AS DUST SETTLES WE SEE THE EVIDENCE ON WHY BOND YIELDS SURGED

The US 10y yield managed to smash through its multi-decade downtrend last week, mainly due to the fact that the CFTC data showed that speculators had already built unprecedented large short positions. It seemed that every man, woman and child was already bearish and so who was left to sell? Well clearly someone was!

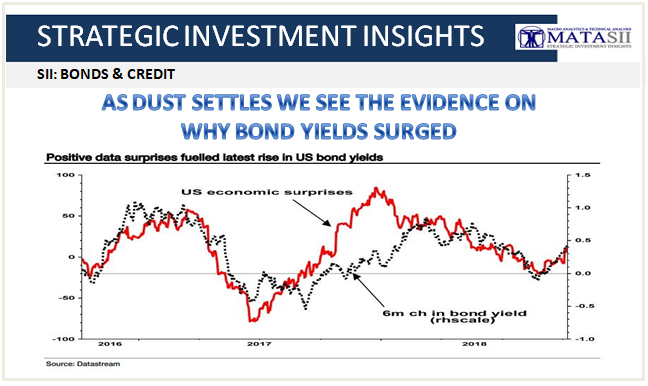

One thing that helped tip bond prices over the edge and take yields up to 3¼% was the fundamental support from stronger than expected economic data.

Another factor for the latest breakout in yields which pushed the 10Y interest rate to fresh 7 years highs was the previously discussed economic exuberance by Fed Chair Powell who managed to convince markets that they were still too sanguine on their expectations on interest rates, "and the futures strip ratcheted up another notch towards the Fed dots."

The speech last week by Fed Chair Powell was interpreted as unusually upbeat - referring to a remarkably positive outlook for the economy. This contributed to the surge in expectations for further tightening throughout next year.

For, although expectations for tightening in the first half of next year had been rising for some time, until very recently this had merely pulled rate hikes forward from H2 to H1. In recent weeks, expectations of more rate hikes have risen sharply in both halves of next year and even spilled into 2020.