TEN TECHNICAL REASONS THE BULL MARKET ENDED IN FEBRUARY

-- SOURCE: 04-10-18 Lance Roberts - "Technically Speaking: 10-Reasons The Bull Market Ended In" --

I highly suggest you use any substantial rally to reduce risk and re-balance portfolios accordingly.

Why? Because I am going out on a limb and making a call.

“I think the 9-year old bull market may have ended in February.”

I could be wrong. Actually, I hope that I am because managing money is far easier when markets are rising.

However, as I was writing the newsletter, there was a moment of clarity as I penned a list of challenges weighing on the economy, and the markets, which are very different from where we were back in 2009 or even in 2016.

“In 2015, the market plunged as Fed Chair Janet Yellen brought QE3 to its conclusion and started hiking interest rates for the first time in 9-years. Again, this correction would likely have been substantially deeper as the Eurozone faced “Brexit” which sent shocks through the market. The well-timed phone calls to the Bank of England and the European Central Bank by then Fed Chairman Yellen, to take over liquidity operations stemmed the decline. Also as opposed to 2000 and 2007, the Fed had only just started its rate-hiking campaign.”

“Today’s market correction is more aligned with the end of a market cycle versus the beginning of one. The market is facing numerous headwinds that did not exist in 2011 or 2015.”

I want to expand and illustrate that list:

1) The Federal Reserve continues to hike interest rates on the short-end pressuring the yield-curve flatter which has never ended well for investors.

2) The Federal Reserve, ECB, and other Central Banks are tapering their liquidity operations. While balance sheets globally continue to expand, the rate of growth is beginning to slow.

3) Economic growth globally has begun to weaken as the boost to the U.S. economy from 3-hurricanes and 2-major wildfires have started to fade.

4) The current Administration is engaging in a “trade war” which potentially impacts various aspects of the economy. As noted by the Heisenberg this past weekend:

“The Trump administration decided to look into the possibility of proposing an additional $100 billion in tariffs on China in retaliation for Beijing’s retaliation”

“The major risk after Thursday evening is that the Trump administration ultimately backs China into a corner by proposing more in tariffs than China imports in U.S. goods. If the U.S. were to up the ante to $150 billion in total tariffs, that would exceed U.S. goods exports to China.

Do you see the problem with that? If not, allow me to quickly explain. It would corner Beijing into going the so-called ‘nuclear route’, and the thing investors need to understand is that China actually has several ‘nuclear’ options, two of which are devaluing the yuan and selling Treasuries.”

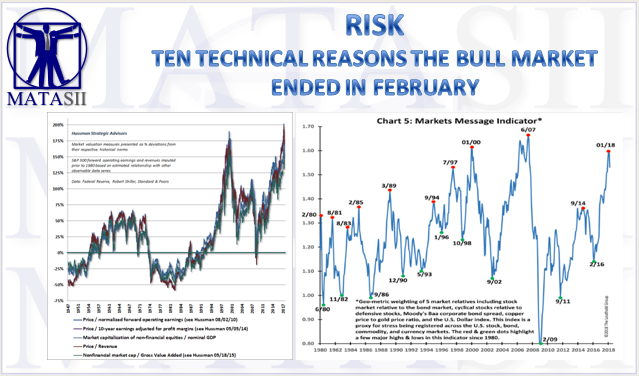

5) Valuations remain extremely extended as noted in John Hussman’s latest essay.

“The chart below presents several valuation measures we find most strongly correlated with actual subsequent S&P 500 total returns in market cycles across history. They are presented as percentage deviations from their historical norms. At the January peak, these measures extended about 200% above (three times) historical norms that we associate with average, run-of-the-mill prospects for long-term market returns. No market cycle in history – not even those of recent decades, nor those associated with low interest rates – has ended without taking our most reliable measures of valuation to less than half of their late-January levels.”

“Don’t imagine that a market advance “disproves” concerns about overvaluation. In a steeply overvalued market, further advances typically magnify the losses that follow, ultimately wiping out years, and sometimes more than a decade, of what the market has gained relative to risk-free cash.”

6) Despite the recent turmoil, high-yield spreads remain very compressed which suggests that “fear” has not entered back into the market yet.

7) Interest rates are rising in the areas of the economy that impact consumers directly through variable-rate debt like credit cards. Not surprisingly, rising rates on the short-end are already causing rising delinquency and charge-off rates and falling loan demand.

8) Price volatility is rising. Historically, significant increases in weekly point changes have occurred going into, and coming out of, more meaningful market corrections.

9) Investors are still overly aggressive. Via Bloomberg:

“Perhaps the Markets Message Indicator peak in January will prove only temporary. However, its current warning comes when the indicator is near the peaks of 2000 and 2007,” Paulsen wrote in a note to clients Monday. “That is, it suggests investor confidence and aggressiveness ‘across all financial markets’ is nearly as pronounced today as it was at the last two major stock market tops.”

The same can be seen by investor actions. Via Decision Point

“Note that money has left and continues to trickle out of bear funds. Money market assets remain about the same, so we’re not seeing increased worry or cashing out. In fact, we are seeing money now flowing to bull funds.”

10) Earnings estimates are at a record which leaves plenty of room for disappointment.

“In fact, Q1 of 2018 has marked the largest increase in the bottom-up EPS estimate during a quarter since FactSet began tracking the quarterly bottom-up EPS estimate in Q2 2002. The previous record for the largest increase in the bottom-up EPS estimate was 4.8%, which occurred in Q2 2004.“

“Still, while on the surface, Q1 will be a clear upward outlier, the reality is that most of it (and according to Morgan Stanley, more than all) has already been priced in. Which is a risk because as Reuters reports, while in Q1 corporate America will post its biggest quarterly profit growth in seven years, rising by just over 18% Y/Y…even the smallest disappointments could add to further upset the fragile market.”

Conclusion

The backdrop of the market currently is vastly different than it was during the “taper tantrum” in 2015-2016, or during the corrections following the end of QE1 and QE2. In those previous cases, the Federal Reserve was directly injecting liquidity and managing expectations of long-term accommodative support. Valuations had been through a fairly significant reversion, and expectations had been extinguished.

None of that support exists currently.

Let me conclude with this quote from John’s recent missive:

“At its core, investment is about valuation. It’s about purchasing a stream of expected future cash flows at a price that’s low enough to result in desirable total returns, at an acceptable level of risk, as those cash flows are delivered over time. The central tools of investment analysis include an understanding of market history, cash flow projection, the extent to which various measures of financial performance can be used as “sufficient statistics” for that very long-term stream of cash flows (which is crucial whenever valuation ratios are used as a shorthand for discounted cash flow analysis), and a command of the basic arithmetic that connects the current price, the future cash flows, and the long-term rate of return.

At its core, speculation is about psychology. It’s about waves of optimism and pessimism that drive fluctuations in price, regardless of valuation. Value investors tend to look down on speculation, particularly extended periods of it. Unfortunately, if a material portion of one’s life must be lived amid episodes of reckless speculation that repeatedly collapse into heaps of ash, one is forced to make a choice. One choice is to imagine that speculation is actually investment, which is what most investors inadvertently do. The other choice is to continue to distinguish speculation from investment, and develop ways to measure and navigate both.

At present, stock market investors are faced with offensively extreme valuations, particularly among the measures best-correlated with actual subsequent market returns across history. Investment merit is absent. Investors largely ignored extreme “overvalued, overbought, overbullish” syndromes through much of the recent half-cycle advance, yet even since 2009, the S&P 500 has lost value, on average, when these syndromes were joined by unfavorable market internals.”

There is a reasonably high possibility, the bull market that started in 2009 has ended. We may not know for a week, a month or even possibly a couple of quarters. Topping processes in markets can take a very long time.

If I am right, the conservative stance and hedges in portfolios will protect capital in the short-term. The reduced volatility allows for a logical approach to further adjustments as the correction becomes more apparent. (The goal is not to be forced into a “panic selling” situation.)

If I am wrong, and the bull market resumes, we simply remove hedges and reallocate equity exposure.

“There is little risk, in managing risk.”

The end of bull markets can only be verified well after the fact, but therein lies the biggest problem. Waiting for verification requires a greater destruction of capital than we are willing to endure.

As my friend Doug Kass has often written:

“Risk is under-priced, and likely considerably so.”

“Risk” is simply the function of how much you will lose when you are wrong in your assumptions.

Invest accordingly.