MAJOR RED FLAG: LEVERAGED (COV-LITE) LOANS SURPASS HY JUNK BONDS

A PUBLIC SOURCED ARTICLE FOR MATASII (SUBSCRIBERS-SII & PUBLIC ACCESS) READERS REFERENCE

SII - BONDS & CREDIT --- SII - LENDERS (INSTITUTIONAL LEVERAGED LOAN FUNDS)

10-18-18 - ""We're In Uncharted Territory": In Historic Milestone, Leveraged Loan Market Overtakes Junk Bonds"

At the start of the month, we highlighted that the "incredibly shrinking junk bond spread" had just passed a historic landmark, when the Bloomberg Barclays U.S. Corporate High Yield index broke below the lowest spread since before the financial crisis, dipping to 309bps, the tightest level since late 2007.

The key reason for this relentless demand for "junk paper" has been the accelerating shrinkage in high-yield supply, as last month was the slowest September for junk bond issuance since 2011, while the high yield market as a whole has been contracting as investors have shifted their focus to leverage loans where - together with CLOs - demand has exploded recently, and the size of the loan market has soared even as the junk bond market has continued to shrink.

Meanwhile, with rates continuing to rise, investor demand has shifted ever more aggressively to floating-rate debt, i.e., leveraged loans, which provide buyers with interest rate protection as the cash interest is indexed to Libor or Prime which rises alongside the Fed Funds rate (earlier today, 3M USD Libor hit the highest since 2008) at the expense of traditional junk bonds where due to the fixed coupon, price is inversely affected by rising yields.

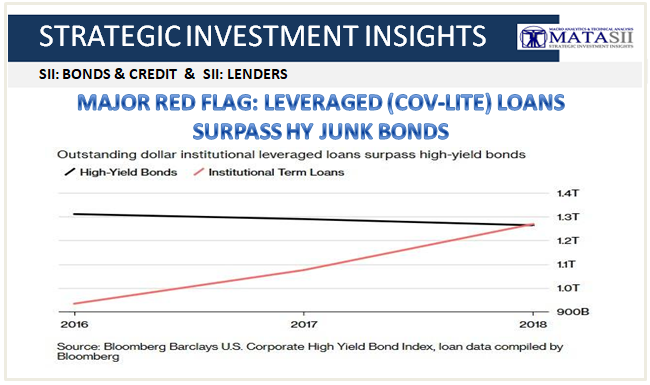

Which brings us to another landmark inflection point: according to Bloomberg calculations, in the past week the total notional of outstanding USD leveraged loans has just hit $1.27 trillion for the first time, overtaking the high-yield bond market which dipped to $1.26 trillion, and cementing the status of loans as the go-to financing source for junk bond companies. Additionally, October is on course for the highest loan issuance since June, while junk bond sales are the slowest since 2009.

While understandable - investors don't want to be penalized for rising rates in the current tightening environment - the relentless growth in the loan market has prompted numerous and widespread warnings, from banks such as Bank of America and JPMorgan, to prominent investing luminaries such as Howard Marks and Scott Minerd, all the way to the Fed, which in its latest FOMC Minutes on Wednesday, warned that it is watching for "possible risks to financial stability" from the leveraged loan industry, which unlike traditional junk bonds, belongs largely to the domain of non-bank lenders and as a result is generally unsupervised by regulators.

In his September memo to clients, Oaktree's Howard Marks captured the key tension in the junk vs loan markets, noting that "growth has been in levered loans, not high-yield bonds," and adding that “the risk level has risen in loans while remaining stable in high yield bonds."

Another rising concern has been the rapid deterioration in investor protections in the form of a growing prevalence of covenant-lite loans, which now make up the majority of the market and which have effectively stripped secured protections from the loan market: "overall, loan documentation is weaker and there’s further evidence that new borrowers coming to the market for the first time are coming with much weaker credit than in the past,” said Morningstar Credit Ratings analyst John Nagyker, cited by Bloomberg. "These features can enable or worsen the next crisis."

Commenting on this pervasive covenant stripping, in an extensive note published by Bank of America last week, credit strategist Oleg Melentev said that "strong competition in the new CLO/loan asset management space in the last few years led to deterioration in key investor protections, such as restricted payments, asset sales, EBITDA add-backs, and incremental debt capacity."

As a result, the bank predicted that during the next credit cycle, credit losses could balloon far more than historical precedent would suggest, as much as 2x the expected annual yield income in high yield and leveraged loans, and 1.3x in private debt.

Investors could also experience temporary mark-to-market losses of up to 5x of their annual income. To put this downside risk into perspective, it would take a 325bps increase in yield to wipe out 2 years of yield income in HY, given the 4yr duration of this asset class. In other words, a 150bps increase in Treasury yields coupled with a 150bps widening in spreads is less damaging than a cyclical turn.

However with investors clearly oblivious to any of these risks, last month even the Bank for International Settlements chimed in, warning about the danger from leveraged loans in its September quarterly outlook, and noting that a boom in leveraged loans often presages a bust in the wider economy. The loan market - which is "particularly pro-cyclical" had risen faster than high-yield bonds in the run-up to the GFC and during the subsequent period of extraordinary monetary accommodation the BIS reminded its readers, a clear reference to the current period.

Even so, demand continues unabated, and in an amusing anecdote , Bloomberg writes how JPMorgan Asset Management CIO Bob Michele recently passed on some prospective high-yield bonds this year, "only to discover that the borrower later circumvents the bond market entirely and sells loans. You find they surface later with a lower yield in the loan market, where they’re swept up by floating-rate buyers and CLOs," said Michele.

“There’s potentially an over-extension of cheap borrowing,” said Michele "That’s always what seems to get the system in trouble.”

To be sure, much of the demand comes from Wall Street’s CLO machine, which will gobble up any leveraged loan product, often without regard for underlying fundamentals, hoping that its broad exposure will insulate it from wholesale losses. According to Bloomberg, collateralized loan obligations raised $90 billion in the first half in the U.S., compared with $53 billion over the same period last year.

In another example of the ravenous demand for loans, as part of the largest post-crisis leveraged buyout, Blackstone last month boosted the size of term loans in its $13.5 billion debt package to pay for its stake in Thomson Reuters’s financial-and-risk operations.

Of course, there is no such thing as a free lunch, and as monetary policy tightens and the business cycle ages, companies that have relied heavily on floating-rate loans will face bigger debt burdens, triggering defaults, the BIS - and virtually everyone else - warns. In fact, according to the BIS, default rates are already on the rise: according to BIS calculations, the default rate of U.S. institutional leveraged loans rose to 2.5% in June 2018 from about 2% in mid-2017.

One thing that is guaranteed: that number will only keep rising until the next recession, or until it causes the next recession.

We conclude with some parting words from Guggenheim's Scott Minerd who, when asked during a recent interview with Goldman Sachs what aspect of capital markets he is most worried about, and whether he is worried by the growth of non-bank lending, he had a simple answer: leveraged loans.

Fifteen years ago, around 80% of all syndicated loans remained on bank balance sheets through a “pro-rata” tranche that was a revolving credit line or an amortizing term loan; now, 70-80% of syndicated bank loans are outside of the banking system, meaning that the pro-rata tranche is much smaller in comparison to the institutional loan tranche that is distributed among non-bank lenders. We’ve also seen estimates that the private debt market has grown to around $400bn to $700bn in size—larger than the size of the bank loan market in 2007. That has made it harder to trace credit risk and maintain credit standards. Meanwhile, innovations like bank loan ETFs have moved credit risk into the hands of retail investors. That’s something we didn’t have to worry about in the last major crisis in corporate credit, in 2001/02.

His conclusion: "We’re in uncharted territory."

He is right, of course, but to most investors that simply means that during the next downturn the Fed will again have to bail everyone out. It will be up to Jerome Powell to prove them wrong... assuming Trump hasn't fired him by then.