GLOBAL SLOWDOWN IS NOW SERIOUS: WEAKEST GROWTH SINCE FINANCIAL CRISIS

A PUBLIC SOURCED ARTICLE FOR MATASII (SUBSCRIBERS & PUBLIC ACCESS) READERS REFERENCE

SOURCE: 02-18-19 - Bloomberg - "Global Slowdown Leaves Growth Weakest Since Financial Crisis"

MATASII SYNTHESIS:

- A UBS model suggests world growth slowed to a 2.1 percent annualized pace at the end of 2018, which it says would be the weakest since 2008-2009.

- OECD leading index has fallen, ECB officials hint at shift - the euro area now looks like the weak link in global growth,

- Loss of global momentum has left expansion now looking like its weakest since the global financial crisis, a development that’s already sparked a dramatic shift among central banks.

The global economy’s loss of momentum has left expansion now looking like its weakest since the global financial crisis, a development that’s already sparked a dramatic shift among central banks.

A UBS model suggests world growth slowed to a 2.1 percent annualized pace at the end of 2018, which it says would be the weakest since 2008-2009. An early reading for this quarter shows a slight improvement, but the numbers still mean there’ll need to be a dramatic improvement to reach the 3.2 percent pace UBS has forecast for the three months as a whole.

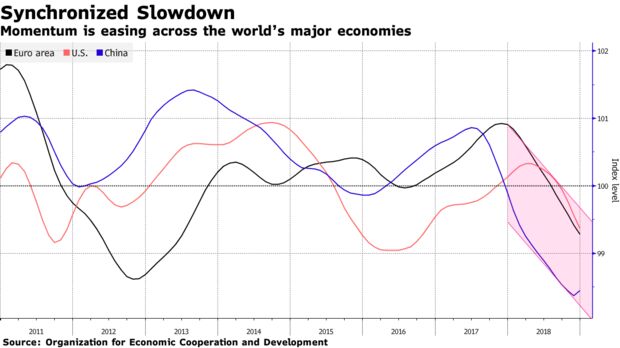

Unfortunately, there hasn’t been much sign of that. China car sales dropped in January, and data last week showed U.S. retail sales posted their worst drop in nine years in December. In Europe, where the slowdown has been particularly marked, sentiment indicators continue to weaken, and the latest OECD leading indicator has also declined.

European Central Bank Governing Council member Francois Villeroy de Galhau said in an interview published at the weekend that the euro-area slowdown is “significant.” Peter Praet, the institution’s chief economist, told Boersen-Zeitung that if the situation worsens, “we could adapt our forward guidance on interest rates and this could be complemented by other measure.”

The ECB will on Thursday publish the accounts of its January meeting, when it changed language to say risks to the outlook were to the downside. That report comes a day after the U.S. Federal Reserve releases the minutes of its recent policy meeting, at which it paused its interest-rate hiking cycle.

Read More: Central Bankers Take to Stage as Data Disappoint

While the euro area now looks like the weak link in global growth, the good news is we may be in the trough and soon over the worst as idiosyncratic factors start to fade, according to UBS. That’s in line with the view among economists at Bloomberg Economics, who say there is “nascent evidence that confidence is stabilizing.”

“There are tentative signs that some industrial data are starting to edge up,” Janet Henry, global chief economist at HSBC, said in a note Monday on the slowdown in global industrial production. “It could still be a false dawn though, as survey data still point to further weakness.”