PRIVATE EQUITY FIRMS ABOUT TO GET CRUSHED ON SUBPRIME AUTO BETS

Of course, the "thesis" seemed to be confirmed when auto securitizations performed relatively well throughout the financial crisis, amid a sea of mortgage bonds getting wiped out, and private equity titans were off to the races with wall street titans from Perella Weinberg to Blackstone and KKR scooping stakes in small niche lenders.

Unfortunately, as Bloomberg points out today, the $3 billion bet on subprime auto lenders hasn't played out precisely to plan as the "well, people have to get to work" thesis has proved to be somewhat less than full proof.

A Perella Weinberg Partners fund has been sitting on an IPO of Flagship Credit Acceptance for two years as bad loan write-offs push it into the red. Blackstone Group LP has struggled to make Exeter Finance profitable, despite sinking almost a half-billion dollars into the lender since 2011 and shaking up the C-suite multiple times. And Wall Street bankers in private say others would love to cash out too, but there’s currently no market for such exits.Since the turn of the decade, buyout firms, hedge funds and other private investors have staked at least $3 billion on non-bank auto lenders, according to Colonnade. Among PE firms, everyone from Blackstone and KKR & Co. to Lee Equity Partners, Altamont Capital and CIVC Partners waded in.

Many targeted smaller finance companies that often catered to the least creditworthy borrowers with nowhere else to turn. Overall, subprime car loans -- those extended to people with credit scores of 620 or lower -- have increased 72 percent since 2011. Last year, about 20 percent of all new car loans went to subprime borrowers.

“The PE guys sailed into this thing with stars in their eyes. Some of the businesses have done fine and some haven’t,”said Chris Gillock, managing director at Colonnade Advisors, a boutique investment bank. But right now, “it’s about as out-of-favor a sector as I can think of.”

Of course, the turnaround strategy was 'simple.' Given that subrpime auto collateral held up well during the great recession, private equity investors figured they were sitting on rock solid collateral that would holdup under even the most egregious loosening of underwriting standards. Therefore, given that there was 'no downside', lenders wholeheartedly embraced deteriorating underwriting standards, like stretching out terms so borrowers could 'afford' cars they couldn't really afford, as a way to grow their loans books.

Take Exeter. The company, which is licensed in all 50 states and works with roughly 10,000 dealerships, hasn’t been profitable since 2011, when Blackstone took a majority stake, an S&P Global Ratings report in September showed. That’s after the PE firm invested $472 million to help Exeter expand and cycled through three CEOs at the lender.On a pretax basis, Exeter turned a profit in 2016 and 2017, according to Matthew Anderson, a spokesman at Blackstone. He added the New York-based firm hasn’t tried to sell the lender.

Blackstone may look to unload Exeter later next year, said a person familiar with the matter, who asked not to be identified because it’s private.

Bad loans remain an issue. This year, a rash of delinquencies in two bonds stuffed with loans that Exeter made in 2015 caused the securities to dip into their extra collateral to keep investors whole.

Another example is Flagship, which Perella Weinberg bought in 2010. (Innovatus Capital Partners, which manages the lender on behalf of Perella Weinberg, was formed by former Perella Weinberg managers last year after they split from the firm.)

As it turns out, the "well, people have to get to work" thesis only works to the extent that auto manufacturers maintain some level of discipline and refrain from exploiting their captive finance companies to flood the market with new supply...a move which will eventually lead to crashing used car prices and massive subprime securitization losses.

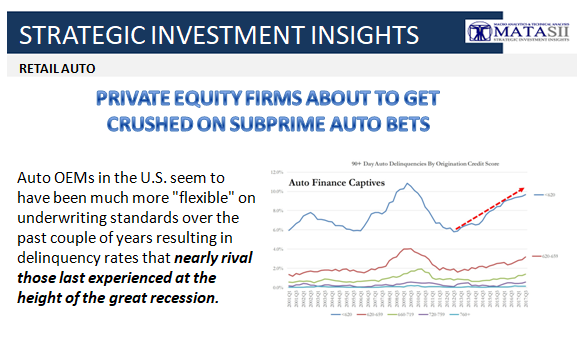

Unfortunately, as we pointed out last month, a review of the latest Fed data on auto loans underwritten by "Banks and Credit Unions" compared to those loans provided by "Auto Finance" companies prove that the nightmare scenario is playing out for subprime lenders...

First, taking a look at auto loans provided by traditional banks and credit unions, one can see some marginal deterioration in subprime auto loans. That said, the deterioration is certainly nothing substantial with 90-day delinquencies pretty much in line with 2004/2005 levels and no where near the rates experienced in 2008/2009.But, a drastically different picture emerges when looking at just the auto loans originated by America's auto finance captives. To our great 'shock', auto OEMs in the U.S. seem to have been much more "flexible" on underwriting standards over the past couple of years resulting in delinquency rates that nearly rival those last experienced at the height of the great recession.