THE HEADLINES:

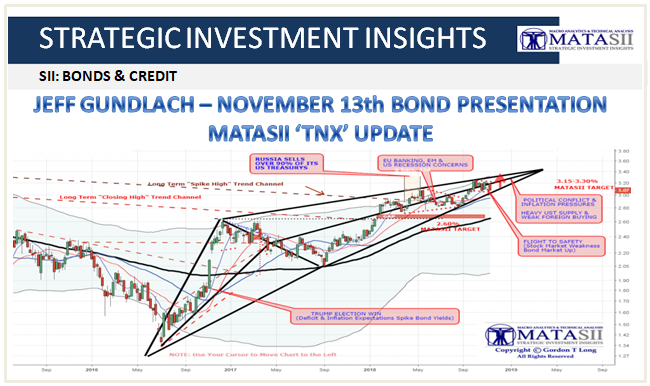

JEFF GUNDLACH - NOVEMBER 13th BOND PRESENTATION

MATASII SII ANALYSIS:

Gordon T Long's Macro View - TNX - 11-16-18

MATASII TAKEAWAYS:

The 10-year Treasury yield has risen pretty much in sync with the shrinkage of the Fed’s balance sheet,

The 10-year Treasury yield has risen pretty much in sync with the shrinkage of the Fed’s balance sheet,- It’s very possible yields could go up in a recession, if for no other reason than the large amount of pending bond issuance,

- Strong economic growth in the U.S. is being caused by the growth in the deficit, Gundlach said. “This is good for the short term, but we are borrowing from the future.”,

- The deficit is now 4% of GDP, “but if you include loans from Social Security it is 6%. This is why interest rates have been stubborn to fall,

- There are $7 trillion of Treasury bond maturities due in the next five years with a 2% average coupon. With yields at 3%, those bonds will have to be replaced with higher cost debt, resulting in another $150 billion of interest-rate expense given current market conditions,

- “We are on a suicide mission,” ---- “This will be an important issue in the next five years.”,

- The deficit crisis will be resolved through devaluation – by entitlement reform “once the nation wants it, once the nation realizes that path we are on leads to catastrophe.”,

- Treasury bonds are unattractive to foreign borrowers because of the U.S. trade policies and because hedging costs are too high. The currency-hedged yields on foreign sovereign bonds are below zero. Domestic demand for Treasury bonds has been higher and has offset the lack of foreign demand,

The 30-year yield could be 5% or 6%, but it may take a while. We are on track to hit 6% by 2021,” as per a prediction he made some time ago.

Those looking for a risk-free investment should opt for two-year Treasury bonds, which yield 2.90%. When they mature there will be better opportunities.

THE BREAKING NEWS STORY:

JEFF GUNDLACH - NOVEMBER 13th BOND PRESENTATION

As the Fed started its QT, the 10-year Treasury yield has risen pretty much in sync with the shrinkage of the Fed’s balance sheet, Gundlach said. When the stock market fell in October, the 30-year Treasury yield went up slightly, he said. It is very unusual for this to happen when equities are in distress, according to Gundlach.

As a result, he said it’s very possible yields could go up in a recession, if for no other reason than the large amount of pending bond issuance.

The deficit suicide mission

Strong economic growth in the U.S. is being caused by the growth in the deficit, Gundlach said. “This is good for the short term, but we are borrowing from the future.” Historically, the Fed has cut rates when economy was bad, and vice versa. That Keynesian view changed after the global financial crisis, according to Gundlach, when the Fed started raising rates while the deficit rose. That was because of Trump’s policies – specifically, the Tax Cuts and Jobs Act. As a result, he said the deficit is now 4% of GDP, “but if you include loans from Social Security it is 6%. This is why interest rates have been stubborn to fall.”

“These are very alarming trends,” Gundlach said. There are $7 trillion of Treasury bond maturities due in the next five years with a 2% average coupon, he said. With yields at 3%, those bonds will have to be replaced with higher cost debt, resulting, he said, in another $150 billion of interest-rate expense given current market conditions.

“We are on a suicide mission,” Gundlach said. “This will be an important issue in the next five years.”

How will the deficit crisis be resolved? Gundlach said it will be through devaluation – by entitlement reform “once the nation wants it, once the nation realizes that path we are on leads to catastrophe.”

Problems abroad

Gundlach referenced “underlying problems in the core of the European banking system,” based on the fact that the stock prices of Deutsche Bank and Credit Suisse, two large European banks, have declined precipitously.

Emerging markets have been weak as the dollar has strengthened, he said. “The success and failure of emerging markets are with the fate of the dollar,” he said. “Bullishness on the dollar is extraordinary,” but he said he does not expect the dollar to rise to the level of its high in 1984.

China and the European central bank want to have a role as a reserve currency, according to Gundlach. China is trading oil futures of its own currency, the Yuan. “Once you start trading in global commodities,” he said, “you are taking steps to be a reserve currency.”

Treasury bonds are unattractive to foreign borrowers because of the U.S. trade policies and because hedging costs are too high, Gundlach said; the currency-hedged yields on foreign sovereign bonds are below zero. Domestic demand for Treasury bonds has been higher and has offset the lack of foreign demand.

There is a positive, albeit small, real rate of return on Treasury bonds. Unless inflation goes down (which Gundlach said is likely) Treasury bonds are unattractive to domestic buyers.

The 30-year yield could be 5% or 6%, he said, “but it may take a while. We are on track to hit 6% by 2021,” as per a prediction he made some time ago.

Those looking for a risk-free investment should opt for two-year Treasury bonds, he said, which yield 2.90%. When they mature, he said, there will be better opportunities.