Macrostrategy Partnership writes about perhaps the most important chart of the decade...

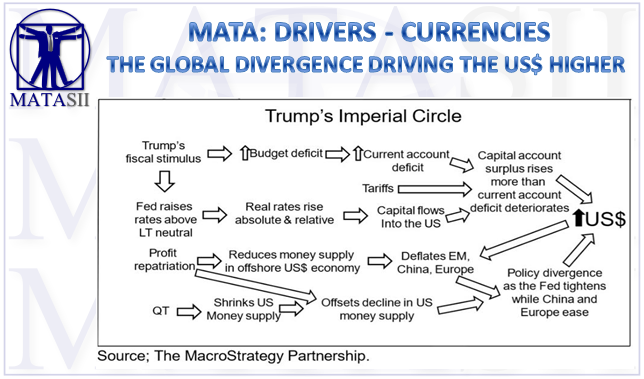

Policy divergence is now set to accelerate the US$ rally.

The Fed is in a battle with an overheating US economy, where a 4% of GDP fiscal stimulus meets an economy with more job vacancies than unemployed.

Lael Brainard’s recent speech highlights that the Fed is now looking to hike rates above long-term neutral levels.

Meanwhile, in the months ahead, China will have to accelerate PBoC printing to offset a looming bad loan crisis, while Draghi will have to reverse his recent hawkish position in the face of deflationary pressure at home.

The last time we saw this trifecta of Fed tightening and PBoC/ECB easing was 2H 2014, and the dollar rallied by 25%.

Don’t even ask about Indian Markets, in absence of huge Dollar funding,we are just... Collateral Damage!