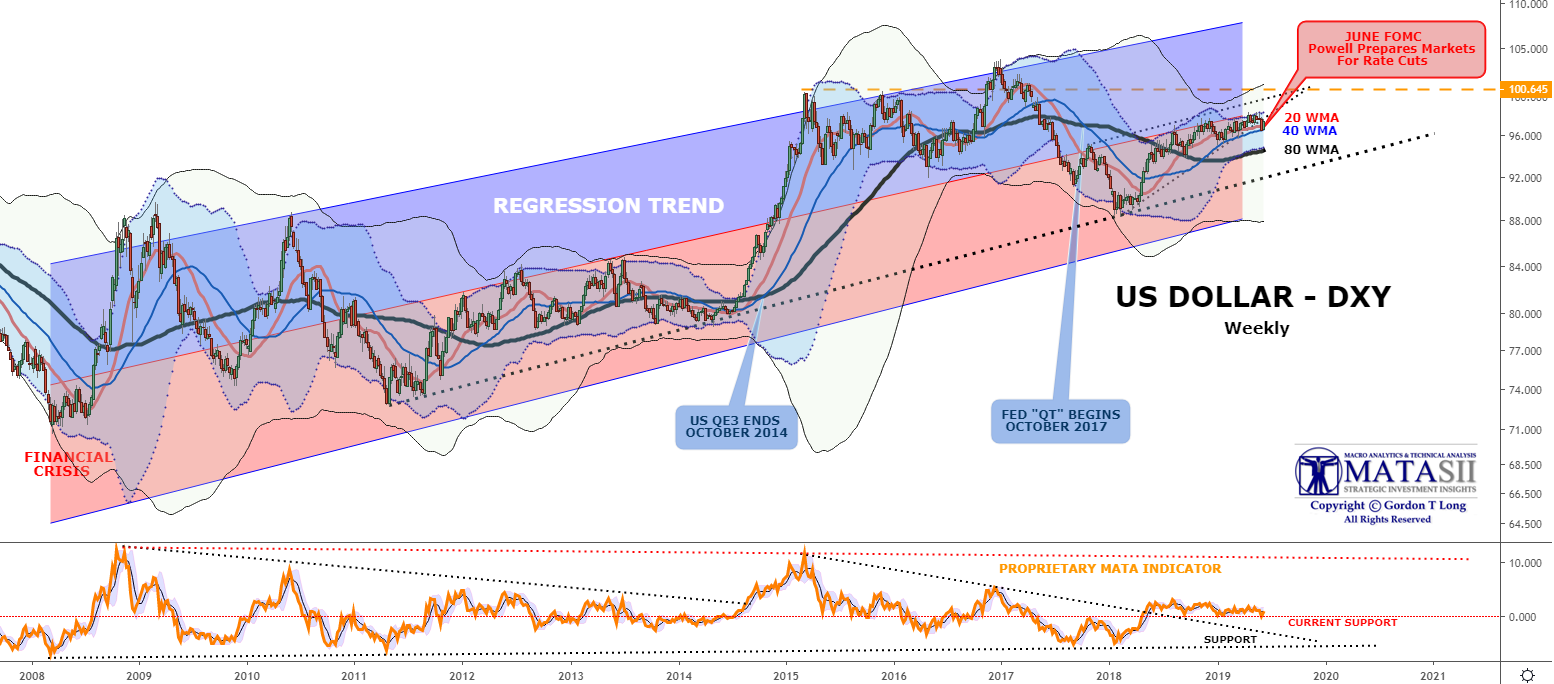

FED CHAIRMAN POWELL PREPARES MARKETS FOR MONETARY EASING & FURTHER US$ DEBASEMENT

As fully expected Fed Chairman Jerome Powell did not disappoint in signalling FOMC Rate cuts are ahead. Though the dollar did not appear to react, that is because it had weakened going into the much anticipated FOMC meeting and had already prepared by finding support at the 40 WMA. The dollar (DXY) looks technically week with the next support level at the 80 WMA (and lower).

The Powell's announcement and ECB's Mario Draghi's comments the previous day from Sinatra, Portugal exploded Gold higher, breaking major overhead resistance going back to 2013.

KEY FOMC TAKEAWAYS

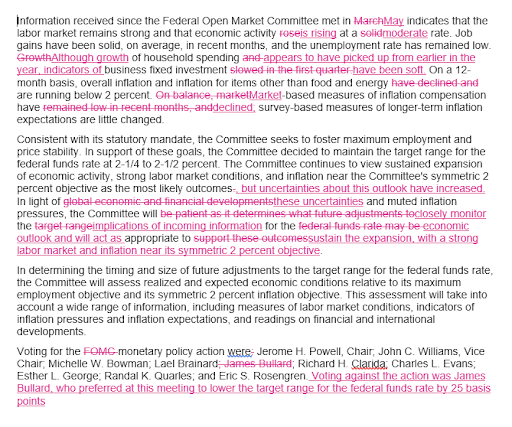

- Fed keeps rates unchanged but removes reference to being "patient" on rates while adding that "uncertainties" around its outlook have increased, even if did not warn of "material downside risks" to outlook.

- The FOMC says it will "act as appropriate to sustain the expansion" and "closely monitor" incoming information, language that echoes Powell's recent speech but is new to the statement.

The key sentence was the following:

... uncertainties about this outlook have increased. In light of these uncertainties and muted inflation pressures, the Committee will closely monitor the implications of incoming information for the economic outlook and will act as appropriate to sustain the expansion, with a strong labor market and inflation near its symmetric 2 percent objective

And yet it wasn't as dovish as some had expected, with the Fed avoiding to mention "material downside risk to the outlook."

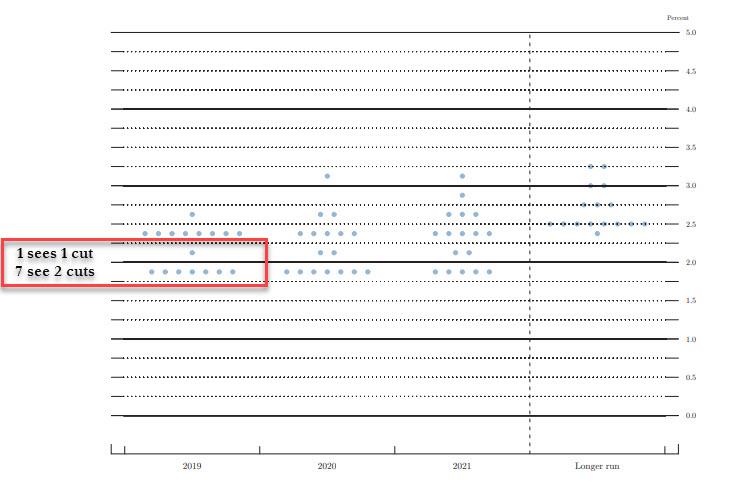

The Dot Plot adjusted dramatically lower...

- For 2019, 8 Fed officials see lower rates with 7 of them seeing 2 cuts this year (and 1 seeing one cut). At the same time 8 see unchanged rates and 1 sees a rate hike.

[SITE INDEX -- TIPPING POINTS - CURRENCY WARS]

A PUBLIC SOURCED ARTICLE FOR MATASII

READERS REFERENCE: (SUBSCRIBERS & PUBLIC ACCESS)

MATASII RESEARCH ANALYSIS & SYNTHESIS WAS SOURCED FROM:

SOURCE: 06-19-19 - - "Fed Hints At July Cut As Expected, Drops "Patient" Language, Says "Outlook Uncertainty" Has Increased"

FAIR USE NOTICE This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a 'fair use' of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond 'fair use', you must obtain permission from the copyright owner.

NOTICE Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. MATASII.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility.