-- ABSTRACTED FROM 04-11-17 - " Lance Roberts via RealInvestmentAdvice.com" --

As the first quarter of 2017 closes, April begins the last leg of the markets “seasonally strong” period of the year, which is where the idea of “Sell In May And Go Away” comes from. And, of course, every year, there is always a litany of articles written about why it is such a bad idea, you need to just “buy and hold”, blah…blah…blah.

Yes, there are years where the markets rise during the summer months, but more importantly, it is those years that don’t which cause the most damage. Last year, selling in May, saved investors the emotional trauma of the Brexit plunge in June and the pre-election angst in November.

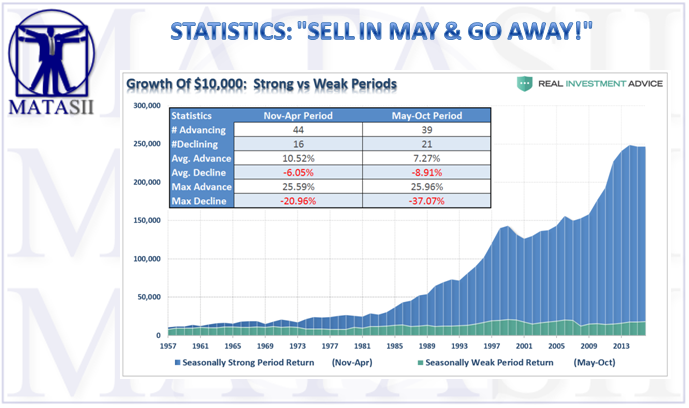

Importantly, “selling in May” does not necessarily mean “going all to cash,” so can we please stop using extremes to try and prove a point. “Selling In May,” at least in my world, is the process of reducing risk during a period time where historical returns have tended to be poor. Take a look at the chart below which shows a $10,000 investment into markets during the “Seasonally Strong” vs. “Seasonally Weak” periods. Did you really miss anything by skipping the summer months?

During this past weekend’s 2017 Economic and Investment Summit, Greg Morris, author of “Investing With The Trend” made a salient comment about “Sell In May & Go Away.”

“Let’s assume the statistics suggest that 75% of the time ‘Selling In May’ is a profitable strategy. As an investor, those are odds worth banking on.However, as soon as you try it, the strategy doesn’t work. In fact, it doesn’t work over the following three years. So, as an investor, you quit the strategy because it doesn’t work. Right?

Wrong? You just experienced some of the 25% of the time the strategy doesn’t work and with each year the strategy fails to work, the odds increase of a profitable return in the subsequent year.”

The statistics are undeniable. Reducing risk in the summer months has benefited investors more often than not. However, given the focus of commentators, journalist and Wall Street to create action, the long-term benefit is lost to the short-term headline.

Let me paraphrase Greg’s conclusion:

“The two biggest keys to winning the long-term investment game are patience and discipline.“

Unfortunately, patience and discipline are extremely rare commodities for individual investors today.