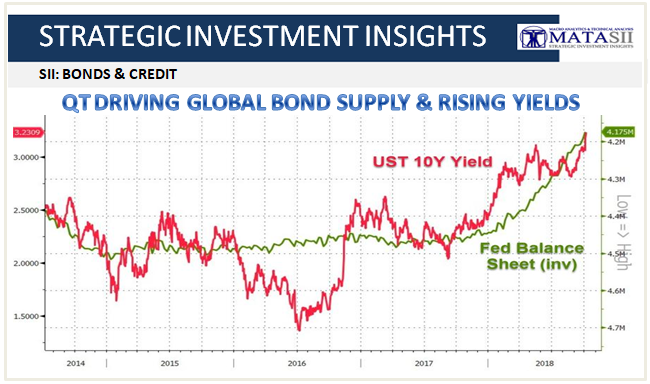

QT DRIVING GLOBAL BOND SUPPLY & RISING YIELDS

Prophesies of doom are everywhere.

- There’s billionaire investor Stan Druckenmiller, who says our “massive debt problem” will ignite a crisis.

- Oaktree Capital’s Howard Marks warns that public and private debt will be “ground zero when things next go wrong.”

- And Citadel’s Ken Griffin sees a credit binge ending badly.

And they are right to worry, because if interest rates rise and growth slows, companies are bound to see to their financial soundness deteriorate. More than $1 trillion of investment grade corporate bonds could be cut in the next downgrade cycle, according to analysis this week by Morgan Stanley.

- "Leverage is near all-time highs, and companies used tax reform proceeds for buybacks instead of paying down debt,” said Max Gokhman, head of asset allocation for Pacific Life Fund Advisors, which manages $40 billion.

- “More than triple the debt that came due in 2018 will be due each year from ’19-’21. If yields go up, there’s real concern about companies’ ability to reissue and keep their leverage.”

And that concern is starting to be priced into markets with the bond market's 'VIX' - The Merrill Lynch MOVE Index tracking Treasury volatility - rose almost 20 percent this week, the biggest jump since 2015.

.............

SUBSCRIBER CONTENT ONLY