GLOBAL FORECAST CUT IN HALF BY ECONOMISTS AS "IT HAS TAKEN US BY SURPRISE!"

A PUBLIC SOURCED ARTICLE FOR MATASII (SUBSCRIBERS-RESEARCH & PUBLIC ACCESS ) READERS REFERENCE

MACRO: GLOBAL - ASSESSMENT

SOURCE: 03-11-19 - - "Economists Cut Global Growth Forecast In Half, Admit Slowdown "Has Taken Us By Surprise""

MATASII SYNTHESIS:

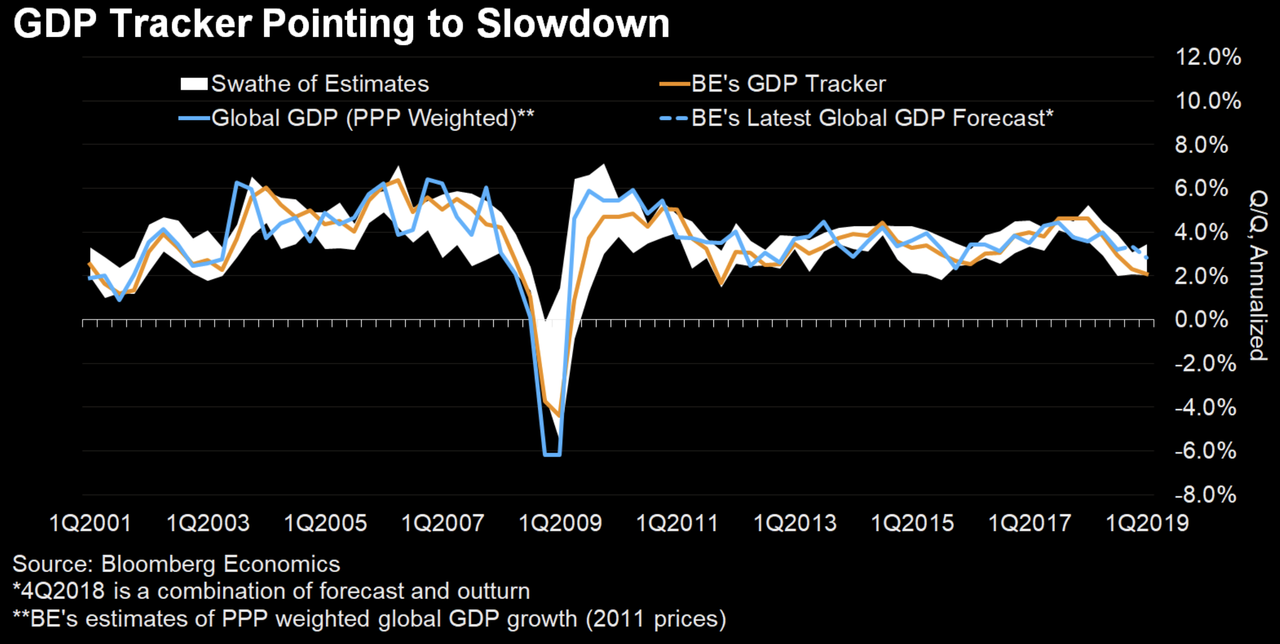

- Bloomberg economics' global GDP tracker has been downgraded to its slowest pace since the financial crisis, with world economic growth slumping to 2.1% on a quarterly basis. That's down from 4% in the middle of last year.

- "The risk is that the downward momentum will be self-sustaining."

- “The cyclical upswing that took hold of the global economy in mid-2017 was never going to last.

- Even so, the extent of the slowdown since late last year has surprised many economists, including us.”

- The OECD joined the IMF in slashing its 2019 growth forecast, cutting its projection for aggregate global growth to just 1%, just over half of its previous outlook of 1.8%.

"as more central banks opt to retreat into the safety of stimulus, or at least back off their hawkish rhetoric, we'll see if disaster can be averted once again?"

Bloomberg economics' global GDP tracker has been downgraded to its slowest pace since the financial crisis, with world economic growth slumping to 2.1% on a quarterly basis. That's down from 4% in the middle of last year.

And while there's a chance that a US-China trade deal, the Fed's "pause", and a fading of the pressures plaguing Europe might stave off a global recession, Bloomberg economists Dan Hanson and Tom Orlik said the risks appear to be tilted toward the downside. "The risk is that the downward momentum will be self-sustaining."

“The cyclical upswing that took hold of the global economy in mid-2017 was never going to last.Even so, the extent of the slowdown since late last year has surprised many economists, including us.”

To be sure, the economists aren't the only ones lowering their outlook on global growth. Last week, the OECD joined the IMF in slashing its 2019 growth forecast, cutting its projection for aggregate global growth to just 1%, just over half of its previous outlook of 1.8%.

While Draghi's gloomy outlook and decision to push back the timeline for ECB rate cuts last week sent a shock through markets, some ECB officials are apparently still desperately trying to reassure the world that everything is going to be just fine (despite a dearth of economic data implying the opposite).

Executive Board member Benoit Coeure said in an interview with Italian newspaper Corriere della Sera published Monday that "we are still seeing robust economic growth, though it's less strong than before."

“It will take longer for inflation to reach our objective, but it will get there. We are reacting to the developments we have seen so far.”

And although Jerome Powell said during an interview with 60 minutes last night that the US economy is "in a good place", a raft of economic data, including Friday's shockingly disappointing jobs report, would suggest otherwise.

The extent of the slowdown in recent months has taken many economists by surprise. But as more central banks opt to retreat into the safety of stimulus, or at least back off their hawkish rhetoric, we'll see if disaster can be averted once again.

FAIR USE NOTICE This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a 'fair use' of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond 'fair use', you must obtain permission from the copyright owner.

NOTICE Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. MATASII.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility.