MARKET WATCHING FANGS FOR SIGNAL OF A FED MISCUE!

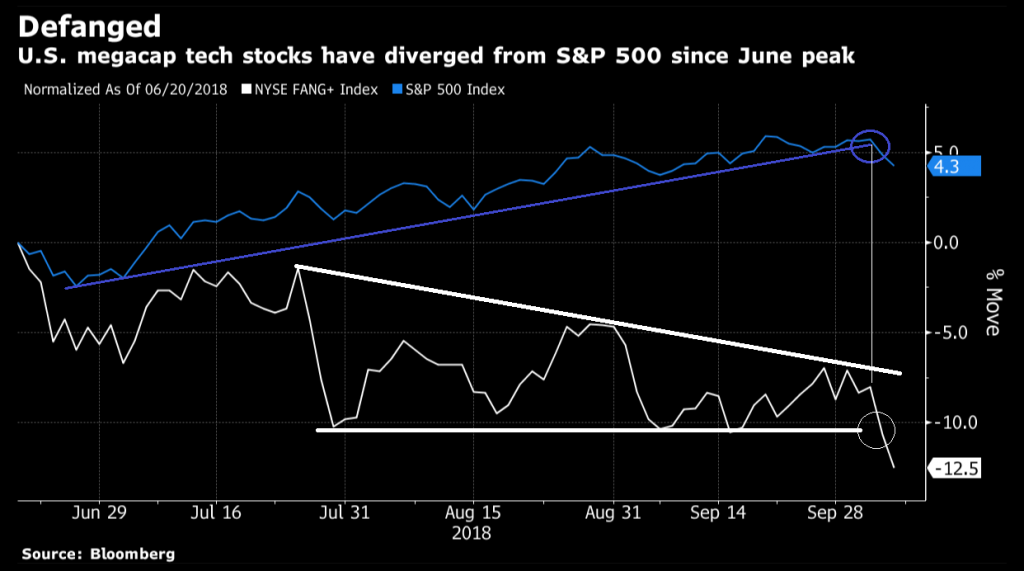

If the Federal Reserve tightens U.S. monetary policy too far, investors in the bull market’s biggest winners will feel the pain first, according to Bank Julius Baer & Co. That’s tech stocks.

Strong economic growth will encourage the Fed to keep raising interest rates, even if the tightening sucks out more liquidity than financial markets can tolerate, said Yves Bonzon, chief investment officer at Julius Baer. That could drive the S&P 500 Index down about 20 percent before the equity losses start moderating the central bank’s actions, he said.

“I’m the most nervous I’ve been in a long time because I think we’re approaching that point,” he said at a press round table in Hong Kong on Monday, referring to when Fed tightening starts to drive a reversal in stocks. “The biggest beneficiary of the expansion of liquidity will be the biggest casualty, irrespective of their fundamentals.”

......

SUBSCRIBER CONTENT ONLY