ECB UNVEILS MASSIVE EASING & EUROPEAN BANKS TUMBLE?? THIS IS BAD!!

A PUBLIC SOURCED ARTICLE FOR MATASII (SUBSCRIBERS & PUBLIC ACCESS) READERS REFERENCE

SOURCE: 03-07-19 - KimbleCharting - ""This Is Bad" - European Banks Tumble As ECB Unveils Massive Easing: Here's Why It's Not Working"

MATASII SYNTHESIS:

- The major takeaway from this is that algos, which simply correlate one event with another, no longer associate central bank easing with instant market ramps.

- Should that "alternative" explanation become accepted by the binary crowd, then all bets may soon be off as central banks find themselves unable to boost stocks even if they promise - or do - "whatever it takes."

KEY COMPLAINTS

- Start date leaves a gap when current TLTRO funds become non-eligible for net stable funding ratio in June.

- Lenders will only be entitled to borrow up to 30% of the stock of eligible loans as of the end of February.

- Given worse rate conditions of the new program, “carry trades are less attractive” and solid names might be able to refinance more cheaply via covered bonds; as a result Berenberg expects utilization of the new tenders to be noticeably lower overall

- This is even more bank adverse due to the extension of Europe's NIRP period, which as Deutsche Bank made very clear in the past 5 years, has crushed bank earnings: "The interpretation of today’s measures is negative as low rates for longer hurts a lot banks’ margins and the new TLTRO doesn’t look as attractive as the previous ones," said Nuria Alvarez, bank analyst at Renta 4.

THE GOOD NEWS

- For now at least, even as stocks tumble, bond yields are plunging,with the German bund yield crashing to the lowest level in 3 years and on the verge of going negative. If central banks were about to lose all control, yields would be exploding higher, i.e., the "end of days" scenario.

""This Is Bad" - European Banks Tumble As ECB Unveils Massive Easing: Here's Why It's Not Working"

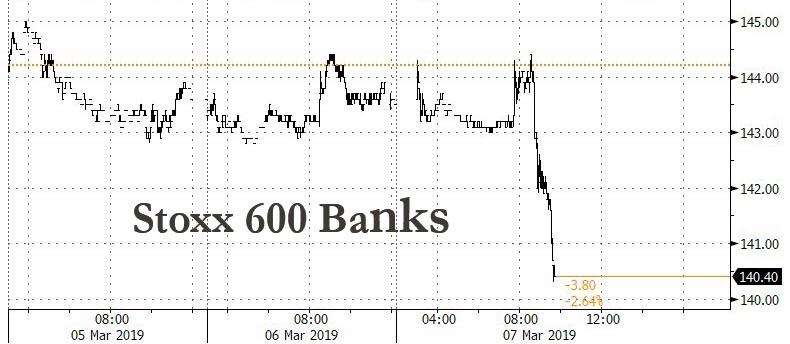

Something odd is taking place in the market today: the world's biggest central bank - whose balance sheet is 40.5% of Europe's GDP - unveiled massive monetary easing in the form of new carry-trade facilitating bank loans and an extended NIRP period and... stocks tumbled, a reaction which the market has rarely even seen before in the context of a central bank unveiling a surprisingly dovish move. And no stocks are hit harder than the Stoxx 600 Bank Index, which is extending its intraday losses, tumbling to sessions lows down over 2%.

Why the unexpected reaction, one which suggests central banks may now be losing control over markets having pushed on a string just one attempt to push stocks too far, a reaction which a trader at a major trading desk laid out simply as "this is bad."

According to Berenberg analyst Philipp Jaeger the problem is that the details of the TLTRO revealed by Mario Draghi have disappointed the market, which was expecting even more generosity by the ECB.

Here are the key complaints:

- Start date leaves a gap when current TLTRO funds become non-eligible for net stable funding ratio in June.

- Lenders will only be entitled to borrow up to 30% of the stock of eligible loans as of the end of February.

- Given worse rate conditions of the new program, “carry trades are less attractive” and solid names might be able to refinance more cheaply via covered bonds; as a result Berenberg expects utilization of the new tenders to be noticeably lower overall

Meanwhile, the broader picture is even more bank adverse due to the extension of Europe's NIRP period, which as Deutsche Bank made very clear in the past 5 years, has crushed bank earnings: "The interpretation of today’s measures is negative as low rates for longer hurts a lot banks’ margins and the new TLTRO doesn’t look as attractive as the previous ones," said Nuria Alvarez, bank analyst at Renta 4.

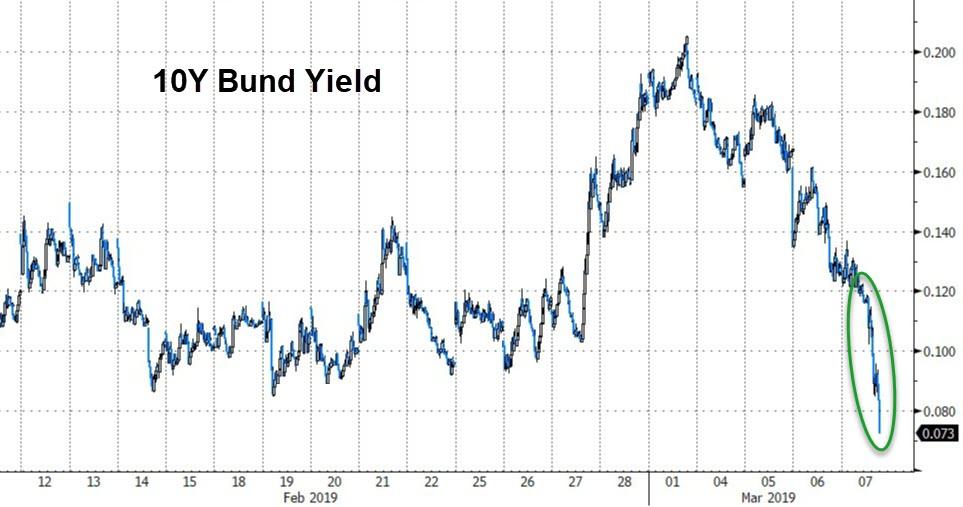

The good news - for now at least - is that even as stocks tumble, bond yields are plunging,with the German bund yield crashing to the lowest level in 3 years and on the verge of going negative. If central banks were about to lose all control, yields would be exploding higher, i.e., the "end of days" scenario.

But specific justifications for the market slide aside, the far bigger risk is that algos, which simply correlate one event with another, no longer associate central bank easing with instant market ramps. Should that "alternative" explanation become accepted by the binary crowd, then all bets may soon be off as central banks find themselves unable to boost stocks even if they promise - or do - "whatever it takes."

FAIR USE NOTICE This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a 'fair use' of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond 'fair use', you must obtain permission from the copyright owner.

NOTICE Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. MATASII.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility.