IN-DEPTH: TRANSCRIPTION - THEY WILL DO MORE THAN “PRINT THE MONEY”!

COVER

AGENDA

In Part I & II, I focused on structural issues within the financial markets with specific emphasis on the Equity Market. As serious as the problems I outlined in Part I & II are, they are basically reflective of how the system is being "Gamed". Like a Casino the financial markets attract all manner of personalities who have all sorts of devious ideas (both legal and illegal) with which to "beat the system". Unfortunately, we are talking about the bedrock of the capitalist system here, not a playground for "Gamers". The financial markets are relied on to properly allocate precious capital in the most productive & efficient manner possible.

Unfortunately, the massive & sophisticated gaming has been going on for such a long time now that it is only a matter of time before the growing distortions it has created will not doubt propagate an across the board systemic crisis.

SLIDE 5

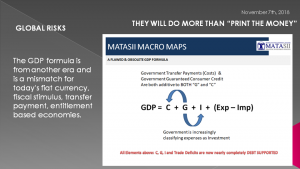

.. but it gets worse than what I outlined in the first two parts of this three part series. The "Gaming" extends out of Wall Street and into the real economy. The most blatant is how we measure Economic Growth or what is referred to GDP. This number is the basis for an infinite number of decisions that underpin daily our entire financial system.

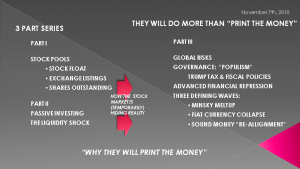

As you can see on the left GDP has been steadily declining across the globe... and these are the official numbers (from in the case shown here the OECD), but match those from the IMF, WTO, WEF et al. This is a profound slowing especially if factored against realistic numbers and not the bogus politically motivated adjustment numbers like the CPI (... the social security pensioners out there will attest to this!).

--- But again it gets worse!

Our 2017 Thesis Paper "The Illusion of Growth" lays this out in a 111 page document. I encourage you to scan it if you haven't already. For non-subscribers you can gain access to it through our free e-mail services.

SLIDE 6

We won't discuss the manipulative techniques of Imputation, Hedonics, Substitution et al today but rather just one example of the degree of distortion.

The GDP formula is from another era and is a mismatch in the context of today's fiat currency, fiscal stimulus, transfer payment, entitlement based economies. Governments are now such a large part of most sovereign economies that they completely distort this formula. Government spending gets counted multiple times for multiple reasons. There is no "netting" that would bring it back closer in line with a measure of true productivity centered economic growth.

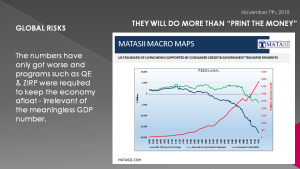

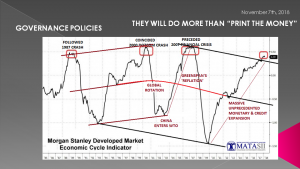

SLIDE 7

The green line shown places this problem into perspective. The 2008 Financial Crisis was the point where the accumulation of all the government money associated with government transfer payments and consumer credit actually overwhelmed the system. The numbers have only got worse since and while programs such as QE & ZIRP have kept the economy afloat - irrelevant of the meaningless GDP number. As you are fully aware this is not solely a US problem, but rather a global problem and it is why it took a total global expansion of the money supply approaching $29T to keep the global financial system afloat.

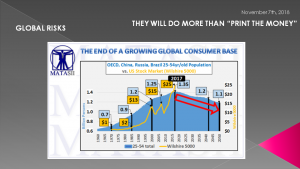

SLIDE 8

We need to appreciate that all corporations and government revenues lead back to consumer consumption. In the case of the US consumption (or the "C" in the GDP formula) it is ~70% of our GDP. To sustain growth US corporations have therefore been aggressively pursuing the global consumer market for over 4 decades now. Lifting economies out of poverty and political headwinds such as getting China to become a more consumer centric economy are daunting in themselves but are seen to be required if we are to keep global economic growth expanding faster than the real rate of inflation.

But the glacial & stealth problem we tend to overlook is demographics.

The consuming 24-55 age of the global population has peaked! This is more than a headwind. This is like pulling the rug out from under the economy - especially the economies addicted to expanding credit and debt to keep the growth charade alive!

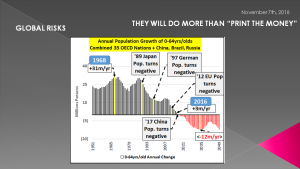

SLIDE 9

Last year China's decades old "one child" policy kicked in! China's population growth has now gone negative. So where are all the consumers going to come from and at the rate we have built a global financial infrastructure on?

The world is certainly not coming to an end but financial policies are going to forced to change because of this and that is the point we are leading to. We obviously need to ask - in what direction is that change likely to head?

SLIDE 10

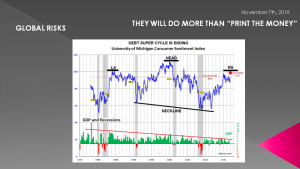

Additionally, I believe (as do others) that the Debt Supper Cycle is ending. Look at any Kondratieff Generational Long Wave and you can see it is overdue.

We are likely at the midst of the final "sugar high" in public sentiment, ignited by unprecedented Monetary Policies but as you can see from the downward sloping green GDP line at the bottom, the inevitable lies ahead.

SLIDE 11

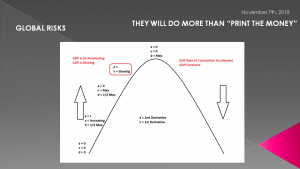

My simplistic view of all of this is that it is like tossing a ball into the air. From your calculus classes you will recall that distance, velocity and acceleration experience different measures as the ball reaches it's peak before falling back to earth. What happens before we reach the peak is that acceleration becomes negative or experiences deceleration, while velocity starts to slow (but is still positive) and height meanwhile still shows growth.

That is exactly what is happening with the "official" GDP measures. In reality based on true growth it is my opinion we are actually on the descending side of this illustration.

SLIDE 12

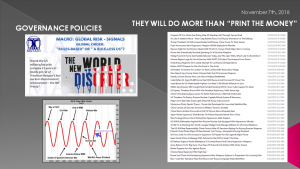

In 2014 I wrote an extensive Thesis paper entitled "The Globalization Trap". This 184 page document laid out in gory detail what was inevitably going to happen with advancing Globalization. It would inevitably lead to a hyper inflation and a liquidity trap due to impaired collateral and insufficient real wealth creation. I encourage you to also review this document if you haven't already.

SLIDE 13

A core point of the document is that ironically real deflation will impair real disposable income. Global labor arbitrage will effectively kill the golden goose of high earning economies and stall the debt driven growth engine.

That is where we are now.

SLIDE 14

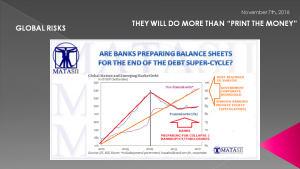

I don't believe I am alone in this thinking. You can see that the global banks have been preparing for something that is clearly bothering them!

SLIDE 15

Lets shift from the risks and problems out there and talk about what we are doing about them? Lets talk about Global Governance (a section we regularly post to in our Macro Research section on Global Risk).

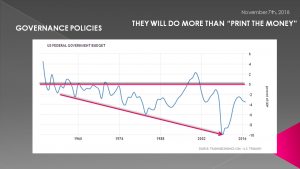

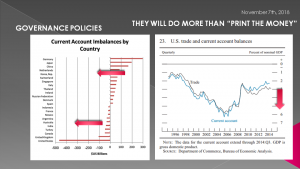

A central belief our political leadership has is that when the economy slows, then "Fiscal Stimulus" is the first order of the day. Government Fiscal spending is the sole solution always, immediately resorted to! The consistent adoption of such policies has lead to massive and growing fiscal deficits, negative current accounts and historic levels of debt to GDP. Somehow we always forget to payback the debt encumbered stimulus.

You would think that when you find yourself in such a deep hole the first order of business would be to stop digging? Not the case. It is an excuse or perceived requirement to spend even more and at a faster rate!

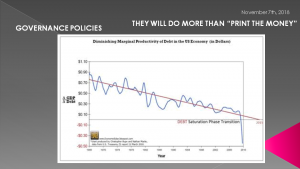

SLIDE 16

Well the law of diminishing returns appears to be something that our politicians failed to study (the few that ever bothered with even a rudimentary Economics 101 course). Endless studies have proven that the "bang for the buck" for stimulus spending has been steadily falling. Some argue it actually went negative during the last financial crisis and is still negative. Even conservative economies agree it is now minimal. compared to historical expectations.

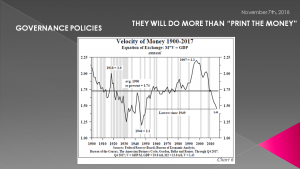

SLIDE 17

The Velocity of Money has also been steadily falling since the Dotcom peak and fell below the long term average going back to 1900 during the 2008 financial crisis. Money is effectively now being consumed for things like debt versus moving through many hands all participating in increasing productivity through capital investment. When Money Velocity is not increasing then standards of living fall and as a consequence real disposable income also falls.

This isn't rocket science but appears to be something that is politically best left untouched and out of the tightly controlled public narrative - like $84T in unfunded US entitlement programs and $400T in global pensions obligations by 2050

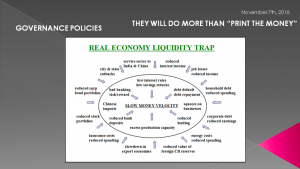

SLIDE 18

As this chart illustrates there are a raft of factors all now contributing to slowing velocity of money! Few if any are being addressed and as a matter of fact all have forces on them to increase. Short term pressures and thinking in the face of longer term problems. "Avoidance" is the domain of politicians. They are about taking advantage of an inevitable crisis to achieve goals that otherwise wouldn't be achieved - like limiting Social Security and Medicare during the next crisis or using it as the excuse for why spending must be increased!

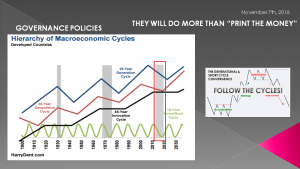

SLIDE 19

This game is not new and actually can be seen in the study of cycles. I have done many UnderTheLens video's on cycles but as you can see here from one of the best cycle guys in the world - Harry Dent, we have many of them (if not all) converging at this time. Sometime between now and 2022 almost all cycles I have studies are pointed downward within their various cycle frequencies. I refer you to the UnderTheLens archive on our YouTube channel to explore more cycles than illustrated here.

SLIDE 20

Politicians and Government Institutions are motivated for their own survival to maintain social stability and the status quo. No matter what, keep the system afloat even if only temporarily to buy more time - just kick the can down the road. This is irresponsible but is how our democratic system actually works and can be counted on not to change until a crisis is so large it gives the required political 'cover' to implement long overdue changes. Governments are not managed like businesses. An effective politician is not often a good businessman - they think differently.

One is about perceptions, the other about reality. One is about fixing problems the other is about avoiding them. For those who have studied "Management" they will recognize the term "Country Club Managers". That is what politicians are. They actually wouldn't survive if they were different.

SLIDE 21

Now we are getting to what lies ahead. Politicians will do what they have already been doing (even if it has failed) by doing even more of it, but at a faster and more aggressive rate.

SLIDE 22

There are no new ideas even being proposed for any the problems we previously discussed. None - notta!

We see social tensions everywhere and as I pointed out is this months Global Risk we are now seeing global governments hurriedly heading in the fiscal direction of dramatically increasing military and defense procurement.

SLIDE 23

Current conditions are highly likely to simply continue in their deteriorating trajectories. This is where investing steps in. Taking advantage of high probability predictable outcomes.

SLIDE 24

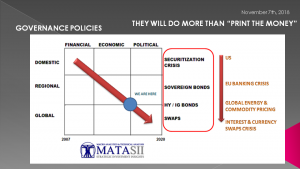

What is likely to break and create the next crisis, which we have been calling for a few years now, is the ~550T unregulated, OTC, opaque global currency & interest rate Swaps game. Many of you will recall this grid which we put together at the time of the Financial Crisis on what the unfolding sequence would be. At that time we were in the upper left quadrant. We are now after nearly a decade in the bottom right quadrant.

SLIDE 25

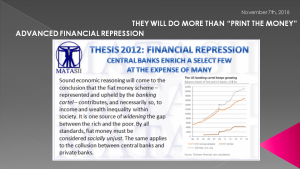

The Governance answer to all this is going to be significantly advance levels of Financial Repression. This is one of the reasons that years ago I co-founded the Financial Repression Authority where we still have an active web site with regular guests interviews.

SLIDE 26

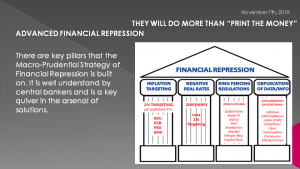

There are key pillars that the Macro-Prudential Strategy of Financial Repression is built on. It is well understood by central bankers and is a key quiver in their arsenal of solutions to keep governments solvent despite continuous failing fiscal policies. Never forget that the central banks like the Federal Reserve often answers to the banks and not the political apparatus - called separation of powers.

SLIDE 27

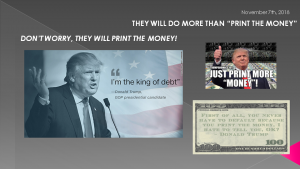

When government start spending even more excessively, (and our current President has spent his career leveraging debt and even publicly considers himself the "King of Debt") you can expect the Central Bankers to soon go into overdrive.

SLIDE 28

What we are highly likely to witness is advanced Financial Repression programs such as:

- Helicopter Money to avoid the Banking issues associated with collateral requirements,

- Negative Interest Rates (NIRP versus ZIRP) which the EU already implemented with at one point $9T of global debt being negative.

- Guarantees to keep Pensions and Insurance companies from imploding,

- The purchase of Assets other than Bonds to include the Stock Market (as Japan is already doing),

- The Implementation of a Cashless system to stop bank runs & bankruptcies and forced liquidity injections,

SLIDE 29

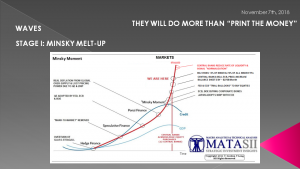

It is my opinion, other than a few moments of market panic the Near to Intermediate Term future will see an accelerating Minsky Melt-Up in Financial Assets.

They will print the money in the event of any and all financial problems as the only agreed to expedient political solution to the problem dejure!

This is Stage I - which we are presently in.

SLIDE 30

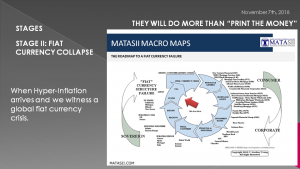

Of course this cannot last and is when we enter Stage II.

This is when Hyper-Inflation arrives and we witness a global fiat currency crisis. It is still quite a few years ahead so this is not your concern today but you need to plan for it or your retirement will not be a happy one. Remember Hyper-Inflation is a Currency Event - not an Inflation Event (though Inflation goes through the roof and is what everyone believes is happening while it is really about falling currency values).

SLIDE 31

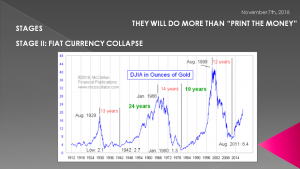

This thing to watch closely here for its advancement is the rate of US "De-Dollarization". Our MATASII "De-Dollarization" Tipping Point tracks this with breaking news posts.

SLIDE 32

Gold prices will also be another tell tale sign to watch.

SLIDE 33

But those days are still ways away and many gold bugs are highly likely to have finally thrown in the towel before Stage II occurs. If they haven't their profits will be confiscated in the form of predatory taxation.

SLIDE 34

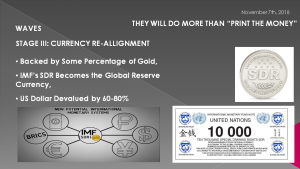

Stage Three will be about a Global Re-Alignment of the Global Reserve Currency. There are many possibilities here depending which power has been most successful in surviving. Right now it looks like some form of the current IMF's SDR (Special Drawing Rights).

SLIDE 35

Everything I have talked about here in itself is another video or has been a video or two previously.

My intent as I spelled out at the beginning of Part I was to explain simply why I always end the videos with "Don't Worry - They will spend the Money!"

Knowing this defines your investment strategy for the foreseeable future.