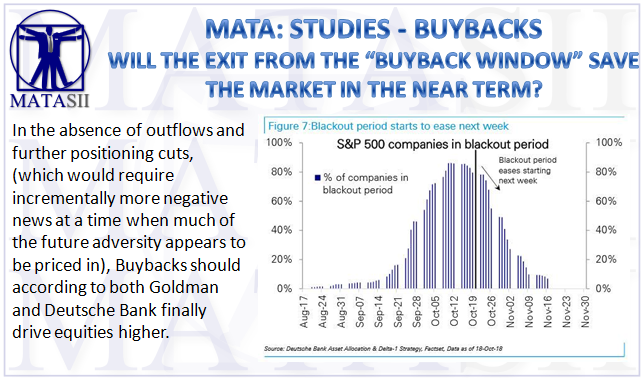

WILL THE EXIT FROM THE "BUYBACK WINDOW" SAVE THE MARKET IN THE NEAR TERM?

MATASII TAKEAWAYS:

- ASSUMPTIONS: In the absence of outflows and further positioning cuts, which would require incrementally more negative news at a time when much of the future adversity appears to be priced in,

- CONCLUSION: Buybacks should - according to both Goldman and Deutsche Bank - finally drive equities higher.

- The "sell-off appears overdone relative to fundamentals" with the market pricing in "too sharp of a near-term growth slowdown" in response to which Goldman "expects continued economic and earnings growth will support a rebound in the S&P 500."

- Goldman believes the market has moved past fair value and expects earnings growth will lift the S&P 500 toward their year-end target of 2850,

- The potential catalysts for a bounce is that earnings are nowhere near the disaster that the market has made them out to be. To wit 48% of S&P 500 companies reported earnings, 54% have beat consensus estimates by more than one standard deviation.

- However the market has been punishing companies that miss while not rewarding those who beat, and the typical firm beating EPS expectations has outperformed the S&P 500 by 36 bp, below the average of 103 bp, as investors focus on the outlook for 2019 earnings.

SUBSCRIBER CONTENT ONLY