CHINA'S MANIPULATED DATA WILL NOT SAVE THE MACRO OUTLOOK

Ambrose Evans-Pritchard wrote in the UK telegraph an article entitled "Hold the champagne, China is not recovering and cannot rescue the West again" I have extracted IMHO the salient points which fundamentally points out the global impact of clearly manipulated economic data. This along with other sources suggests the greater China sphere is in the midst of an Industrial Recession!

The PBOC deserves plaudits for delivering a softish landing, but a landing it is. The economy will probably bottom out at growth rates of 4.5pc this quarter (on proxy measures). Such stabilization is not enough for a world that has come to depend on China to hold up the heavens.

The greater China sphere of east Asia is in the midst of an industrial recession. Nomura’s forward-looking index still points to a deepening downturn. “Those expecting a strong rebound in Asian export growth in coming months could be in for disappointment,”

MANIPULATED ECONOMIC NUMBERS

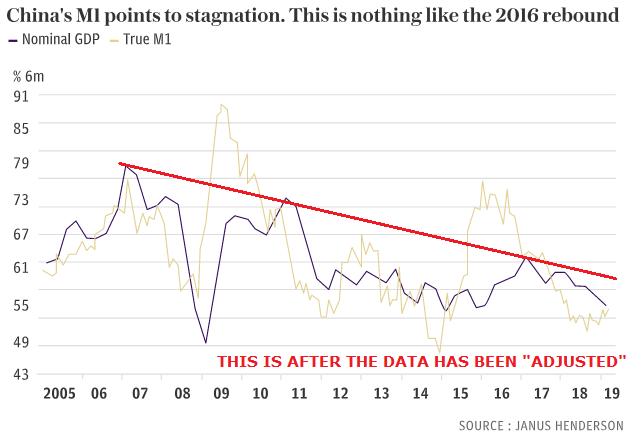

However, don't confuse this with political manipulation! Xi Jinping had to beat expectations with a crowd-pleaser in the first quarter. The number was duly produced: 6.4pc. “Could it really be true?” asked Caixin magazine. Of course it is not true.

- Japan’s manufacturing exports to China fell by 9.4pc in March (year-on-year).

- Singapore’s shipments dropped by 8.7pc to China,

- 22pc to Indonesia, and

- 27pc to Taiwan.

- Korea’s exports are down 8.2pc.

A paper last month by Wei Chen and Chang-Tai Tsieh for the Brookings Institution – “A Forensic Examination of China’s National Accounts” – concluded that GDP growth has been overstated by 1.7pc a year on average since 2006. They used satellite data to track night lights in manufacturing zones, railway cargo volume, and so forth.

Bear in mind that if China’s economy is a fifth or a quarter smaller than claimed it implies that the total debt ratio is not 300pc of GDP (IIF data) but closer to 400pc. If China’s growth rate is 1.7pc lower – and falling every year – the country is less able to rely on nominal GDP expansion whittling away the liabilities.

Debt dynamics take an ugly turn – just at a time when the working-age population is contracting by two million a year. The International Monetary Fund says China needs (true) growth of 5pc to prevent a rising ratio of bad loans in the banking system.

The thinking is that China will rescue Europe. Optimists are doubling down on another burst of global growth, clinched by the capitulation of the US Federal Reserve. It will be a repeat of the post-2016 recovery cycle.

FISCAL FLOOD GATES OPEN

Beijing has opened its fiscal floodgates to some degree over recent weeks.

- Broad credit grew by $430bn in March alone.

- Business tax cuts were another $300bn.

- Bond issuance by local governments was pulled forward for extra impact.

- But once you strip out the offsets, it is far from clear that the picture for 2019 has changed.

I stick to my view that the US will slump to stall speed before China recovers. Europe is on the thinnest of ice. It has a broken banking system. It is chronically incapable of generating its own internal growth or taking meaningful measures in self-defense.

Momentum has fizzled out in all three blocs of the international system. We are entering the window of maximum vulnerability.

[SITE INDEX -- MACRO: MACRO OUTLOOK]

READERS REFERENCE (SUBSCRIBERS-RESEARCH & PUBLIC ACCESS )

MACRO: MACRO OUTLOOK

MATASII RESEARCH ANALYSIS & SYNTHESIS WAS SOURCED FROM:

ABSTRACTED FROM: 04-17-19 - - "Hold the champagne, China is not recovering and cannot rescue the West again"

FAIR USE NOTICE This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a 'fair use' of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond 'fair use', you must obtain permission from the copyright owner.

NOTICE Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. MATASII.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility.