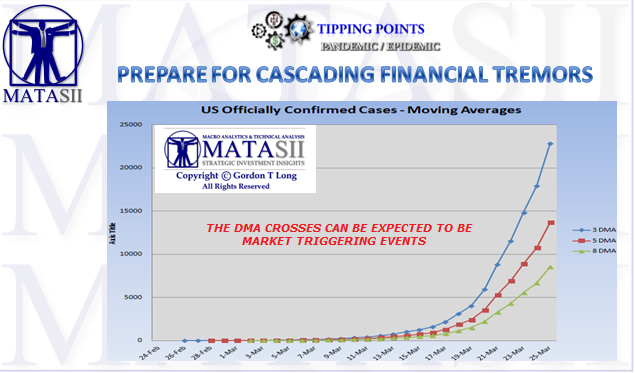

PREPARE FOR CASCADING FINANCIAL TREMORS

The US Economy is driven by Consumption which is just shy of 70%. The biggest employer in America is Small Business which employs approximately 70% of the US workforce. Both are frozen in self isolation or closed under Federal, State and Local government directives with little hope for either ending before May 1st.

The devastation to the US Economy and the other 205 countries impacted by the CoronaVirus is as yet unknowable.

We will be taking a stab at that in the upcoming LONGWave video entitled: “Liquidity versus Solvency”. As the title suggests the carnage and bankruptcies we should expect is going to be historic.

Governments are throwing everything at the looming economic fallout. No one has been more aggressive than the US in the form of both Monetary and Fiscal initiatives.

MONETARY POLICY

-

- The Fed has already launched every facility employed during the 2008 Financial Crisis AND MORE!

The Federal Balance Sheet has exploded by $1.6T in only 3 Weeks. This is the same amount as all of QE3 did over 15 months – and equivalent to an astounding 7.5% of US GDP.

FISCAL POLICY

-

- Congress have now enacted 3 separate phases of relief with the last totaling a historic $2.2T. It is expected that a fourth is on the drawing board for Infrastructure approximating yet another $2.0T

IS ANY OF THIS WORKING? WILL IT WORK?

So far the policy initiatives have stopped the financial “plumbing” from breaking down.

However, the problems only continue to grow. Here is just some of the current reading by impacted financial areas on my desk this morning:

- CLO’S (Collateralized Loan Obligations): CLO Pain Is Just Starting With Leveraged Loan Rating Cuts

- EMERGING MARKETS: Emerging markets will be ‘cut to their knees’ by pandemic, ex-IMF chief economist says

- MUNI MARKET: Muni Market Rout Returns With Record Exodus Fueling Cash Strains – Bloomberg

- HOUSING: Why U.S. Housing Bubble 2.0 Is About To Burst

- COMMERCIAL REAL ESTATE: $81 Billion In Rent Is Due Today And No One Knows What Will Happen

- AUTO SECTOR: US Auto Sales Plunge To Lowest In A Decade, But The Worst Is Yet To Come In Q2

- AIRLINES: United Airlines CEO Threatens Congress -Bailout or Layoffs-

- LEISURE & HOSPITALITY: US Box Office Sales Collapse To Just $5,179; Was $204 Million During Same Period Last Year

- SMALL BUSINESS: Wall Street Wins Again- Banks Force Treasury To Double Rate On Small Business Rescue Loan

- MORTGAGE LENDING: Here Comes The Next Crisis- Up To 30% Of All Mortgages Will Default In -Biggest Wave Of Delinquencies In History–

- UTILITIES: Even Utilities Are Cutting Their Dividends – Barron’s

- EU: Europe In A World Of Hurt (NYSEARCA-FXE) – Seeking Alpha

- WEALTH FUNDS: Very Challenging- – Norway Wealth Fund Lost Record $113 Billion, Withdraws Money To Fight Virus Crisis

- ETF OUTFLOWS: ETFs Liquidate at Quickest Pace Since 2017 Amid Market Turmoil – Bloomberg

- ENERGY: Oil Plunges To 17 Year Low As One Bank Predicts Negative Prices

- RETAILERS: Fitch Downgrades 9 Retailers In One Day, Including Macy’s, Nordstrom And J.C. Penney

It would appear that so far the problems are only getting worse!

THE PROBLEMS ARE GOING TO GET MUCH WORSE

The problem is that the pandemic has sprung a tightly coiled, unbalanced global financial spring that will violently ricochet throughout the global financial system in the years ahead.

To comprehend the full threat, two harsh realities must be grasped before an accurate assessment of the current situation can be appreciated.

- All the Central bank’s free money creation won’t deliver:

- New, Unencumbered Collateral,

- A Single Creditworthy Borrower.

- We are facing a Reversing Trend in Globalization, or “DE-Globalization”

- Supply chains will be fractured and re-oriented,

- Products will cost more as a result,

- Inflation will rise,

- Interest rates, therefore, also will increase contingent upon Fed intervention.

- We have become accustomed to accessing many cheap foreign-made goods, the price for which will now be altered higher or altogether beyond our reach.

Since the 2008 GFC monetary malpractice coupled with Globalization’s stalled economic rate of growth has further tightened the already coiled financial spring. For most people, these realities remain inconceivable.

The widespread expectation is that at some point in the not too distant future, we will return to the relative stability and tranquility of 2019. That is highly unlikely to be the case. The COVID-19 virus only triggered these changes which will have an enormous and lasting impact on our lives, much as 9-11 did in America.

The LONGWave video will be available to subscribers 04-08-20 and will discuss the above in the context of expected market expect of the coming financial tremors.

====

FAIR USE NOTICE This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.

NOTICE Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. MATASII.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility.