TRANSCRIPTION: IN-DEPTH - A SPECULATIVE LOOK INTO THE FUTURE

AGENDA - THE COMING FIAT CURRENCY FAILURE

- GLOBALIZATION, FINANCIALIZATION & COORDINATED MONETARY POLICIES

- THE PERFECT STORM

- AN UNHOLY TRINITY

- THE BIG REVERSAL

- THE COMING MINSKY MOMENT

- POSSIBLE EMERGING STAGES

- A FIAT CURRENCY FAILURE

GLOBALIZATION, FINANCIALIZATION & COORDINATED MONETARY POLICIES

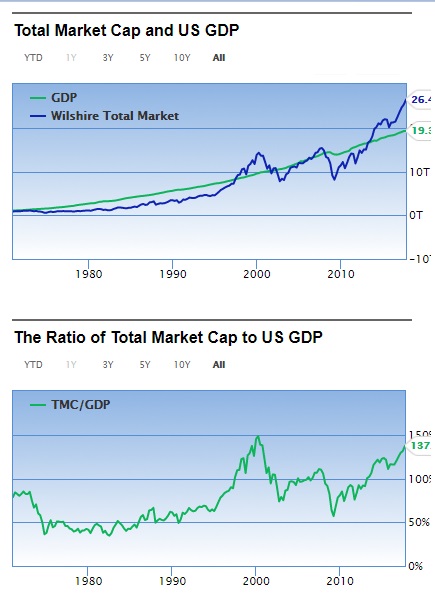

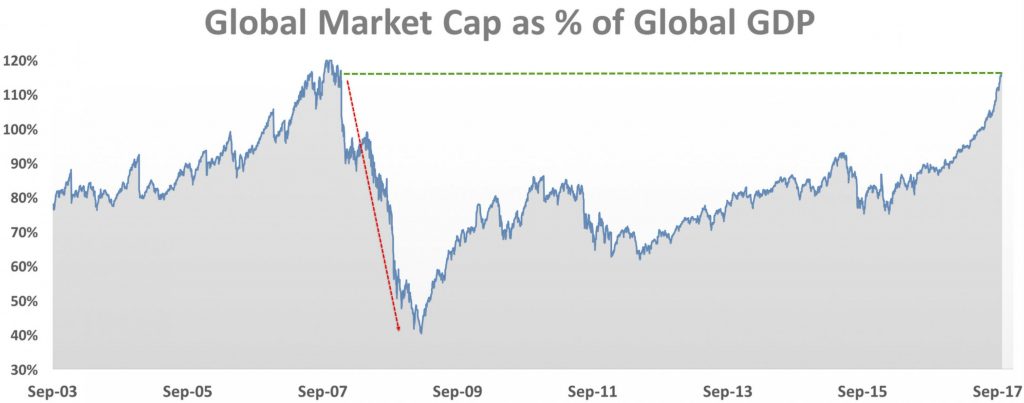

Warren Buffet likes to use a broad view of equity assets compared to the GDP of the country.

For years I followed it closely to spot risk situations similar to this occurring.

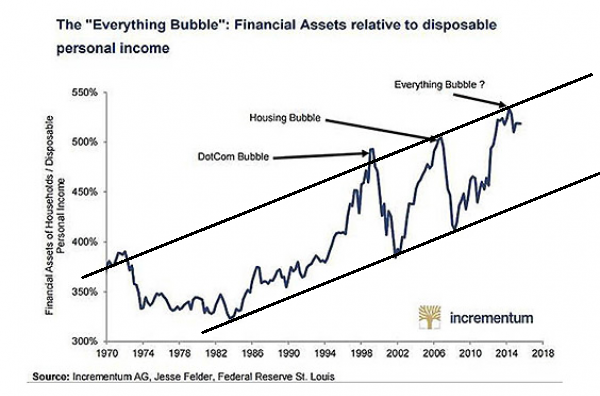

I found it effective but began to prefer the comparison of Household Financial Assets compared to Disposal Income. In prior years both kept me from being caught off guard by major directional shifts in the market.

With the further rapid advancement of Globalization, Financialization and Coordinated Central Bank Monetary Policies (as in Bernanke's "Enrich-thy-Neighbor") I have been steadily shifting my key warning indicators to having a more global weighting.

Global Equity or Financial Market Valuations (ie Stocks & Bonds)

Specifically, I began tracking what I saw to be the major global drivers.

Before I show you this and what it appears to now be signaling, let me first place some of this in context.

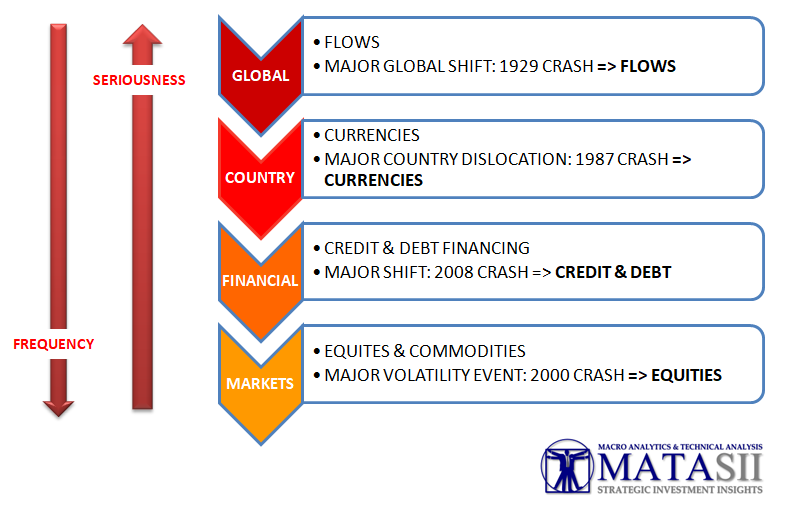

Remembering, that the "King Kong" of trading markets in the world is the Currency Market (at over $5 Trillion per day), then followed by the global Debt & Credit Market measured in 100's of Billions, then in the rear by Equity & Commodity markets measured in the many Billions.

As such I have found that:

- The largest market shocks stem from Global Trend changes where these are best identified through financial "Flows" between differing Currency regimes.

- Other than Wars we have not experienced a "Crisis" on a global basis in this regard other than the fallout from WWI Flows as represented by the credit expansion of the 20's resulting in the 1929 Stock Market crash and launching the Great Depression.

- Financial "Crisis" have been more a country or regional phenomenon stemming from major dislocation of the countries "Currency". The 20% one day crash of 1987 was primarily a US Dollar Currency driven action which spilled over into the debt, credit and equity markets.

- A Major Shift in Debt & Credit associated with the US Housing industry resulted in the 2007-2008 Market Crash.

- A Major Volatility event associated with Technology stocks in 2000 resulted in the Dotcom Bubble Implosion taking US Equity market along with it to a significant degree.

- MAJOR GLOBAL SHIFT: 1929 CRASH => FLOWS

- MAJOR COUNTRY DISLOCATION: 1987 CRASH => CURRENCIES

- MAJOR SHIFT: 2008 CRASH => CREDIT & DEBT

- MAJOR VOLATILITY EVENT: 2000 CRASH => EQUITIES

THE PERFECT STORM

I don't recall seeing all three concurrently?

The closest being 1987. The Unholy Trinity above is setting up for just such an occurrence. I am not saying it will occur tomorrow! Only that it has a high probability of occurring and if history is any indication it is assured to happen.

But history never repeats and there are factors coming into play which we will get into in a few moments.

AN UNHOLY TRINITY

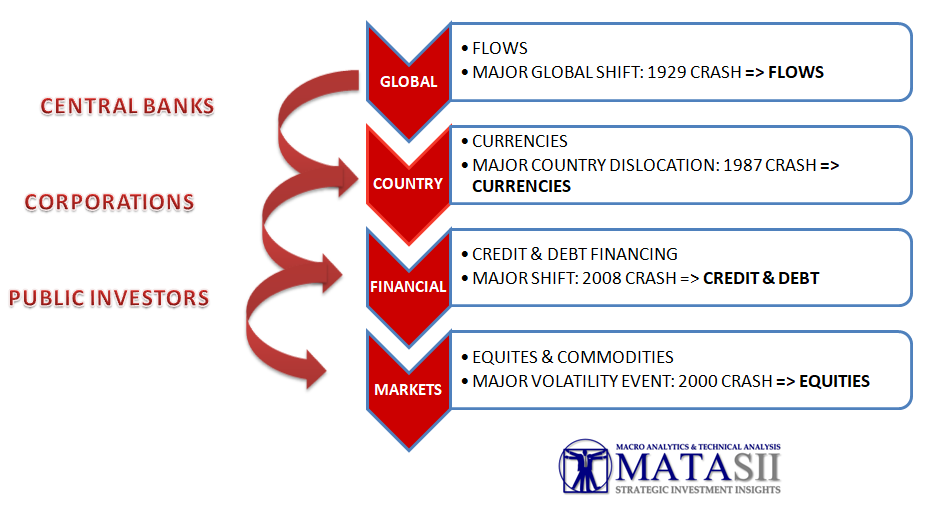

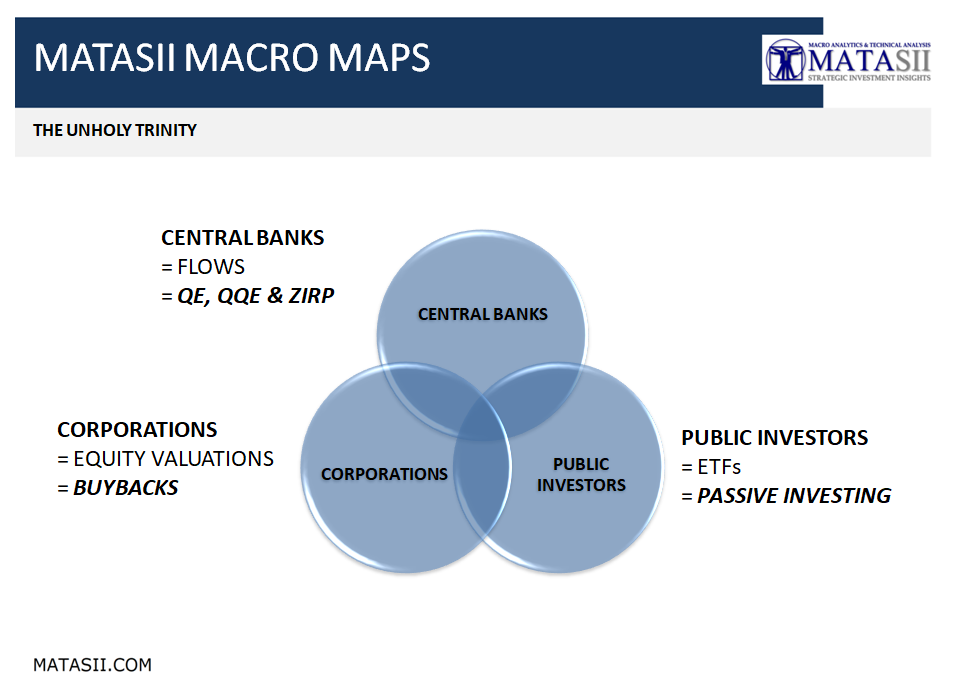

To fully appreciate the conundrum we and Central Banks specifically now presently face we need to understand the importance of three major activities operating independently yet intertwined in three different areas of investment influence.

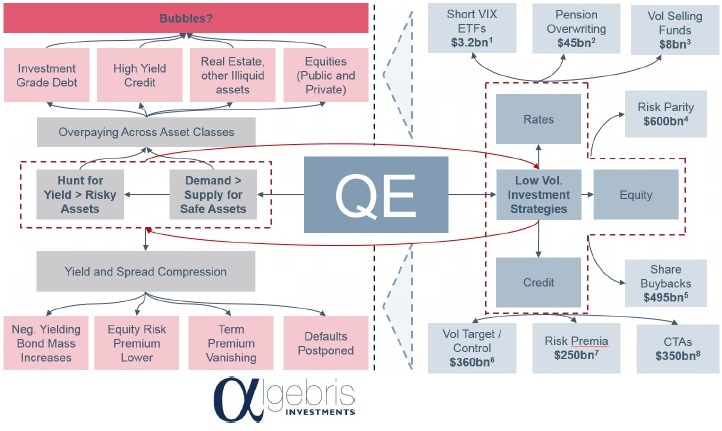

- CENTRAL BANKS have been heavily committed to QE & ZIRP after the 2008 Financial Crisis. This has produced Credit & Liquidity which I will label FLOWS.

- CORPORATIONS have been heavily committed to Stock Buybacks since the advent of QE & ZIRP. These activities have fostered major movements in EQUITY VALUATIONS.

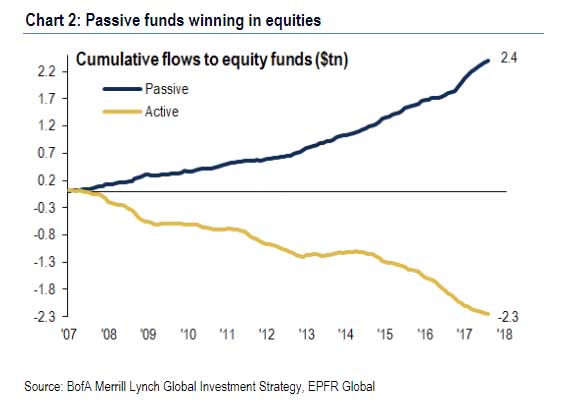

- PUBLIC INVESTORS have shifted from the use of Active Managers (ie Mutual Funds) to Investments vehicles using quick entry and exit ETF's which have become dominated by those tracking the major indexes or popular assets such as the FAANGS. This shift has fostered PASSIVE INVESTING.

Unfortunately, the Unintended Consequences of these three entities has the potential to now create a perfect storm.

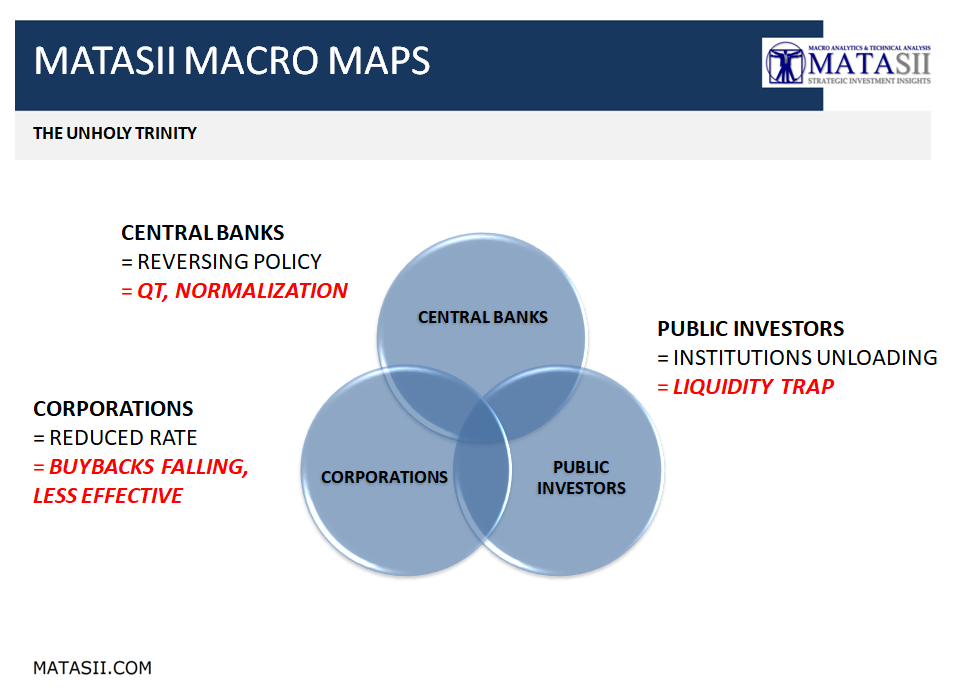

- CENTRAL BANKS are REVERSING POLICY to Quantitative Tightening (QT)

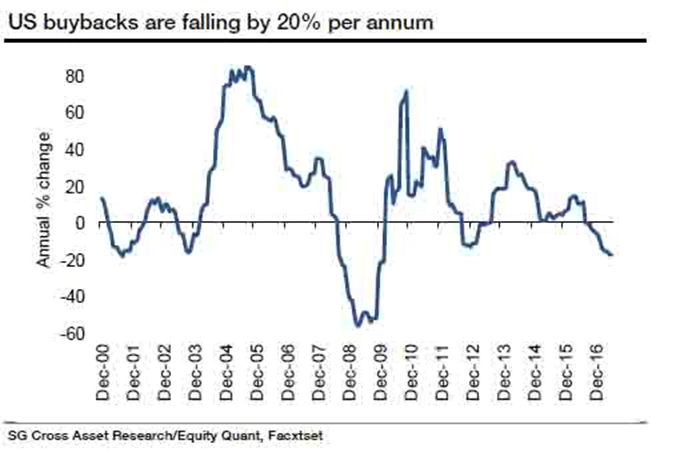

- CORPORATIONS are REDUCING THE RATE of Stock Buybacks,

- PUBLIC INVESTORS are heavily into Passive Instruments that may LACK LIQUIDITY if aggressive selling occurs which is specifically the reason they were bought in the first instance.

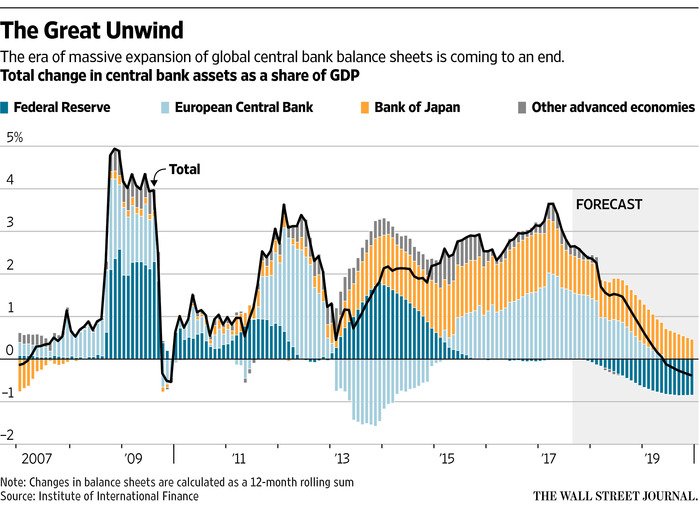

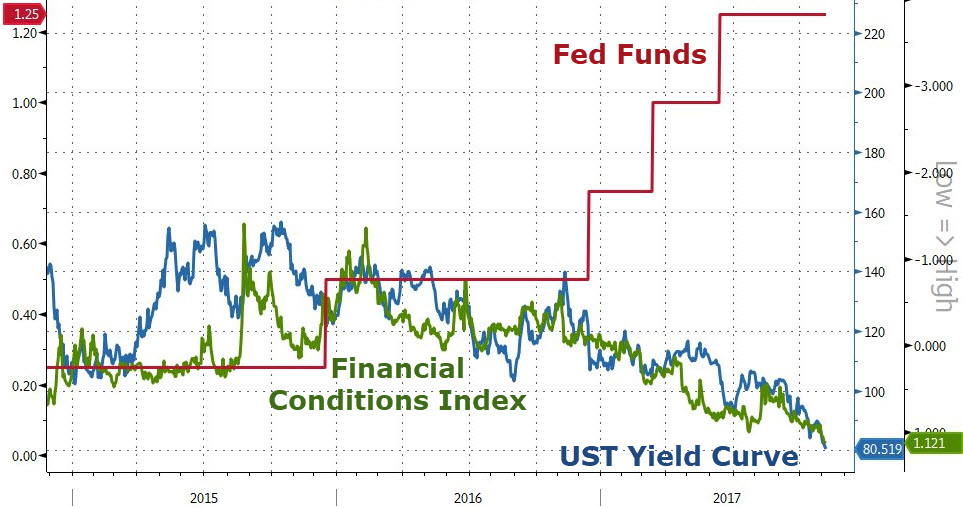

Consider the degree which these shifts are occurring:

- CENTRAL BANKERS: QE, QQE & ZIRP going to QT, Normalization

This is obviously serious and many don't believe the Fed will be able to follow through. Equality as serious is those dissenting from the Fed's view of the world because they are signaling a Recession or worse lies ahead in 2018.

The three QE programs have fostered a full array of unintended consequences that are ready to "come home to roost" from Risk Parity and a plethora of investment strategies, to risky Rehypothecated Collateral Chains to diminishing Trade Liquidity due to higher capital regulatory requirements and Fiduciary Risk etc..

- CORPORATIONS: SHARE BUYBACKS now Falling & Affect being Reduced

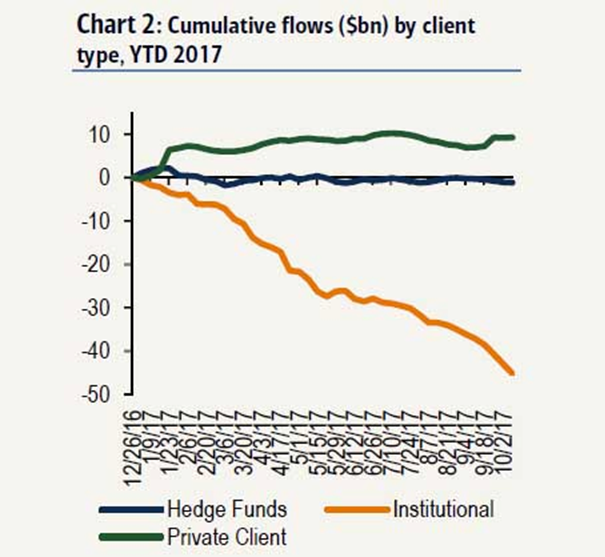

- INVESTORS: PASSIVE INVESTMENT (ETF GROWTH) now seeing Professionals Leaving & Public Rushing In

The psychological issue with the collapsing Unholy Trinity will be the perception of the withdrawal of the Bernanke / Yellen “PUT”. The Central Bank will no longer be seen to be supporting higher asset values in its quest to stimulate consumer demand through the “Wealth Effect”.

This may be a bigger issue then the reality of the individual components?

THE BIG REVERSAL

As important and critical as the elements of the Unholy Trinity are there is something occurring that is even more important.

Charles Hugh Smith and myself began laying this out in a just released 32 minute video discussion, supported by 44 slides concerning what we termed the "Big Reversal".

After three and half decades the global economy has now entered what I see to be a three and half year period of slow rotational change.

DEBT + DEMOGRAPHICS + DISRUPTION = DEFLATION

The world is leaving an era which as witnessed unprecedented global debt growth, work force demographics and the emergence of profoundly disruptive technologies. These trends through globalization, labor arbitrage, and oversupply have coupled to deliver slow inflation, disinflation and even deflation in various areas of the world.

What we have experienced during this era on a global basis is:

- A decline in real interest rates (which have been a prime supporter of asset prices),

- A drop in real labor earnings in advanced economies, and,

- A meteoric rise in inequality within countries alongside a drop in inequality between them.

What we are failing to realize according to a major new research paper released by the Bank if International Settlements (BIS) is an understanding of what these trends mean, which can only be seen when all three trends are examined together in a global context.

INTEREST + INCOMES + INVERSION = INFLATION

In the approaching new era, Savings & Investment will fall, however what is critically important to understand is that Savings will fall at a faster rate due to advanced economies social entitlement programs. As a consequence:

- Real Interest Rates will Rise,

- Inflation and wage growth will pick up and

- Inequality will fall within countries (versus rising within countries today).

The leading determinants that must be analysed are:

- Importance of the role of China,

- Social Safety net in Advanced Economies

- Global approach to the discussion of demographics

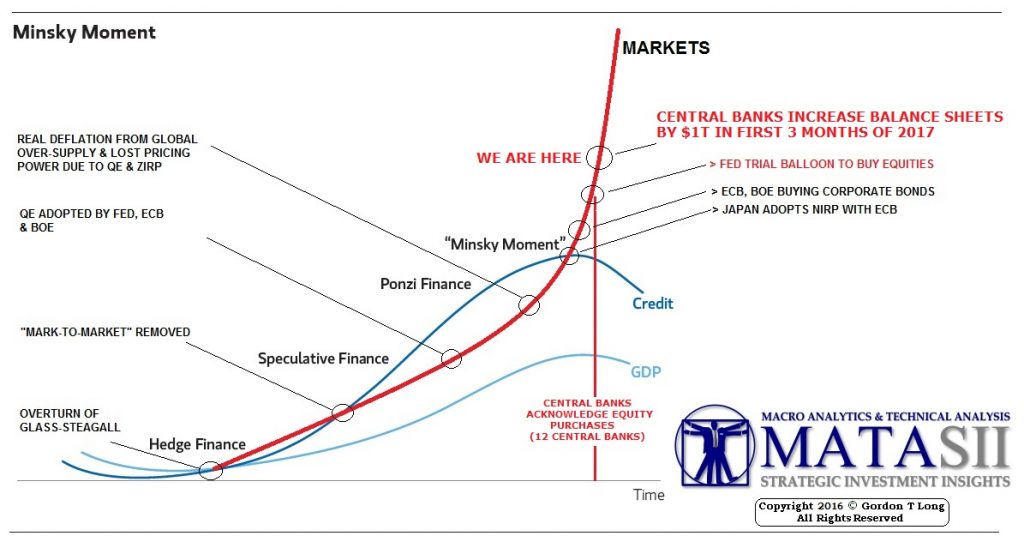

THE COMING GLOBAL MINSKY MOMENT

The magnitude of stretched Financial markets, the Unholy Trinity and the Big Reversal coming into focus what will authorities do to hold all this together or are we immanently about to see a historic crash?

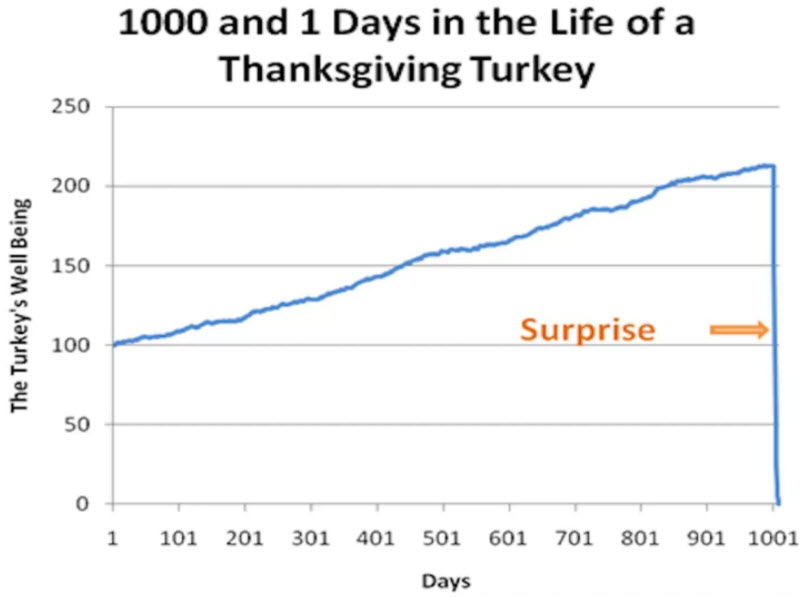

Are the financial charts about to look like the "wellness cycle" of a turkey - where investors are the Turkeys Wall Street will feed on for the upcoming Thanksgiving?

The answer lies in fully understanding that the powers to be will do everything and anything to arrest a financial crisis and maintain the status quo. We have witnessed time and again they will change the laws, change regulations, put up tax barriers or simply collude with other powers to make this happen. It is one of the reasons we are watching what appears to be a market headed towards a Minsky Moment.

There is little doubt in my mind we are headed towards a De-Dollarization event and a final Hyperinflation blow-off (which as I have mentioned in other sessions is first and foremost a Currency event). An event that will lead to a Fiat Currency Failure.

So how might all this unfold? How can we make any sense of it all as investors so we are somewhat prepared.

Let me speculate with you for a moment and show you how I currently see it. No doubt this view will change as the real world unfolds but it may be helpful in envisioning possible outcomes.

POSSIBLE EMERGING STAGES

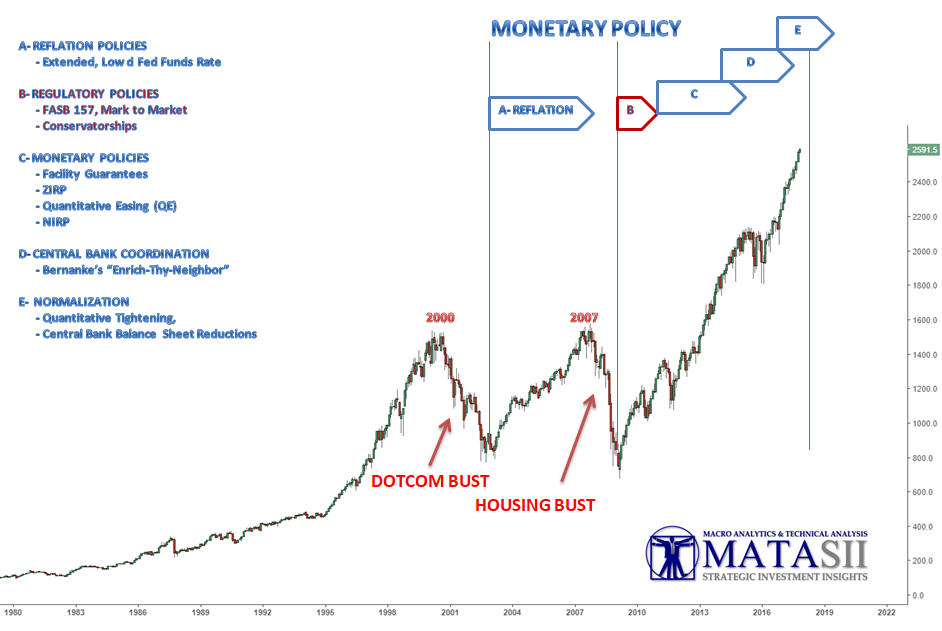

Lets first consider the stages we have come through:

- Stage 1 - Pre-Dotcom -- Securitization & Financialization (Debt becomes & Dominates as an Asset)

- Stage 2 - Reflation -- Regulatories & Central Bank's Fed Funds Rate

- Stage 3 - Post 2008 GFC - Central Bank's QE & ZIRP

In Stage 3 we started with "B" and have moved through "E" shown here.

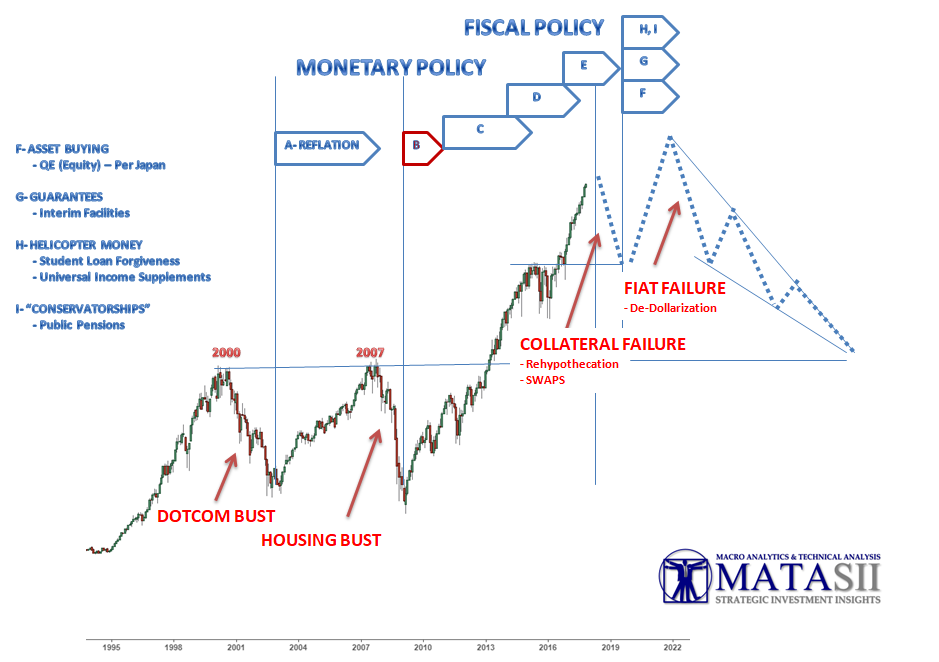

What lies ahead is likely:

- Stage 4 - Great Reversal - Shift from Deflation to Inflation

- Stage 5 - The Minsky Moment

- Stage 6 - New World Order - A New Bretton Woods, SDR's, Asia Centric & Multi-Polar

I have labeled these shifts in "F" through "I" in this schematic.

A FIAT CURRENCY FAILURE

Clearly a Fiat Currency Failure lies ahead which we have been signaling and following in this chart from 2010. We have tracked closely to it over the last decade.

On the other side of it is a New World Order. It will be a multi-polar world order with an IMF SDR based international trade and balance of payment settlement currency, among many new institutional approaches and structures.

It is all to be expected as Globalization firmly takes hold and becomes fully operational and not run like a fiefdom.

These are my current perspective and views. Be assured they will turn out differently but at least you might have something to consider as a framework for reference going forward.