ECB'S DILEMMA REFLECTS THE "SUPPLY SIDE" PROBLEMS EUROPE IS FACING

A PUBLIC SOURCED ARTICLE FOR MATASII (SUBSCRIBERS & PUBLIC ACCESS) READERS REFERENCE

SOURCE: 02-02-19 - "European Central Bank Dilemma Reflects The Problems Europe Is Facing"

MATASII SYNTHESIS:

- The European Commission’s statistics bureau "puts growth at its lowest levels in more than four years."

- “Germany has slashed its growth projections from 1.8 percent to 1.0 percent for this year…”

- Italy is now in a recession, having posted its second consecutive decline in economic growth in the fourth quarter of 2018. For the fourth quarter, Italy’s economy declined by 0.2 percent.

- Then there are the disruptions to the economies in England and also in Europe as the “date of decision” is just around the corner for Great Britain and its “leaving” of the European Union. The disruptions have already begun for all concerned.

- France is not doing all that well, and general weakness is being felt almost everywhere.

- “The latest downturn comes off the back of far sharper recessions, in 2008, 2011, and 2014, from which the country has still not fully recovered.”

- Labor productivity growth has been almost non-existent over the past decade or so.

- “On a per capita basis, (current) real gross domestic product was lower than when Italy adopted the Euro in 1999.”

- The urban/rural economic divide is massive.

- The banking system is a mess, with many of the lending problems faced in the 2007 to 2009 worldwide financial collapse unresolved.

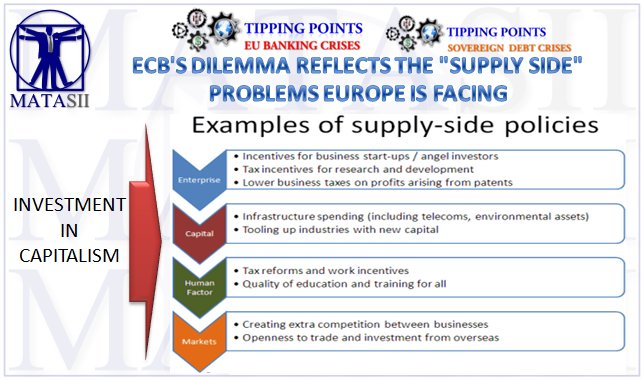

almost all of them (above issues) have to do with supply-side problems

The proposed remedy is for governments to spend and spend and spend.

- The general undertone among the most dissatisfied groups in Europe is that government fiscal policies need to be dialed up toward a more aggressive effort to stimulate growth in both the individual countries and in the community itself.

- What is needed is not more government spending or tax relief. What is needed is structural change and organizational reform. But, this is not what is on the agenda.

- "The policy debates Germany needs concern chronic weaknesses that would be laid bare by a recession. Those include

- A failure to cultivate entrepreneurial startups, especially in service industries;

- A stubbornly unreformed banking system, made vulnerable by decades of political meddling in managements and years of profit-sapping ultra low interest rates;

- A tax code that kills incentives and investments. That’s for starters."

If you add the issues associated with Brexit and the dislocations and distortions that will be forthcoming for this exercise, regardless of the specific plan, you have economies that cannot fully compete in the current environment.

SUPPLY SIDE PROBLEMS

- Supply-side problems cannot be corrected by simple spending programs that are supposed to provide a rapid response to the issues voters want attacked. This is why politicians focus on these problems because more and more spending makes sense to a lot of the electorate and this is what the electorate wants, a quick solution to their problems. This, the politicians play on because it is their pathway to re-election.

- Focusing on demand-side solutions is not going to resolve Europe’s problems.

Conclusion: We should just continue to expect more of the same thing!

The European Central Bank is facing a slowing growth in the eurozone just as it is ending several years of quantitative easing.

Italy is in recession and Germany has just substantially reduced it projected growth rate with the whole community lagging at only 0.2 percent in the fourth quarter.

Supply-side problems abound, but the only response heard to the economic growth issues is more government spending, something that will not resolve the eurozone's dilemma.

Growth in the eurozone is decreasing.

