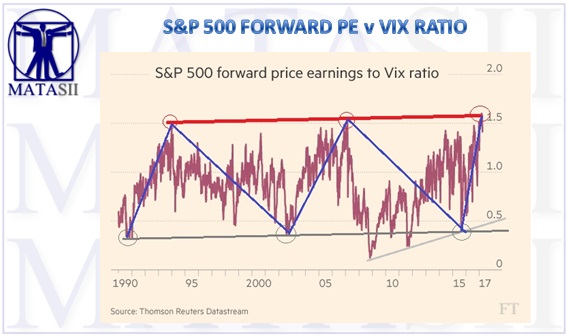

S&P 500 FORWARD PE v VIX RATIO

The Financial Times in London identifies the S&P 500 Forward PE to VIX Ratio as something to pay particular attention to when considering just how expensive the US Equity Market has become.

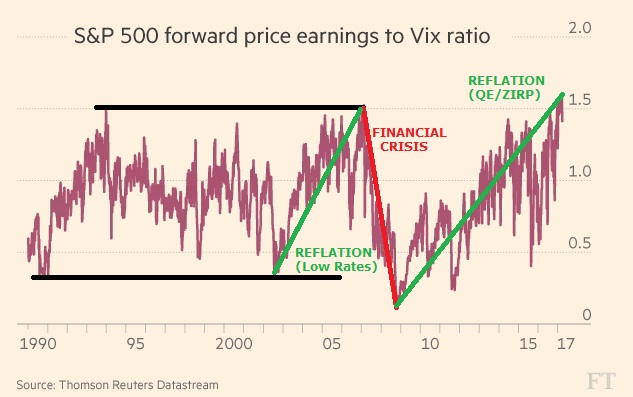

The S&P 500 Forward PE to VIX Ratio is presently at highs only seen prior to the Bush I recessio,n which cost him his second term as US President, and just prior to the 2007-2008 Financial Crisis. It also approached these levels prior to the Dotcom Bubble imploding. This is yet another fundamental analysis that indicates equities are highly valued by historical measures. Though markets can stay overpriced for sustained periods of time, it is unusual at these levels for this to last too long.

If we annotated the chart we see that periods of central bank Reflation, whether by the Fed Funds Rate or via Monetary Policy such as QE / ZIRP have been the primary drivers of the last two periods of overvaluation.

Since the Federal Reserve has already terminated its period of Reflation and in fact has ended QE/ZIRP as well has begun raising the Fed Funds Rate in addition to signalling at least two more rates increases in 2017.

It would seem clear therefore that we should expect markets sometime in 2017 to consolidate - hopefully at higher levels.

However, we also can see a very clear technical channel that suggests the period between now and early 2010 may turn out to be painful for the equity markets.

The S&P 500 Forward PE to VIX Ratio is yet another Fundamental Indicator suggesting caution is strongly advised.

"The last 5% of a market lift or drawdown is always the most expensive!"