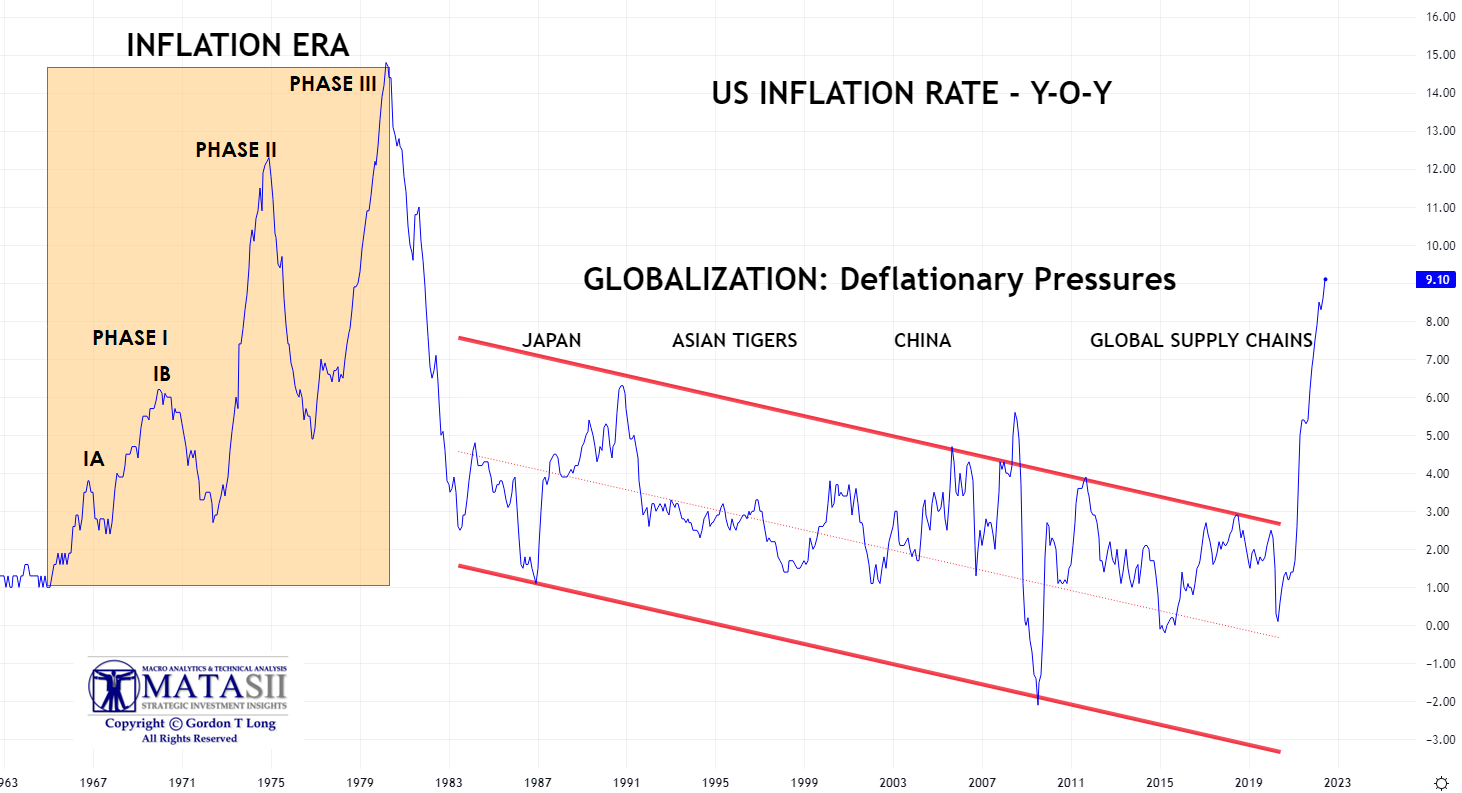

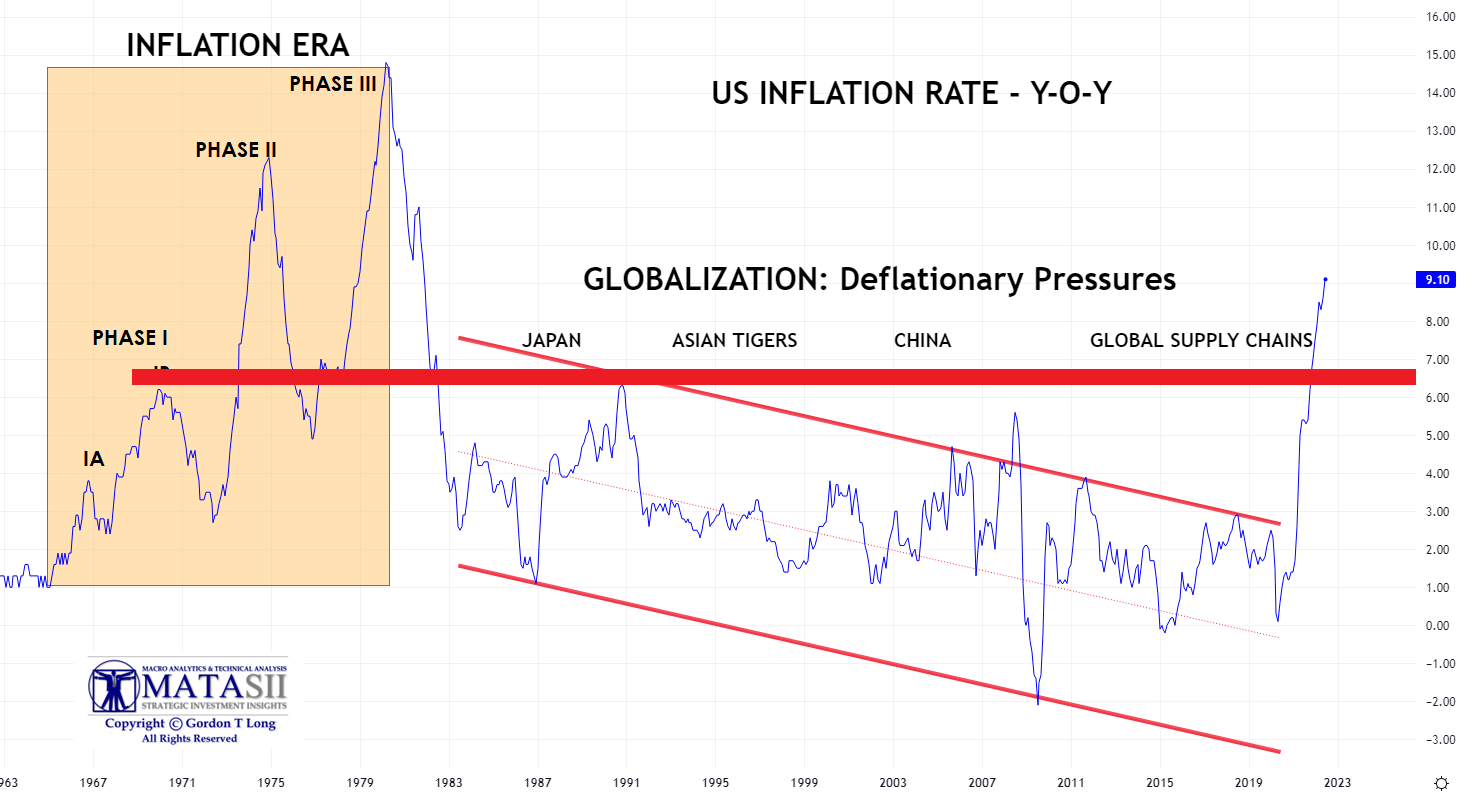

In 2020 we wrote extensively that Inflation would soon become a major problem. We felt Covid-19 and global lock-downs would be disruptive to Global Supply Chains which would lead to rising import cost. You would see we got it generally right if you were to review the

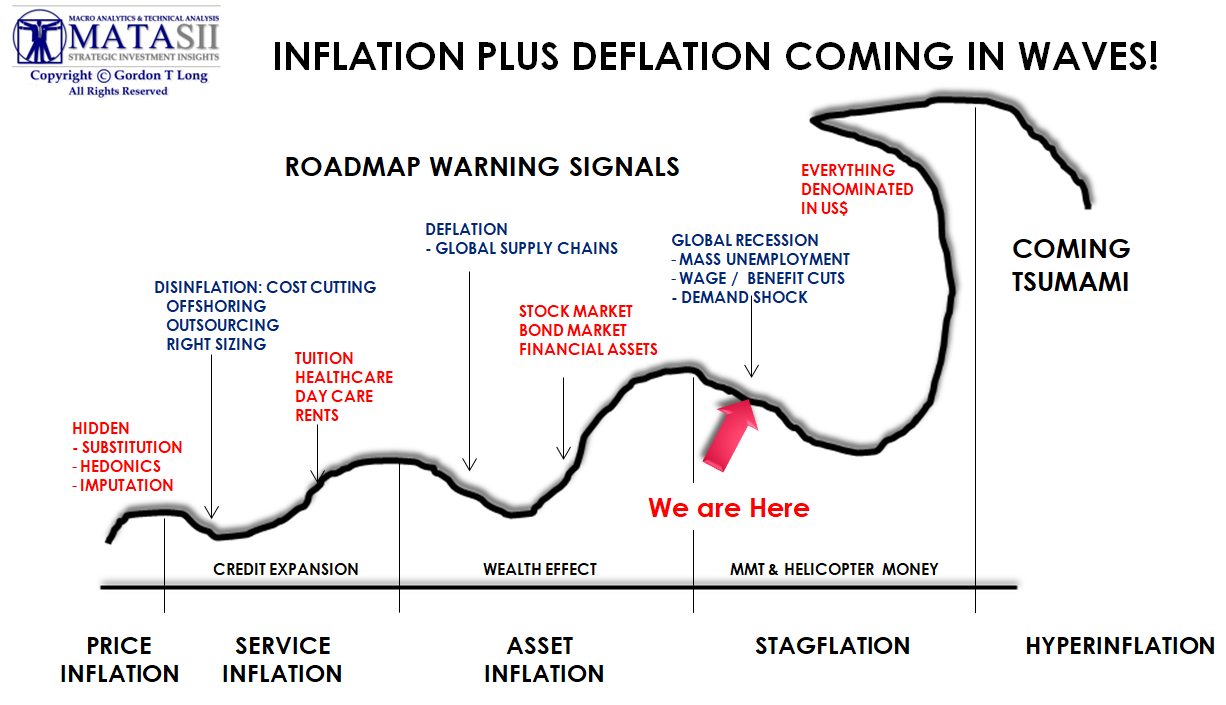

October 2020 UnderTheLens video entitled “Inflation PLUS Deflation“.

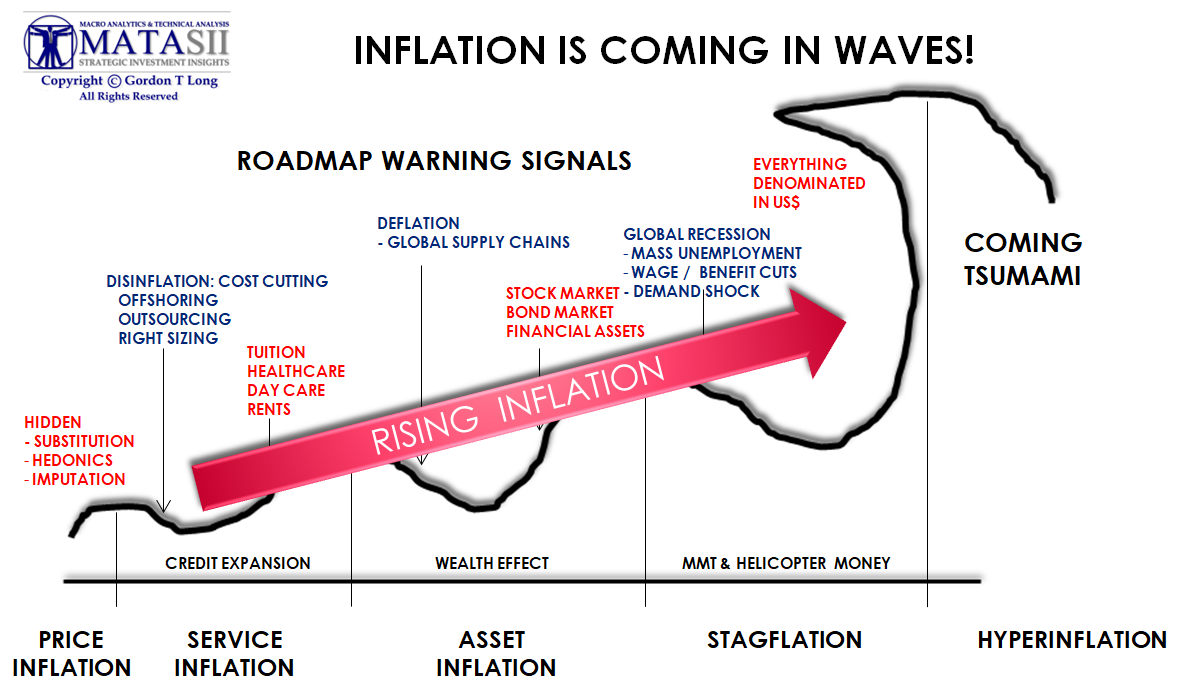

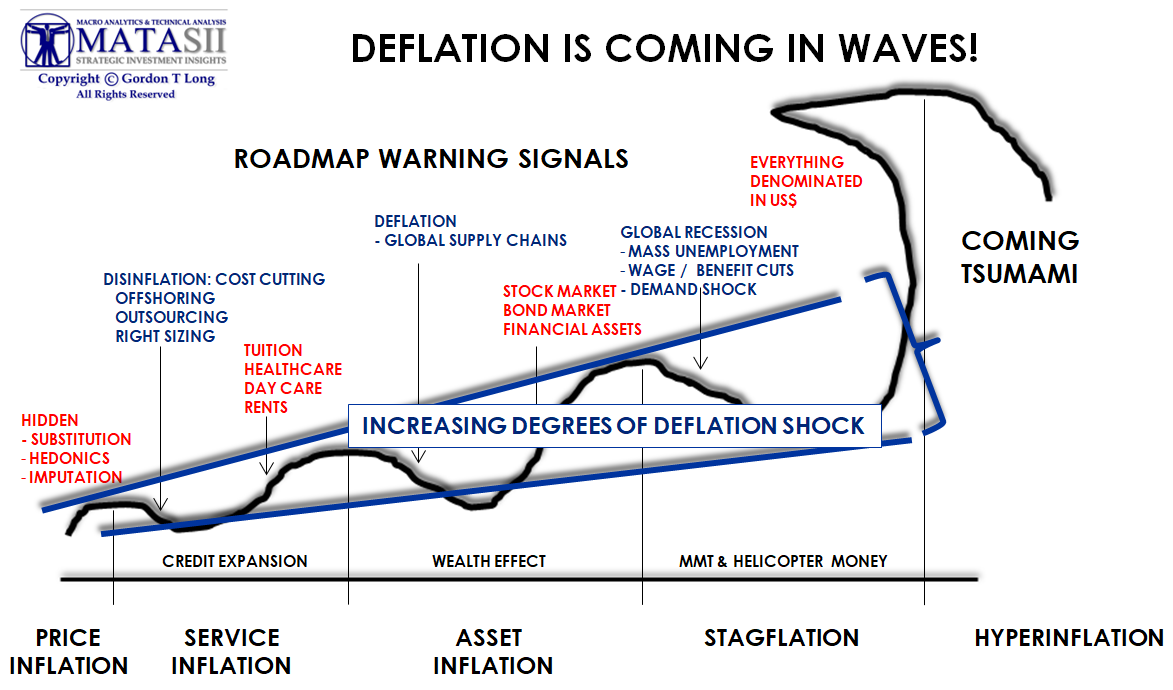

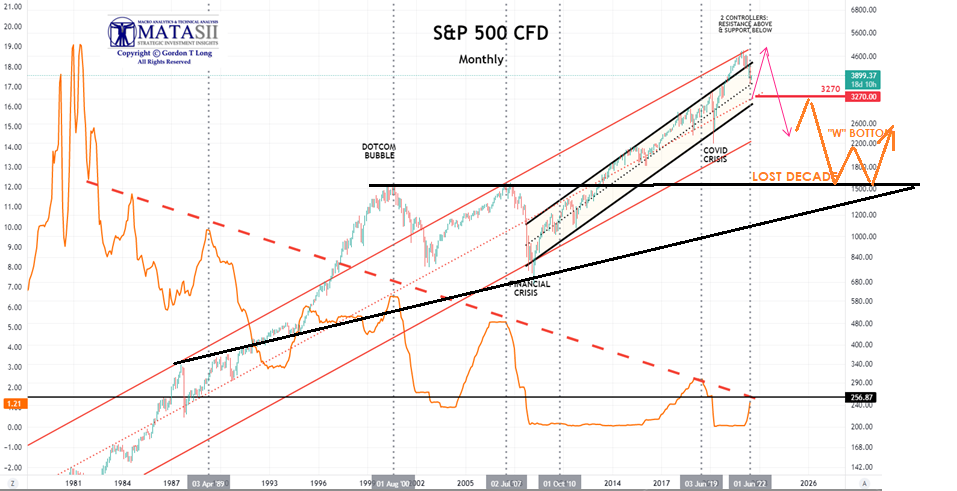

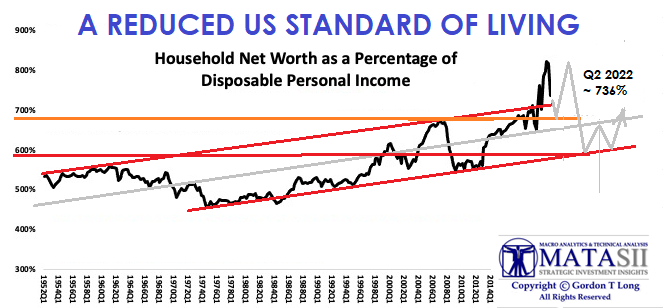

We primarily argued that we would continue to have Inflation PLUS Deflation occurring in ever increasing concurrent waves, but in differing areas. We have most recently been experiencing Deflation in Asset values, while experiencing inflation in energy, food, services and almost any areas not financed, but paid directly from real disposable income.

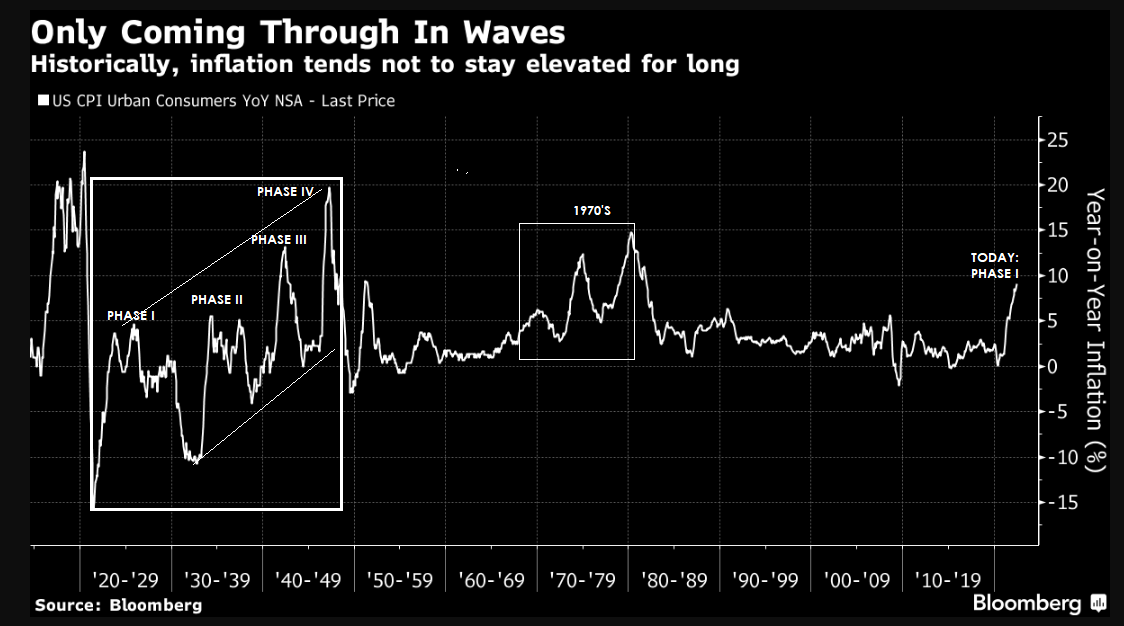

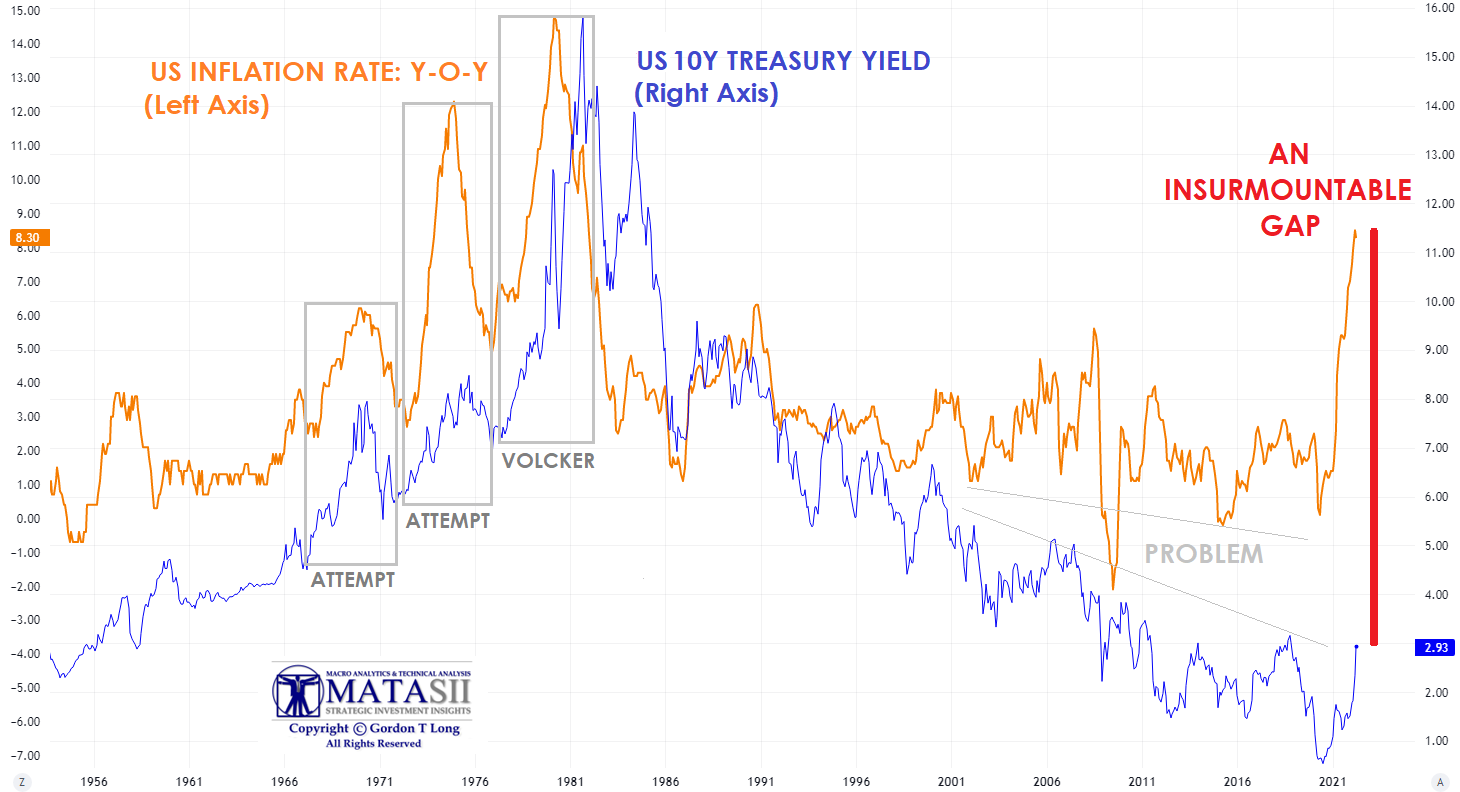

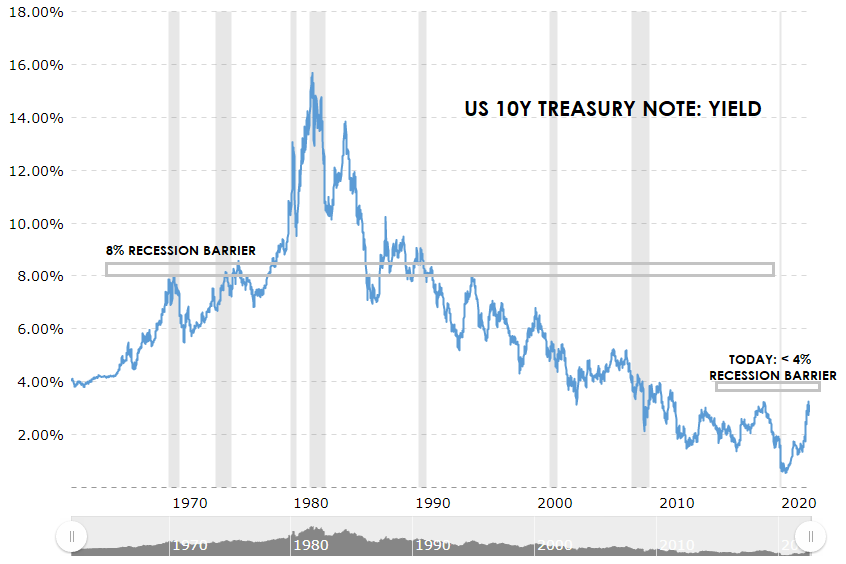

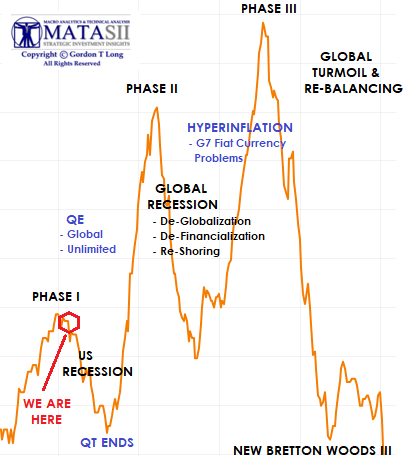

Regarding Inflation, we believe we are now completing Phase I of an expected three phases to unfold over the course of the final Inflation Shock Wave during the next 4-6 years. We are now entering the initial Deflation Shock wave that will see an unfolding US Recession with layoffs and corporate cutbacks. Wage and Benefit cuts and an unprecedented reduced demand shock to global supply chains will soon follow as we feel the impact of a Global Recession. (See Chart below: “We are Here”).

WHAT YOU NEED TO KNOW

WHAT YOU NEED TO KNOW