SCHIFF: BOND MARKET RIGHT BUT MAKING WRONG BET

Peter Schiff is out with a new note that on how he believes the bond market is right about its views and reaction to the pending recession. However, he feels they are missing what the outcome of the recession will be.

That outcome is STAGFLATION. This would mean higher INFLATION and slower growth. Schiff feels Inflation will drive bond prices down and yield up.

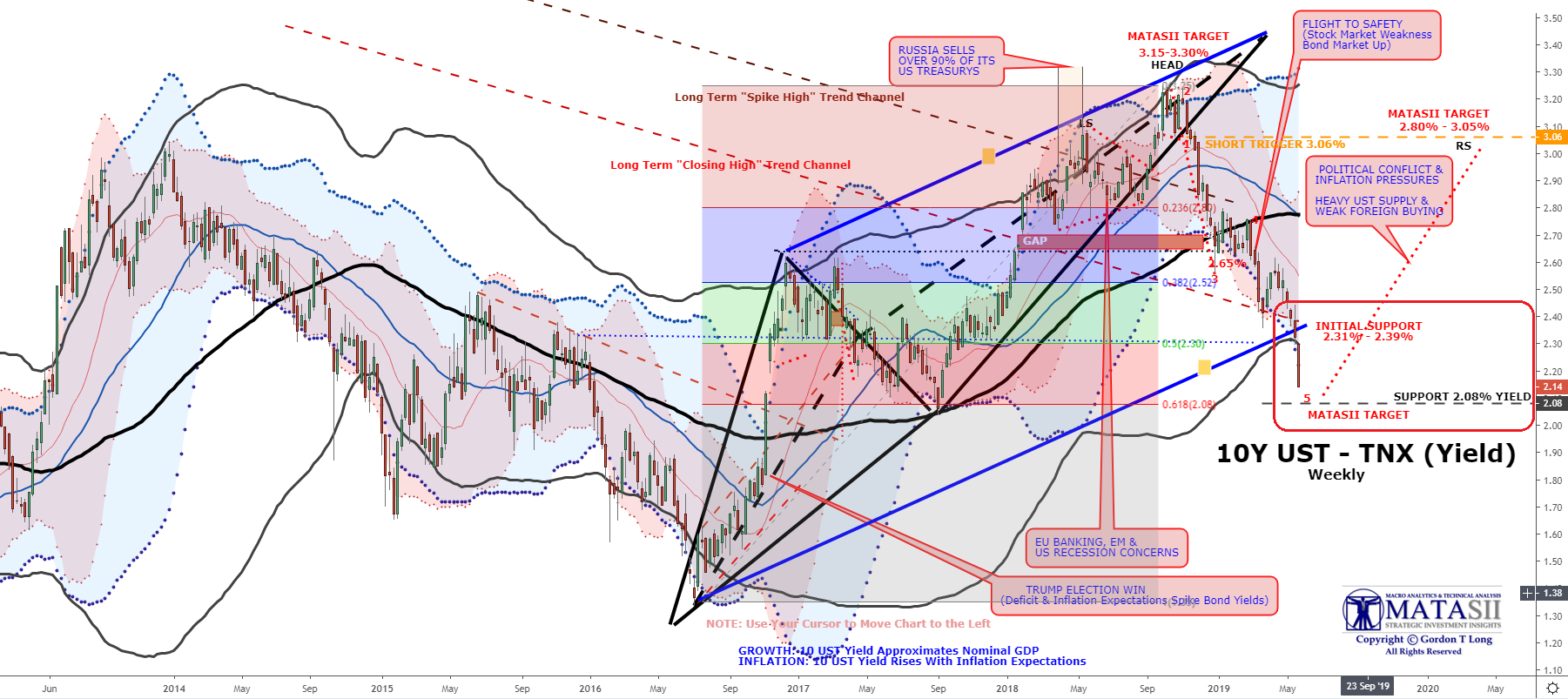

This is what we have been arguing at MATASII.com with a slightly different twist. We see Skiff's argument being the driver of our "Right Shoulder".

Here is Peter Schiff's note:

Bond prices have spiked and yields have fallen in the last several weeks. Investors are beginning to see a recession on the horizon and they are pouring into Treasurys believing they will provide a safe haven. In his most recent podcast, Peter said bond buyers are right about the looming recession, but they are making the wrong bet.

In a podcast earlier this month, Peter Schiff called the end of the bear market rally. He reasoned that the rally was built on expectations that the Federal Reserve was shifting toward an easing cycle. When Jerome Powell came out and threw cold water on that, Peter figured that would be the end of the market rally. As he put it, “What the Fed giveth by being more dovish than the markets expected, the Fed had finally taken away by being more hawkish.”

In that podcast, Peter said he didn’t believe that the Fed was nearly as hawkish as it was projecting, nevertheless, it gave that impression.

Fast-forward to today and the S&P 500 and the Dow Jones are both down about 5.5% from their early-May highs.

I still think we are in a bear market. I do not believe that the rally that we had following the Fed’s pivot constituted a brand new bull market that is now already probably over and this is a new bear market. I think this is the same bear market.”

Peter said it did surprise him a bit that the bear market rally went as high as it did. But he thinks things are beginning to turn back and that we will eventually revisit the lows we saw early this year. That will prompt the Fed to once again come to the markets’ rescue. In fact, the markets are already pricing in rate cuts even though Powell and company took them off the table.

The question is how long with the central bank wait?

If the Fed waits until we’re officially in a recession, well, then they’re just going to go straight to zero. They’re not going to pass go. But if they started cutting rates sooner, like maybe next week or something, then maybe its possible they only go a quarter point or a half point. But that’s not going to be enough. That is going to do nothing. That is going to be like waving a scarf at a bull. Because the minute the Fed cuts the markets are going to push them to cut more.”

Peter said that he doesn’t even think another round of QE will do the trick this time around. Every time a bubble pops, it takes more air to reflate it. The amount of air — QE — that the Fed would need to blow up another bubble once the current one completely deflates would wreck the dollar.

The markets still don’t get this, but they are starting to worry about a recession.

Investors are pouring into US Treasurys, thinking they are a safe haven. The yield on the 10-year bond fell to 2.26% on May 29 and we are seeing some inversion on the yield curve. This has historically signaled a looming recession. Peter said they are right about the recession, but everybody is getting one thing wrong – this is not bullish for bonds. It’s bearish for bonds.

The bond market is betting on a recession and that the Fed will slash rates.

Now, the market is correct. We are going into recession and the Fed is going to respond to this recession the same way it responds to all recessions that it causes, and that is by doing more of what caused it, which is slashing interest rates back to zero. But what the markets, I think, have got wrong is the reaction. Because the recession we’re going to get this time is going to be stagflation. We are not going to have stable prices or a drop in the official inflation rate. Inflation is going to rise. And that means bond prices are going to fall. And that is going to exacerbate the severity of the next recession.”

In recent recessions, low inflation has provided a cushion for consumers. It has also allowed the Fed to cut interest rates which provides relief in the high-debt environment that generally precedes the economic downturn.

But if the next time the Fed slashes the short-term interest rates inflation spikes up, and that means long-term interest rates don’t go down, they go up and they follow the inflation rate higher, then that is going to exacerbate the pain of the next recession.”

Imagine how bad this will be given the extreme amounts of government, consumer and corporate debt out there right now.

The stagflation that is coming is bad for bonds.

The bond market still hasn’t figured this out yet. They still think that we’re going to follow the playbook from the last financial crisis. We’re not.”

[SITE INDEX -- SII - BONDS & CREDIT]

A PUBLIC SOURCED ARTICLE FOR MATASII

READERS REFERENCE: (SUBSCRIBERS-SII & PUBLIC ACCESS)

SII - BONDS & CREDIT

MATASII RESEARCH ANALYSIS & SYNTHESIS WAS SOURCED FROM:

SOURCE: 05-30-19 - - "Peter Schiff: Bond Buyers Are Right About a Recession But They’re Making the Wrong Bet"

FAIR USE NOTICE This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a 'fair use' of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond 'fair use', you must obtain permission from the copyright owner.

NOTICE Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. MATASII.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility.