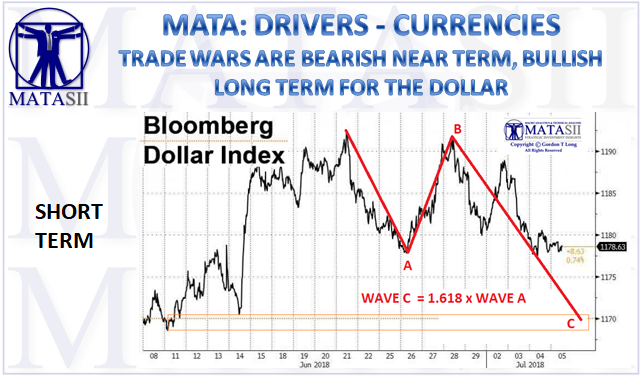

TRADE WARS ARE BEARISH NEAR TERM, BULLISH LONG TERM FOR THE DOLLAR

---- SOURCE: 07-05-18 ZeroHedge - "Why One Trader Thinks Trade War Will Send The Dollar Tumbling" --

LONG TERM TRADE WARS ARE DOLLAR BULLISH

According to conventional wisdom, trade wars are bullish for the dollar, for two main reasons:

- They tend to be inflationary (import prices spike), and

- They impact risk assets, resulting in a flight for USD-denominated safety.

Indeed, just today, Bloomberg writes that for dollar bulls, Trump's trade wars are just what the doctor ordered.

They see the greenback as a better haven than gold should the tariff tit-for-tat intensify. Four months after the U.S. president shocked equity markets with his vision of higher duties on imports to America, investors are discovering catalysts that should help the nation’s currency withstand trade turbulence better than gold.

“The dollar has become the main destination for safe-haven investors,” Ole Hansen, head of commodity strategy at Saxo Bank A/S, said by email from Copenhagen. “Geopolitical risk is on the rise, bonds and stocks have sold off and yet gold continues to drift lower.”

A “significant” driver of the dollar’s gains this year has been reduced risk appetite, spurring a tide of capital to dollar assets as emerging markets seize up, according to Jane Foley, head of currency strategy at Rabobank. That said, “the sheer liquidity associated with the dollar means that for some investors it will always be a safe haven,” she wrote in a recent note.

There is another reason why traditional economic theory would suggest the dollar should gain: the prospect that import tariffs will reduce the US current-account deficit even as the Fed hikes rates, thereby creating a rare opportunity in which the dollar can be used both as a haven and in carry trades, according to Andreas Steno Larsen, a global currency strategist at Nordea Bank AB in Copenhagen.

But is that really true?

NEAR TERM "IMMINENTLY" DOLLAR NEGATIVE

According to Bloomberg macro commentator and former Lehman trader Mark Cudmore, not only are trade wars imminently dollar negative, but in a note overnight, he writes that the dollar is set for an imminent slide on what he calls "flawed tariff logic."

Specifically, he envisions two key things:

- Positioning and

- Yield effect.

1- POSITIONING

On the first, last Friday we showed that after being very bearish on the dollar for the better part of a year, speculators have turned sharply bullish, suggesting there are few shorts left to cover, and the marginal buyers may already be in the trade.

Speculative USD positioning against currencies in the CFTC CoT report, in $ bn

2- YIELD EFFECT

What about yields? as Cudmore writes, "they topped out in mid-May and have been steadily declining since The flattening U.S. curve emphasizes that the more important long-term impact of any tariffs will be the hit to growth. U.S.-led trade wars only encourage other countries to divert their trade relationships elsewhere, thereby undermining the dollar’s relevance at the margin."

As a result of the flattening of the TSY curve, the more important long-term impact of any tariffs will be the hit to growth U.S.-led trade wars only encourage other countries to divert their trade relationships elsewhere, thereby undermining the dollar’s relevance at the margin.

So are all those betting on a strong dollar (and weaker yuan), as trade war begin wrong? Read his full note below and decide:

Dollar Set for Imminent Slide on Flawed Tariff Logic:

The outlook for the dollar is increasingly bearish because investor positioning is misaligned with how the trade war will play out in the market.

There’s a stale narrative that trade tensions are bullish for the dollar. This column argued that way back in March, but the dynamics are shifting negatively for the dollar at the margin.

It’s been overlooked that the Bloomberg Dollar Spot Index hit its intraday high two weeks ago and its closing high in the middle of last week.

The argument that tariffs are inflationary, and so will lead to more rate hikes, is a very poor reason to be already long the dollar.

Any price effects will take time to feed through to consumers and much of the impact will be felt long before there’s any effect on the CPI basket of goods.

For further evidence of the flaw in the tariffs-equal-inflation-equals- higher-rates-equals-stronger-dollar logic, look no further than U.S. yields themselves. Across the curve, they topped out in mid-May and have been steadily declining since

The flattening U.S. curve emphasizes that the more important long-term impact of any tariffs will be the hit to growth U.S.-led trade wars only encourage other countries to divert their trade relationships elsewhere, thereby undermining the dollar’s relevance at the margin.

As the world’s largest economy, the U.S. had the strong hand in the early stages of trade negotiations. But, if it escalates into a sustained trade war, the U.S. position weakens substantially due to its twin deficits. It can’t afford to play such hardball that foreign governments become incentivized to stop funding its largesse.

On the other hand, if trade tensions abate, investors will releverage into EM and risk assets, which will result in a de facto selling of the world’s reserve currency.

Why would fresh investors buy the dollar now? A hawkish Fed and the initial tariffs are priced. Whichever way things develop from here, it’s much more likely to be a dollar-bearish world.