US "PONZI FINANCE" STAGE BEGINS IN 2024

Endgame: Starting In 2024, All US Debt Issuance Will Be Used To Pay For Interest On Debt

HIGHLIGHT

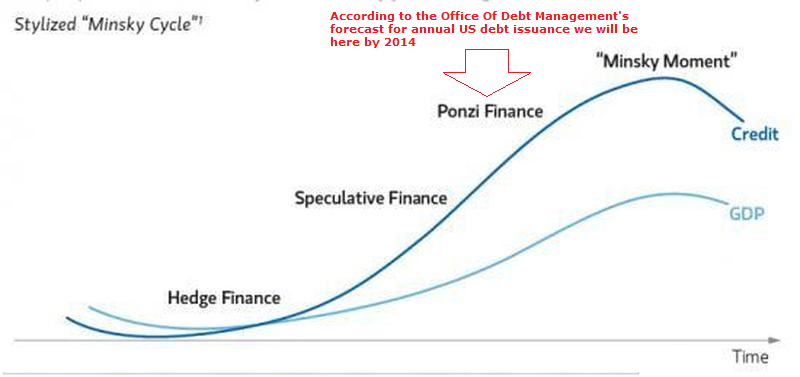

The stylized cycle of the US "Minsky Moment"suggests the US will enter the penultimate, Ponzi Finance, phase - the one in which all the new debt issuance is used to fund only interest on the debt - some time around in 2024.

- From that point on, every incremental increase in interest rates, which will eventually happen simply due to rising inflation expectations, will merely accelerate the ponzi process, whereby even more debt is sold just to fund the rising interest on the debt, requiring even more debt issuance, and so on, until finally the "Minsky Moment" arrives.

- At that point, while we don't know yet what the next reserve currency - either fiat, hard or digital - after the US dollar will be, we urge readers to own a whole lot of it.

DETAILS

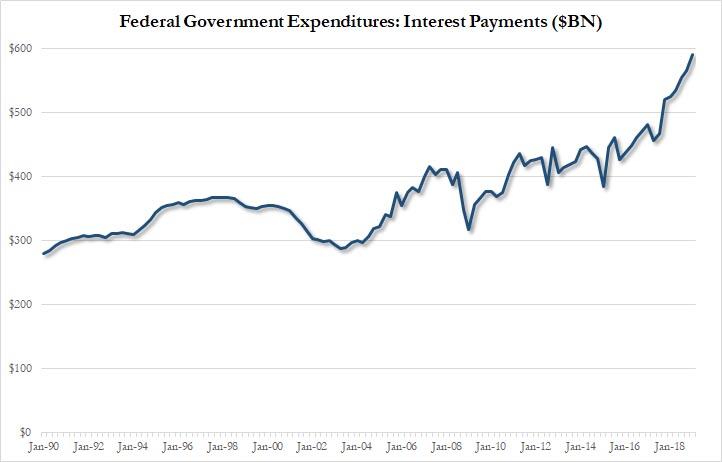

When looking at the US 'income statement', most concerning by far is that for the first four months of fiscal year 2019, interest payments on the U.S. national debt hit $221 billion, 9% more than in the same five-month period last year, with the rate of increase breathtaking (see chart below).

As a reminder, according to the Treasury's conservative budget estimates, interest on the U.S. public debt is on track to reach a record $591 billion this fiscal year, more than the entire budget deficit in FY 2014 ($483 BN) or FY 2015 ($439 BN), and equates to almost 3% of estimated GDP, the highest percentage since 2011.

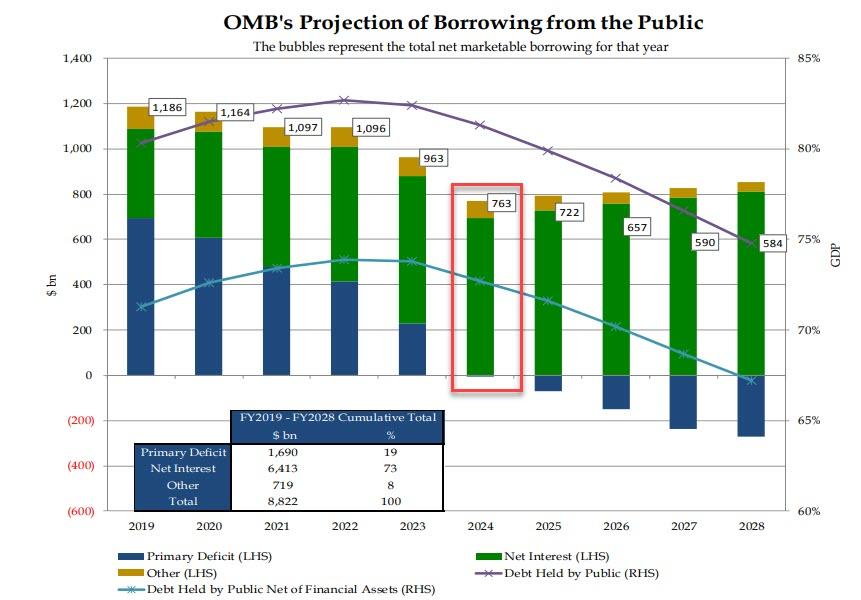

As part of today's Treasury Presentation to the Treasury Borrowing Advisory Committee, there is a chart showing the Office Of Debt Management's forecast for annual US debt issuance, broken down between its three component uses of funds:

- Primary Deficit,

- Net Interest Expense, and

- "Other."

That chart is troubling because while in 2019 and 2020 surging US interest expense is roughly matched by the other deficit components in the US budget, these gradually taper off by 2024, and in fact in 2025 become a source of budget surplus.

But what is the real red flag is that starting in 2024, when the primary deficit drops to zero according to the latest projections, all US debt issuance will be used to fund the US net interest expense, which depending on the prevailing interest rate between now and then will be anywhere between $700 billion and $1.2 trillion or more.

[SITE INDEX -- TIPPING POINTS - SOVEREIGN DEBT CRISIS]

A PUBLIC SOURCED ARTICLE FOR MATASII

READERS REFERENCE: (SUBSCRIBERS & PUBLIC ACCESS)

MATASII RESEARCH ANALYSIS & SYNTHESIS WAS SOURCED FROM:

Abstracted from: 05-01-19 - - "Endgame: Starting In 2024, All US Debt Issuance Will Be Used To Pay For Interest On Debt"

FAIR USE NOTICEThis site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a 'fair use' of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond 'fair use', you must obtain permission from the copyright owner.

NOTICE Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. MATASII.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility.