Gordon T Long Global Macro Research | Macro-Technical Analysis STRATEGIC INVESTMENT INITIATIVES COMMODITIES – HARD ASSETS WHAT DO REAL YIELDS TELL US ABOUT YELLOW & BLACK GOLD? Today, official Inflation Breakeven is the forecast that is derived from the difference between the yields on inflation-linked and fixed bonds of a given maturity or as […]

TP Highest Risk

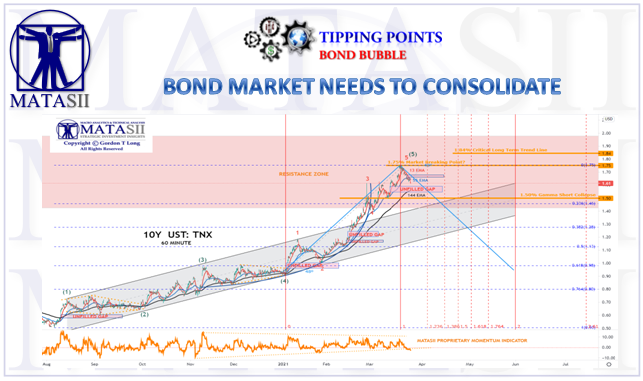

BOND MARKET NOW NEED TO CONSOLIDATE

Gordon T Long Global Macro Research | Macro-Technical Analysis TIPPING POINTS BOND BUBBLE BOND MARKET NEEDS TO CONSOLIDATE BOND MARKET NEEDS TO CONSOLIDATE The historic lift in bond yields has rapidly changed the investment landscape. Bond holders have experienced ~3.7% losses so far in 2021. It has been one of the worst year-beginning starts […]

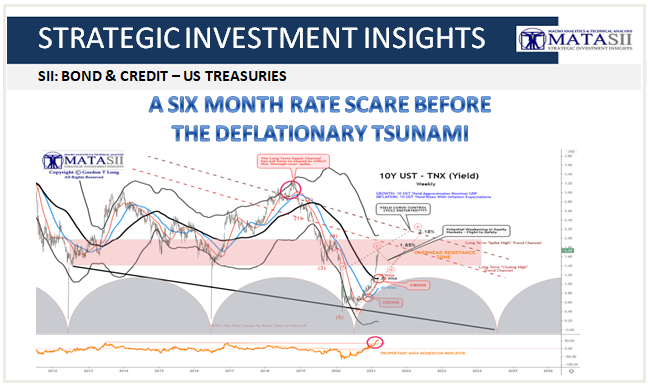

A SIX MONTH RATE SCARE BEFORE THE DEFLATIONARY TSUNAMI

Gordon T Long Global Macro Research | Macro-Technical Analysis STRATEGIC INVESTMENT INITIATIVES BONDS & CREDIT IS THIS A RATE SCARE RATHER THAN A ‘TRANSITORY’ INFLATION SCARE? What exactly are we afraid of? It was always a safe bet that there would be an inflation scare at some point early this year. Just the base […]

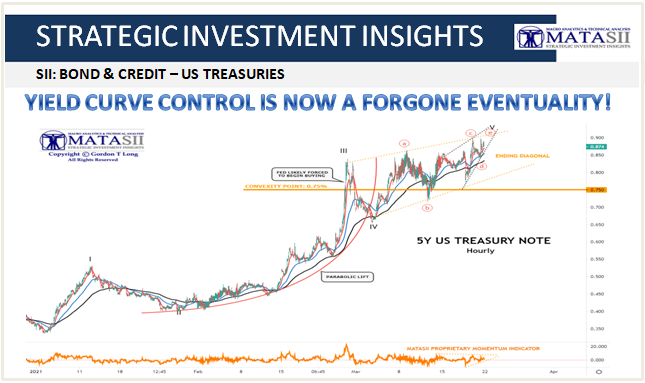

YCC IS NOW A FORGONE EVENTUALITY!

Gordon T Long Global Macro Research | Macro-Technical Analysis STRATEGIC INVESTMENT INITIATIVES BONDS & CREDIT YCC IS NOW A FORGONE EVENTUALITY! You can only play so many games before you are often trapped in a situation of your own creation. This is the situation the Fed finds itself in. Nothing makes this clearer than […]

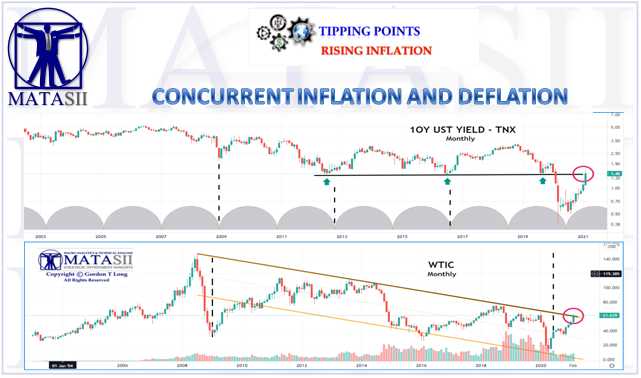

CONCURRENT INFLATION AND DEFLATION??

Gordon T Long Global Macro Research | Macro-Technical Analysis TIPPING POINTS RISING INFLATION CONCURRENT INFLATION AND DEFLATION?? Markets normally price forward with an 8 month lead time on economic expectations. Today’s news often misinterprets market actions based on current news events versus explaining what the markets had anticipated 8 months earlier. However, the recent […]

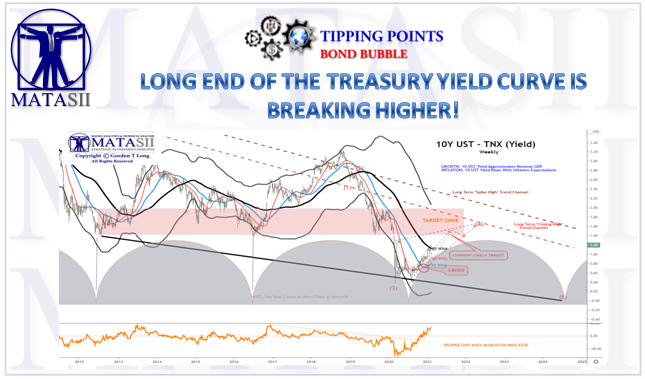

LONG END OF THE TREASURY YIELD CURVE IS BREAKING HIGHER!

Gordon T Long Global Macro Research | Macro-Technical Analysis TIPPING POINTS BOND BUBBLE LONG END OF THE TREASURY YIELD CURVE IS BREAKING HIGHER! Right on-time US Treasury Yields are spiking higher, as we have been warning of in prior newsletters. As we outlined, this Is a result of the correlation since 2008 with the […]

RISING INFLATION YET RISING REAL RATES????

Gordon T Long Global Macro Research | Macro-Technical Analysis TIPPING POINTS RISING INTEREST RATES RISING INFLATION YET RISING REAL RATES???? We clearly have mounting inflation pressures yet we are also seeing rising real rates. How exactly does that work?? To understand how this could happen is to understand what lies ahead! First, Real Rates […]

KEEP YOUR EYES FIRMLY ON INFLATION PRESSURES

Gordon T Long Global Macro Research | Macro-Technical Analysis TIPPING POINTS RISING INTEREST RATES KEEP YOUR EYES FIRMLY ON INFLATION PRESSURES GM joined Nissan & Ford this week in suspending production due to semiconductor shortages used in their vehicles. Global factory growth is being stymied by stalling exports and supply constraints. Meanwhile, US Services […]

THE LULL BEFORE THE COMING STORM

Gordon T Long Global Macro Research | Macro-Technical Analysis TIPPING POINTS RISING INTEREST RATES THE LULL BEFORE THE COMING STORM Both the US 5Y/5Y Forwards and 5Y Break-Even (see chart below) have firmed above their psychologically important 2% cut-off, as investors have started to accept a more robust shift towards fiscal stimuli […]

WILL THE EU BE THE FIRST CASUALTY OF A SPRUNG GLOBALIZATION TRAP?

Gordon T Long Global Macro Research | Macro-Technical Analysis TIPPING POINTS EU BANKING CRISIS II WILL THE EU BE THE FIRST CASUALTY OF A SPRUNG GLOBALIZATION TRAP? No major region in the world is presently being economically hit harder than the Euro Area! The EU is not only one of the hardest-hit by the COVID-19 pandemic, but also the weakest, most […]