BIGGEST INFLOWS OF THE YEAR DRAG JUNK BONDS FROM THE PRECIPICE!

-- SOURCE: 04-20-18 Bloomberg - "Junk Bonds Are Back in Black After Biggest Inflow This Year" --

The rising tide in junk debt markets is lifting all boats -- even ones that looked a little leaky just a few weeks ago.

In the last two weeks, money managers have grown more sanguine about loans and bonds from speculative-grade companies. Funds that buy high-yield bonds posted their biggest inflows of the year in the week ended April 18. That’s helped lift 2018 returns for the securities back into positive territory, and the bump in risk premiums that investors had said was long overdue has essentially been erased.

At the beginning of the month, when oil and stock prices were lower and trade war fearsmore intense, investors were more hesitant. McDermott International Inc. and American Greetings Corp. borrowed more than $4 billion combined in early April, and they had to pay up. McDermott, which helps oil and gas drillers design and install their equipment, sold $1.3 billion of bonds on April 4 for just 94.75 cents on the dollar, an unusually high discount for a new issue.

Now the securities are trading above 101 cents, according to Trace bond price data. The quick returns on both companies’ bonds and loans show that being choosy in tough times can yield benefits sooner than investors expect, said Andrew Feltus, co-head of high yield at Amundi Pioneer, which managed $1.4 trillion of assets globally as of Sept. 30.

“As long as we’re keeping our discipline, our market can keep gaining,” Feltus said. The debt from McDermott and American Greetings "was priced so low, they were priced to sell," he added.

Risky Deals

There may have been good reason to ask questions about the riskiness of McDermott and American Greetings, according to money managers involved in the deals. McDermott is borrowing to fund its purchase of Chicago Bridge & Iron Co., a money-losing competitor. American Greetings is borrowing as part of a sale of a 60 percent stake to a private equity firm.

“The companies were at the mercy of the market, and the market had been fairly weak,” said John McClain, a portfolio manager who helps oversee $21 billion of assets at Diamond Hill Investment Group. “If you were going to buy it, you were going to make sure it was a winning trade.”

American Greetings’ $470 million of six-year loans sold at 98 cents on the dollar. Those loans are now quoted at around 101 cents. The company’s $282.5 million of seven-year unsecured notes sold at 87 cents, and are now trading above 92 cents, according to Trace. McDermott’s $2.26 billion loan was priced at 98 cents on the dollar, and is now quoted around 100 cents.

A spokesman for McDermott declined to comment, while a representative from American Greetings did not return messages seeking comment.

Offerings in Europe that met with similar resistance earlier this month are now reaping similar gains. U.K. watchmaker Aurum Holdings Ltd., owned by Apollo Global Management LLC, sold 265 million pounds ($377 million) of five-year notes last week. It had to increase the yield on the securities by 1 percentage point and remove a controversial clause in the documentation that made it easier to pay additional dividends to its private equity owner. Those bonds, which sold at face value, are now trading above that level.

‘Balance...Power’

Fund inflows and better market sentiment may have boosted prices on debt from American Greetings and McDermott, but more investor money isn’t necessarily good for the health of the junk-bond market, according to Henry Peabody, a portfolio manager at Eaton Vance Corp. When the market was weaker earlier this month, investors had more leverage to push back on deals that were priced aggressively, he said.

“Oddly, negative flows were positive for the health of the market,” Peabody said. “You could balance the power a bit.”

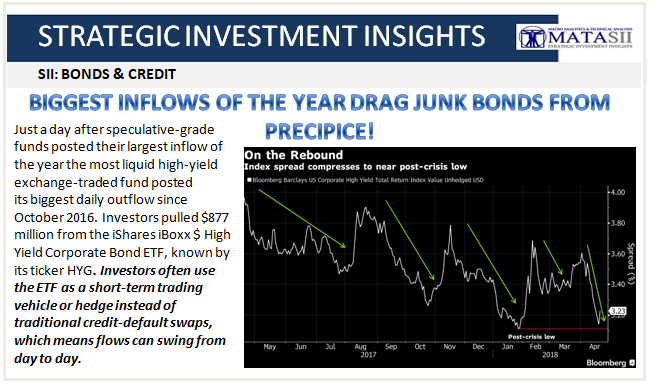

The junk-bond market has been improving, but its upward progress has been halting. Just a day after speculative-grade funds posted their largest inflow of the year in the week through Wednesday, the most liquid high-yield exchange-traded fund posted its biggest daily outflow since October 2016. Investors pulled $877 million from the iShares iBoxx $ High Yield Corporate Bond ETF, known by its ticker HYG, on Thursday. Investors often use the ETF as a short-term trading vehicle or hedge instead of traditional credit-default swaps, which means flows can swing from day to day.

And not all investors are convinced recent gains will last.

“I wouldn’t see the latest surge in high yield as necessarily a risk-on move, or any kind of broader return of euphoria to high yield,” said Patrick Flynn, a high-yield portfolio manager at Neuberger Berman with $135 billion in fixed income assets. U.S. government bonds have been weakening for much of the week, as rising commodity prices stoke inflation fears.

Energy, Stock

In recent weeks, those fears have been less of a concern in junk bonds. With crude oil trading close to its highest levels since 2014, speculative-grade bonds linked to energy have rallied, lifting the broader sector. Stock gains have also been a boon to high-yield, as the S&P 500 now has positive returns for the year, even ignoring dividends.

The junk bond market has been improving all month, with average risk premiums, or the extra yield over Treasuries that investors receive for lending money to companies, shrinking to 3.23 percentage points as of April 19 compared with 3.6 percentage points at the start of the month. Levels this week came close to their tightest since the financial crisis, according to Bloomberg Barclays index data. The debt has gained 0.24 percent in 2018 through Thursday, after having been down for much of the year.

New sales from insurance brokerage Hub International Ltd. and chemical producer OCI NV have drawn substantial orders and priced at yields around the low end of underwriters’ expectations, said Scott Roberts, head of high-yield investments at Invesco Ltd. That’s a stark change from the McDermott and American Greetings offerings.

“It’s been a food fight to get bonds,” Roberts said. “It’s refreshing to see.”