THE HEADLINE: One Hedge Fund Manager Is Betting A Quarter Of His Money On A Credit ETF "Death Spiral"

MATASII SII ANALYSIS: LQD Corporate Bond ETF IDEA - March 4, 2018: The weekly (left) chart for LQD shows a significant lift from $78.00 in 2009; topping around $124.00 in 2012; and moving sideways in a slightly contracting wedge since. The boundaries of the wedge pattern offer technical trigger considerations when reached (highlighted with solid orange). The market is currently on its way to the lower support of the pattern and a bounce or beak of the patterns s/r trend line could be an indication for the next move: either the pattern is broken and the market is shifting to a new wave / pattern; or it holds and the contracting wedge continues.

Once broken to the down side it is technically possible to see this market move back to the lows of 2009. Several significant technicals can be seen on the way down, blue s/r zones and Fibonacci retracement levels, and all can be used for technical trigger or target considerations. Market reactions can be seen from these levels in the past, we should watch them for the same possibilities in the future.

IF we see the wedge patterns supporting trend line hold and the market lift again, then the upper pattern resistance offers technical trigger considerations for more lift (if broken) or another down to continue the pattern (if bounced from). IF broken, it is possible to see another lift similar to the lift from 2009 - 2012, potentially taking the market up another $50.00 (from the base of wedge pattern) to around $163.00.

On the daily (right) chart a few green (daily) s/r zones can be seen at levels where market reactions occurred in the past. These can be used for shorter term movements, expecting the market to continue to bounce between them in some fashion.

Three years after quitting his job at Jeffrey Tannenbaum's Fir Tree Partners and starting his own hedge fund, 39-year-old Adam Schwartz believes he has found the next big short.

Picking up on a theme that has been thrown around frequently on Wall Street, ever Since Howard Marks asked in March 2015 "what would happen if credit ETF holders sold all at once", and prompting many other Wall Street icons to warn about the dangers of debt ETFs, Schwartz is so convinced that a blow up in fixed income is coming and will hit credit ETFs the hardest, that he has been not only shorting these passive vehicles but layering puts on top.

