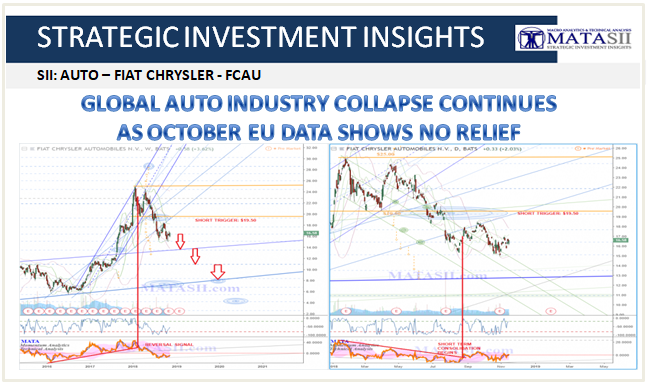

THE HEADLINE: GLOBAL AUTO INDUSTRY COLLAPSE CONTINUES AS OCTOBER EU DATA SHOWS NO RELIEF

MATASII SII ANALYSIS: FCAU Fiat Chrysler Automobiles IDEA: APRIL 13th, 2018

GLOBAL AUTO INDUSTRY COLLAPSE CONTINUES AS OCTOBER EU DATA SHOWS NO RELIEF

A PUBLIC SOURCED ARTICLE FOR MATASII (SUBSCRIBERS-SII & PUBLIC ACCESS) READERS REFERENCE

SII - RETAIL AUTOMOTIVE

11-16-18 - "Global Auto Industry Collapse Continues As October EU Data Shows No Relief"

11-14-18 - "German Economy Shrinks For First Time In 3 Years As Car Production Collapses"

MATASII TAKEAWAYS:

- Third quarter that saw sales drop in many major markets across the globe, including China,

- Deliveries of new passenger cars were down 7.4% in the EU and the European Free Trade Association in October from the year prior. This adds to a 23% drop that occurred during September according to data from the European Automobile Manufacturers Association,

- This was so acute it led to the first negative GDP print for Germany since 2015,

- The new emissions standards (dubbed "WLTP"), a remnant of German automakers' emissions test cheating days, continue to be a cause for profit warnings for companies like Daimler and BMW,

- China now predicts its full year passenger auto sales will post their first annual decline in 30 years.

The outlook for the global automobile market has been increasingly dire lately, especially after a third quarter that saw sales drop in many major markets across the globe, including China. Now, the latest data from Europe suggests that the difficulties may be nowhere close to over despite optimistic fourth quarter guidance by companies like Volkswagen and Daimler AG.

Deliveries of new passenger cars were down 7.4% in the EU and the European Free Trade Association in October from the year prior. This adds to a 23% drop that occurred during September according to data from the European Automobile Manufacturers Association, and which was so acute it led to the first negative GDP print for Germany since 2015.

Despite the ongoing sales weakness, which many attribute to one-time events, some analysts – like those at EY Consultancy - still expect the market to turn around in the fourth quarter. They argue that new emissions testing cited by many companies as the reason for disappointing sales, will only have a temporary effect.

At the same time, Citigroup analyst Angus Tweedie thinks the downside is not over for companies like BMW and Daimler AG, according to Bloomberg. In a note titled"The Golden Age Ends With a Crash",Tweedie wrote that "Heading into 2019 we see few remaining avenues of maneuver, and with volume growth slowing in most markets believe the scale of pressures will become obvious."

Meanwhile, ongoing challenges like the slowdown in China have been exacerbated by trade wars, casting a cloud over the industry. However, one of the main potential threats, tariffs on imports from the EU, has been alleviated for now, as we wrote yesterday. Following the data release, European automakers like Daimler, VM, and BMW were all trading lower between 1% and 2%.

The new emissions standards (dubbed "WLTP"), a remnant of German automakers' emissions test cheating days, continue to be a cause for profit warnings for companies like Daimler and BMW. The rush to get cars ready for new regulations has put pressure on auto sales this quarter. And while BMW made the deadline, it reportedly couldn't escape pricing pressure from competitors entering the market at the same time.

