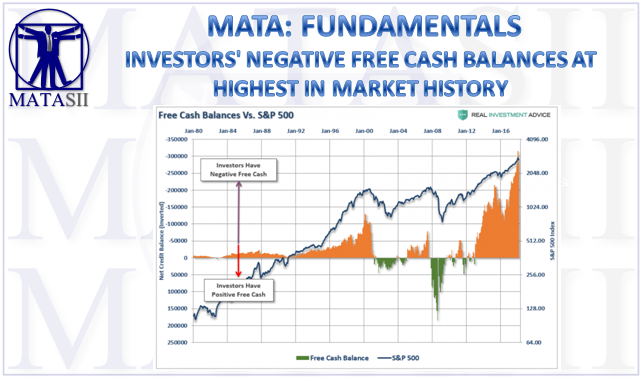

INVESTORS' NEGATIVE FREE CASH BALANCES AT HIGHEST IN MARKET HISTORY

“There are two other problems currently being dismissed to support the ‘bullish bias.’

The first, is that while investors have been chasing returns in the ‘can’t lose’ market, they have also been piling on leverage in order to increase their return. Negative free cash balances are now at their highest levels in market history.”

“Yes, margin debt does increase as asset prices rise. However, just as the ‘leverage’ provides the liquidity to push asset prices higher, the reverse is also true.

The second problem, which will be greatly impacted by the leverage issue, is liquidity of ETF’s themselves.

When the ‘robot trading algorithms’ begin to reverse, it will not be a slow and methodical process but rather a stampede with little regard to price, valuation or fundamental measures as the exit will become very narrow.”

Read: The Risk Of Algo’s