Consequently, the European Central Bank, under the leadership of its president, Mario Draghi, which just ended its multi-year effort at quantitative easing, is concerned about moving to a more restrictive stance.

Mr. Draghi has signaled that the bank will act if evidence of a prolonged slowdown in momentum continued to mount, according to Claire Jones in the Financial Times.

But, how serious is this “slowdown”?

Well, the growth rate for the eurozone was put at 0.2 percent for the fourth quarter of 2018.

The European Commission’s statistics bureau "puts growth at its lowest levels in more than four years."

Three immediate issues come to mind.

First, “Germany has slashed its growth projections from 1.8 percent to 1.0 percent for this year…”

Second, Italy is now in a recession, having posted its second consecutive decline in economic growth in the fourth quarter of 2018. For the fourth quarter, Italy’s economy declined by 0.2 percent.

And then there are the disruptions to the economies in England and also in Europe as the “date of decision” is just around the corner for Great Britain and its “leaving” of the European Union. The disruptions have already begun for all concerned.

But, France is not doing all that well, and general weakness is being felt almost everywhere.

The proposed remedy is for governments to spend and spend and spend.

At least this is what the government of Italy proposes, much to the dismay of Brussels.

And, the general undertone among the most dissatisfied groups in Europe is that government fiscal policies need to be dialed up toward a more aggressive effort to stimulate growth in both the individual countries and in the community itself.

One has to ask, however, if demand-side policies are the answer to the problems the eurozone members are facing.

Miles Johnson writes in the Financial Times, “on a per capita basis, (current) real gross domestic product was lower than when Italy adopted the Euro in 1999.”

“The latest downturn comes off the back of far sharper recessions, in 2008, 2011, and 2014, from which the country has still not fully recovered.”

Bigger problems than just government spending dominate the scene.

Labor productivity growth has been almost non-existent over the past decade or so. The urban/rural economic divide is massive. The banking system is a mess, with many of the lending problems faced in the 2007 to 2009 worldwide financial collapse unresolved.

And, these problems are just the beginning.

One can also look at Germany. Joseph Sternberg lays out some of Germany’s primary problems in the Wall Street Journal. He writes:

"The policy debates Germany needs concern chronic weaknesses that would be laid bare by a recession. Those include a failure to cultivate entrepreneurial startups, especially in service industries; a stubbornly unreformed banking system, made vulnerable by decades of political meddling in managements and years of profit-sapping ultra low interest rates; and a tax code that kills incentives and investments. That’s for starters."

The thing we find in reviewing these issues is that almost all of them have to do with supply-side problems. Furthermore, these problem areas exist in France, and Greece, and Spain and so on.

What is needed is not more government spending or tax relief. What is needed is structural change and organizational reform. But, this is not what is on the agenda.

And, if you add the issues associated with Brexit and the dislocations and distortions that will be forthcoming for this exercise, regardless of the specific plan, you have economies that cannot fully compete in the current environment.

This is one reason that I have written many times that the slow economic growth and the country discontents are supply-side related. And, this is the situation in Europe, England, and the United States.

But, resolving problems that come from the supply-side are generally complicated and take a longer time to resolve.

Supply-side problems cannot be corrected by simple spending programs that are supposed to provide a rapid response to the issues voters want attacked. This is why politicians focus on these problems because more and more spending makes sense to a lot of the electorate and this is what the electorate wants, a quick solution to their problems. This, the politicians play on because it is their pathway to re-election.

Focusing on demand-side solutions is not going to resolve Europe’s problems.

Italy is a case in point here. They have tried demand-side solutions over and over again, but as reported above, Italy had sharp recessions in 2008, 2011, and 2014… and again in 2018.

The United States economic recovery has been going on for almost ten years and the compound rate of growth of the US economy over this period of time is only 2.2 percent.

As usual, Europe will just kick the can down the road again in trying to return the eurozone to faster economic growth. The real questions will not be addressed, just as the real questions surrounding the Brexit struggle will not be addressed.

As for Europe and the eurozone, just continue to expect more of the same thing.