortgage convexity hedging or

- The blow-out in dollar funding basis.

While there is some truth in each one of them, there are other more important takeaways from the move:

SUBSCRIBER CONTENT ONLY