The September and October slump follows a marked jump in August that occurred as auto makers rushed to sell vehicles before the new regulations took place. Total sales in Europe are holding onto a meager 1.4% gain through October even as China now predicts its full year passenger auto sales will post their first annual decline in 30 years.

MATASII TAKEAWAYS:

- Bundesbank's warnings that the economic engine of Europe faltered during the third quarter have proved accurate,

- Just saw the worst GDP print in three years, Germany saw its economy contract 0.2% in Q3, putting Europe's strongest economy on the bring of a technical recession,

- The hope is that the setback is related largely to new emissions tests that temporarily disrupted car production -- the data will feed into fears that the euro area’s expansion has faltered as the Continent faces down risks including Italy's confrontational populism, the looming Brexit, and the ongoing US trade conflict (which threatens to hammer the German auto industry if Trump changes his mind and decides to pursue tariffs),

After notching a tepid growth rate in the prior quarter, the Bundesbank's warnings that the economic engine of Europe faltered during the third quarter have proved accurate.

In what was its worst GDP print in three years, Germany saw its economy contract 0.2% in Q3, putting Europe's strongest economy on the bring of a technical recession and providing the clearest sign yet that economic growth in the euro area stalled just as the ECB was preparing to end its massive bond buying program with an eye toward raising interest rates late next year, according to Bloomberg.

While the hope is that the setback is related largely to new emissions tests that temporarily disrupted car production, the data will feed into fears that the euro area’s expansion has faltered as the Continent faces down risks including Italy's confrontational populism, the looming Brexit, and the ongoing US trade conflict (which threatens to hammer the German auto industry if Trump changes his mind and decides to pursue tariffs). But analysts have found at least one scapegoat to blame the contraction: according to Bloomberg, Germany's economic ministers hope the contraction was largely driven by new emissions tests that temporarily disrupted car production. Data from the VDA German carmakers’ association appears to bear that out, as the agency said September production plunged 24% compared with a year earlier.

At least one analyst said they expect auto production to rebound, as a second quarter of declining growth would be "highly unlikely" especially as that would put Germany in a recession.

"The good news is that the economy will expand at a decent clip so long as auto output doesn’t take another leg down - and that’s highly unlikely. We expect a material rebound as industrial production picks up a bit further through the quarter."

Germany's Economy Minister Peter Altmaier echoed that view during a speech in Berlin, saying the GDP figures were "not particularly pleasing but were also not a secret," and that it's no catastrophe, we had similar numbers in 2015." If anything, the data showed us that the expansion "is a tender flower" that must be protected (the implications of which, we imagine, were not lost on Draghi).

"All experts say that the expansion will continue." "But it also shows that an expansion is a tender flower and that we have to work to make sure it continues."

Germany's statistics office doesn’t offer a detailed breakdown of GDP but it did say that exports and private consumption both dropped last quarter while equipment investment and construction rose. The poor print out of Germany was expected to weigh on growth later in the year.

The third-quarter weakness in Germany dragged on the euro area, with data later on Wednesday forecast to show its economy expanded at the weakest pace since 2014. While the ECB has already downplayed the loss of momentum, a year-end revival isn’t assured. Germany’s manufacturing sector - which accounts for almost a quarter of economic output - may feel the pain of trade tensions and China’s slowdown.

So far, at least, the ECB is choosing to see this as a one-off. But if tepid growth persists for another quarter, the market could begin repricing expectations surrounding a late-2019 rate hike.

Any signs of persistent weakness in Germany, which accounts for a third of the euro area economy, would play into the thinking among ECB policy makers as they complete their exit from three years of large-scale bond-buying.

But Chief Economist Peter Praet said while there’s been a slowdown in the euro area, domestic demand remains "robust."

"Fluctuations in the data can’t hide the fact that the economic upturn in Germany and the euro area remains intact," Bundesbank President Jens Weidmann said on Wednesday.

Germany's economic ministry is calling for a return to growth in the fourth quarter.

"Indicators for manufacturing and the overall economy, as well as the development in the export environment, underline" a return to growth in Q4. But as auto sales in China and the US weaken, Germany's production delays might also mask the fact that the underlying global demand for German cars has diminished.