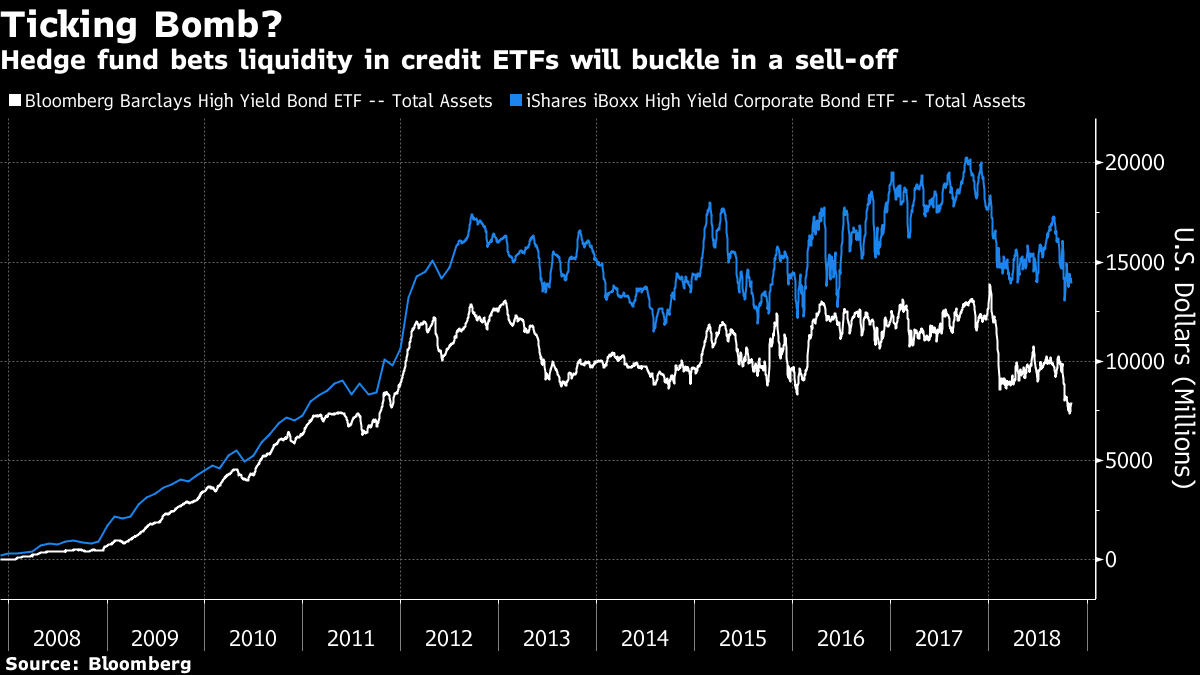

To Schwartz, it’s only a matter of time before rising rates kill the easy financing for highly leveraged companies, spurring a wave of bond defaults. Furthermore, as Bloomberg notes, running a hedge fund with mostly his own cash has allowed Schwartz the freedom to bet on more extreme scenarios, like betting on the very extinction of the product with credit ETFs "perishing in the bloodbath."

Why? Because as he told Bloomberg, "the ETF structure isn’t really designed for a large market sell-off. They will break if people don’t trust that they have the liquidity that they think they do today."

As noted above, Schwartz' thesis is hardly new, and while ETF providers such as BlackRock - naturally - argue their funds provide a positive force by "adding liquidity" and price transparency in times of stress, others such as Marks say they create a false sense of stability.

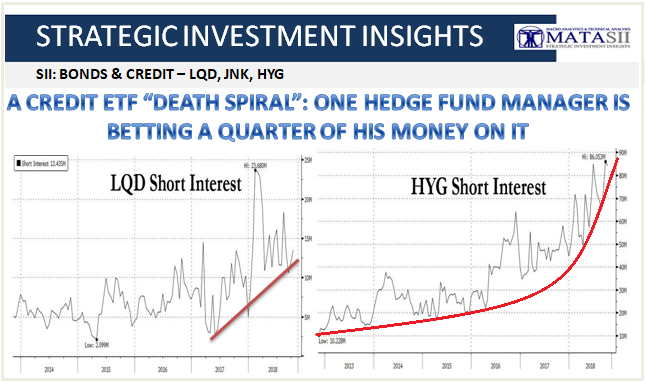

Meanwhile, other shorts have been piling on and as the chart below shows, the amount of short interest in the HYG junk bond ETF is now the highest on record as many other investors are also convinced the credit ETF day of reckoning is coming.

Yet few investors have backed their conviction in the inevitable extinction of credit ETFs to the same extent as Schwartz: while his Black Bear Value Partners is tiny compared with the $600 billion bond ETF market, his shorts make up about 25% of exposures in the hedge fund Schwartz set up and manages, even though so far these are wagers that have yet to deliver much of a profit.

The positions involve products tracking U.S. credit and emerging-market bonds, he said, declining to disclose the fund’s size or the ETFs it’s shorting.

Where Schwartz has carved out a niche, is his expectation that not junk, but rather Investment Grade EFTs are particularly vulnerable for the same reason we have discussed extensively in the past: a deluge of fallen angels, or companies rated just one notch above junk, which will be downgraded to high yield during the next downturn, doubling the size of the $1+ trillion junk bond market and resulting in an epic spread bloodbath.

Incidentally, the short interest in the largest IG ETF. LQD, is still modest at least compared to its high yield-tracking peers.

So what happens when the hammer finally falls and the credit sell-off hits?

To Schwartz, it will play out as follows, via Bloomberg: In a rout, where secondary liquidity in the ETF evaporates, authorized participants - the only parties able to trade directly with the ETF - will be compelled to redeem shares directly with the funds in exchange for bonds. But, Schwartz believes, they’ll balk at receiving less-desirable securities.

Anxious to maintain orderly trading, the funds will give away their most liquid securities, leaving a portfolio clogged with distressed and illiquid notes. At some point, APs will refuse to transact with the fund, sending the ETF shares into a death spiral.

Still, for every critic of credit ETFs there is a fervent believer, and while what Schwartz and others predict is theoretically plausible, ETF proponents take point out that it hasn’t happened yet.

They characterize the frequent griping by active managers as sour grapes from those clinging to business amid the rising passive wave.

Schwartz is not daunted, and is confident that he will be proven right eventually: "People who are buying these things have to be pretty certain that the good times will last forever."

The risks for the 39-year-old hedge fund manager, and others like him, are two-fold:

i) that his puts will expire before the crash finally happens, and

ii) if and when the credit market finally does crack and spills over into other assets, that the instruments he used to bet against the credit ETFs - especially puts - will still be viable securities which can be cashed out at a (material) profit. If there is anything the financial crisis of 2008 showed, is that this is a very generous assumption.