THE SMART MONEY NOW POSITIONED FOR LATE 2020 RECESSION & SECULAR STAGNATION

- Wall Street's professional investors are preparing for the worst, with two-thirds once again falling into the "secular stagnation" camp ahead of what is now a consensus call for a recession in the second half of 2020.

- According to the latest monthly Fund Manager Survey conducted by Bank of America which polled 239 investing professionals with an AUM of $664 billion in the April 5-11 period, investors are now positioned for "secular stagnation" - even as they dipped their toe into risky assets - "They are long assets that outperform when growth and rates fall, like cash, EM and utilities, while short assets that require higher growth and rates, such as equities, the Eurozone and banks"

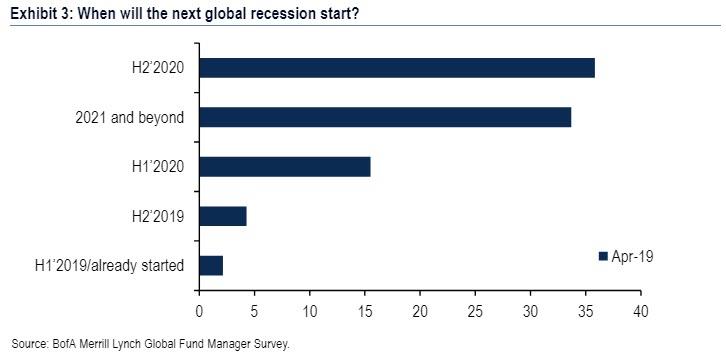

No recession: 70% of investors surveyed expect a global recession to start in the second half of 2020 or later...

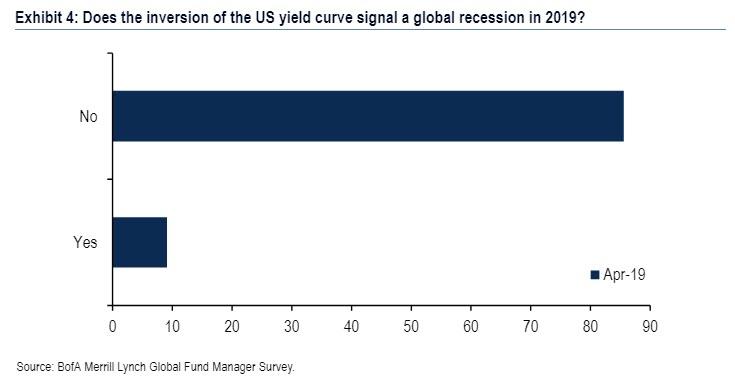

... yet somewhat paradoxically, a whopping 86% believe yield curve inversion does not signal an impending recession, which begs the question: if everyone is discounting the yield curve as a signaling mechanism, why is everyone so convinced that a recession is coming... and tied to that, why is everyone so certain that a yield curve inversion does not indicate a recession?

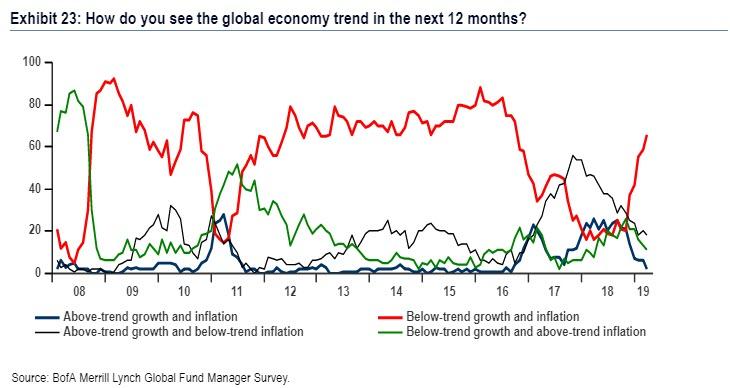

No growth... and yes to secular stagnation: 66% expect "low growth, low inflation" backdrop, the highest level since Oct'16; allocation to global bank stocks falls to lowest level since Sep'16.

[SITE INDEX -- MACRO: MACRO INDICATORS]

READERS REFERENCE (SUBSCRIBERS-RESEARCH & PUBLIC ACCESS )

MACRO: MACRO INDICATORS

MATASII RESEARCH ANALYSIS & SYNTHESIS WAS SOURCED FROM:

SOURCE: 04-17-19 - - "Two-Thirds Of Wall Street Investors Positioned For "Secular Stagnation", See Late 2020 Recession"

FAIR USE NOTICE This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a 'fair use' of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond 'fair use', you must obtain permission from the copyright owner.

NOTICE Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. MATASII.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility.