THE BOJ LEADS THE WAY IN MARKET MANIPULATION

MATASII RESEARCH ANALYSIS & SYNTHESIS:

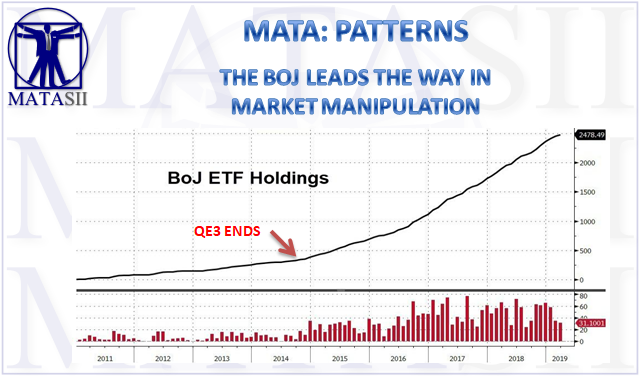

The BOJ's estimated aggregate ETF balance totals 29 trillion yen (about quarter trillion dollars), which is equivalent to nearly 5% of the market capitalization on the TSE's first section.

REPORTED FACTS:

Overseas investors dumped the most Japanese stocks in 31 years in the fiscal year ended Sunday, according to official market data: specifically, market participants abroad unloaded about 5.63 trillion yen ($50 billion) worth of shares on a net basis, the Tokyo Stock Exchange reported Thursday, for a second straight year of net selling and the highest sell-off since 1987.

BOJ ACTIONS:

The Bank of Japan's asset purchases absorbed all the bleeding, exposing the central bank's outsize role in the market. Indeed, as the Nikkei adds, this near-record liquidation was matched nearly yen for yen by the BOJ's pumping of money into the economy through asset purchases, with the central bank buying 5.65 trillion yen worth of equity!

- The broadest Japanese index is now above where it was this time last year.

- Why? Because in its attempt to preserve confidence and avoid what could be a potentially devastating asset selloff in a world in which stock markets are the leading indicators for regional and global economies, the BOJ stepped up its purchases of Japanese stocks through ETFs.

- A first among central banks, the program began in 2010 when the Nikkei Stock Average was trading below 10,000 points.

- The central bank's stated objective then was "to lower the risk premium, and the purchasing volume stood at 450 billion yen."

That was just for popular cover, because in 2016, the BOJ raised its annual ETF purchasing goal to 6 trillion yen.

- Since then, Kuroda unleashed an unprecedented stock buying rampage and as of Wednesday, the central bank's estimated aggregate ETF balance totaled 29 trillion yen (about quarter trillion dollars), which is equivalent to nearly 5% of the market capitalization on the TSE's first section.

The stated purpose behind such blatant intervention in capital markets, is that the BOJ was using ETF purchases to stoke inflation by spurring gains in asset values, as well as promoting active private consumption.

Japan's nationwide CPI is now the same as it was ten years ago.he BOJ's terminal destruction of any feedback loop between executive decisions and capital markets means that no practical analysis is possible any more, and the only observations that make sense are those which put central bank manipulation of asset prices in context, which incidentally is impossible as monetary policy is ultimately a political signal thereby making capital markets a subset of government policy and pure financial analysis not only obsolete, but self-defeating.

- This is an unsustainable equilibrium, and the best that the BOJ (or Fed, or ECB) can hope for is to kick the can for another month, quarter or year, even as the price and corporate imbalances build up to unprecedented proportions.

- Then, when central bank involvement is no longer possible (unlike the recent attempt at interest rate normalization by the world's central banks which lasted for just about a year before banks resumed easing), everything will inevitably crash as the first and last price backstop is gone, and shareholders rush to liquidate in a wholesale panic.

- As a result, the only possible attempt to preserve "value" will be for authorities to halt capital markets indefinitely in a last ditch attempt to make selling impossible.

[SITE INDEX -- MATA: PATTERNS]

A PUBLIC SOURCED ARTICLE FOR MATASII

READERS REFERENCE (SUBSCRIBERS-RESEARCH & PUBLIC ACCESS )

MATA: PATTERNS

ABSTRACTED FROM: 04-05-19 - - "The Bank Of Japan Bought 5.6 Trillion Yen In Stocks Last Year"

FAIR USE NOTICE This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a 'fair use' of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond 'fair use', you must obtain permission from the copyright owner.

NOTICE Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. MATASII.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility.