FEATURE ARTICLES

MACRO – MONETARY & FISCAL POLICY

TWO FLAWED HOPES: LIQUIDITY & STIMULUS

-

- Lost Incomes & Revenues of Consumers, Businesses & Governments,

- Increased Debt Levels,

- Lowered Working Capital & Cash Shortages,

- Lowered Credit Ratings & Availability.

-

- Bankruptcies,

- Reduced Solvency,

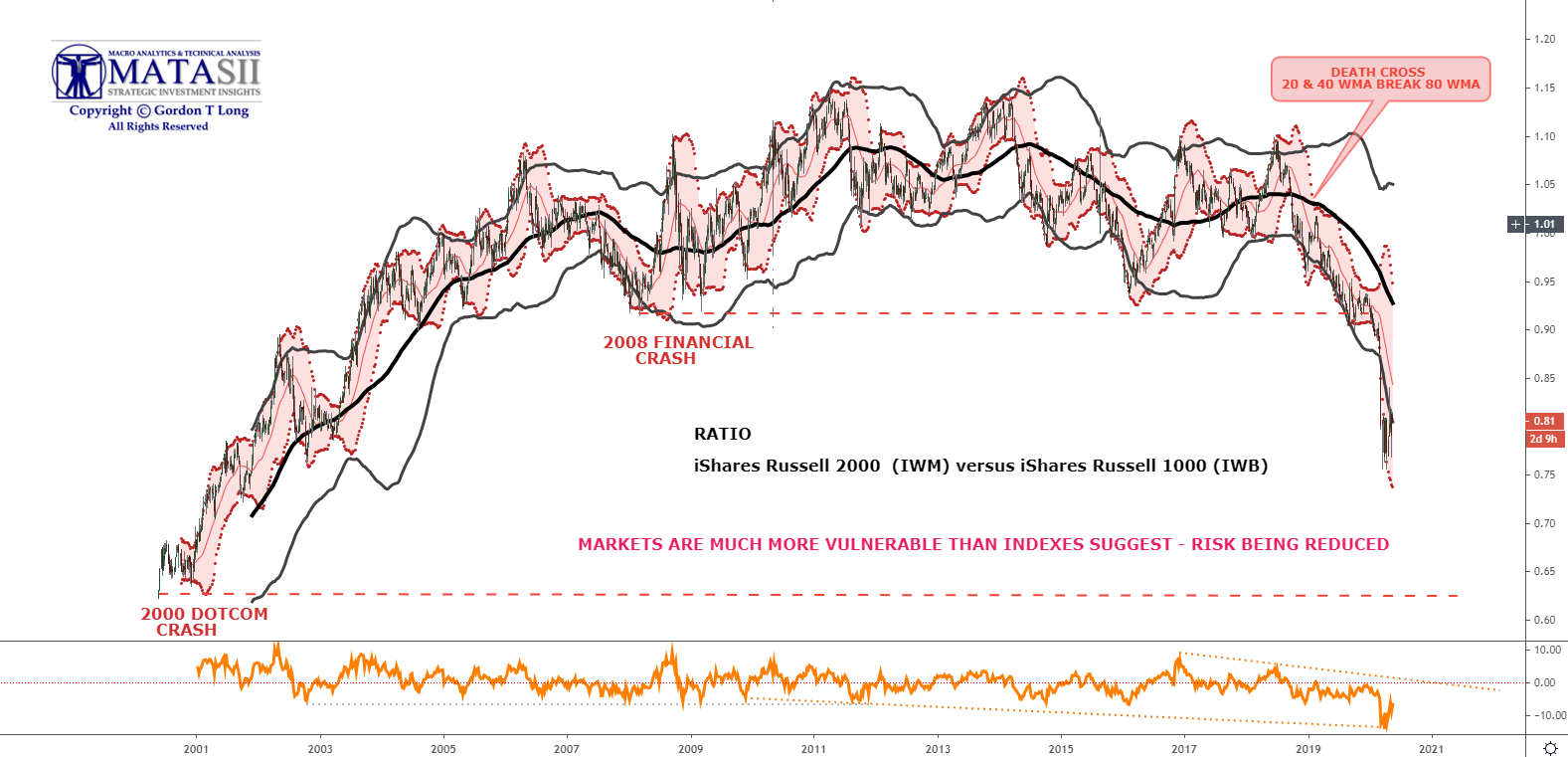

- Decreased Willingness/ Ability for Investors, Businesses & Consumers to Take Risk

-

- The Inevitable delay of the lowering of market PE ratios,

- The Inevitable forced Central Bank Buying of Markets through:

-

-

- Direct Market Intervention

- Indirect intervention in the form of never before undertaken policies of Lending,

- Targeted market sector Guarantees,

- Nationalization through the expanded use of Conservatorships like used for Fannie Mae and Freddie Mac,

-

- CONSUMER CONFIDENCE: Since late 2018 US Consumer Confidence has fallen -37%.

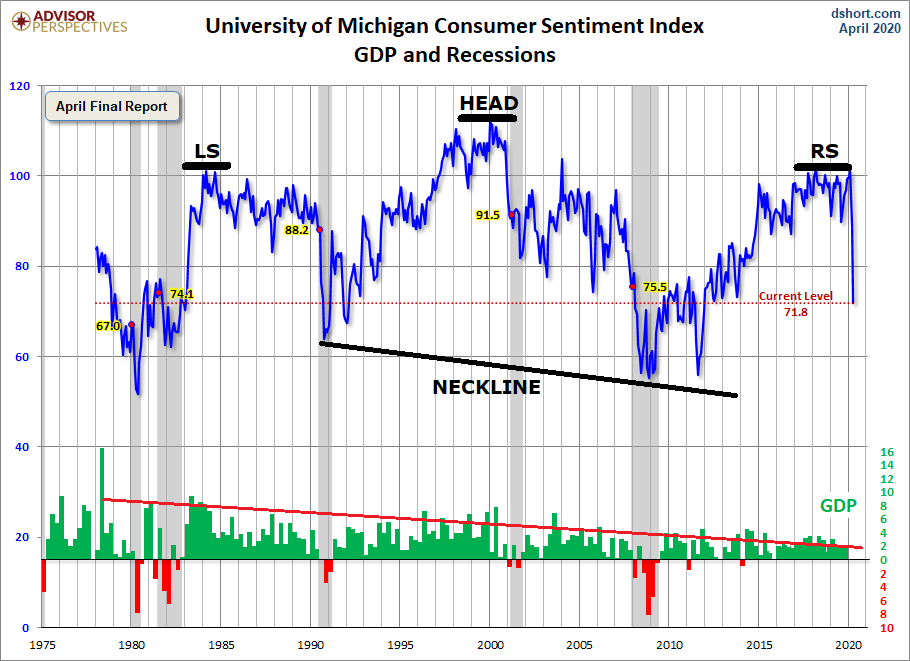

- CONSUMER SENTIMENT: The University of Michigan’s Consumer Sentiment Index has fallen -29% since year beginning 2020.

- NFIB SMALL BUSINESS OPTIMISM INDEX: Has fallen ~-12% since Q1 this year.

- INVESTOR SENTIMENT: The most recent AAII Investor Sentiment Survey shows 50.6% of investors are Bearish, 26.1% Neutral and only 23.3% bullish with markets have rebounded 61.8% since the CoronaVirus market plunge in Q1.

- PUBLIC TRUST IN US GOVERNMENT: Has fallen from 77% during the Kennedy Administration to most recently 19% or -58%, with -30% coming in the lat 15 years of the public trust measurement.

- CASH LEVELS: Cash levels of actively managed funds has increased 150% to 5% from a more traditional level of 2%

- VIX: The VIX is presently at highs not seen since the top of the 2008 Financial Crisis. Prices for options has surged thereby significantly increasing the Cost of Risk and making it more expensive to hedge risk. Both place significant pressures on financial leverage.

- CREDIT DEFAULT SWAPS: CDS’s costs have surged since year beginning increasing the cost of risk protection and thereby further pressuring highly leveraged lenders and borrowers.

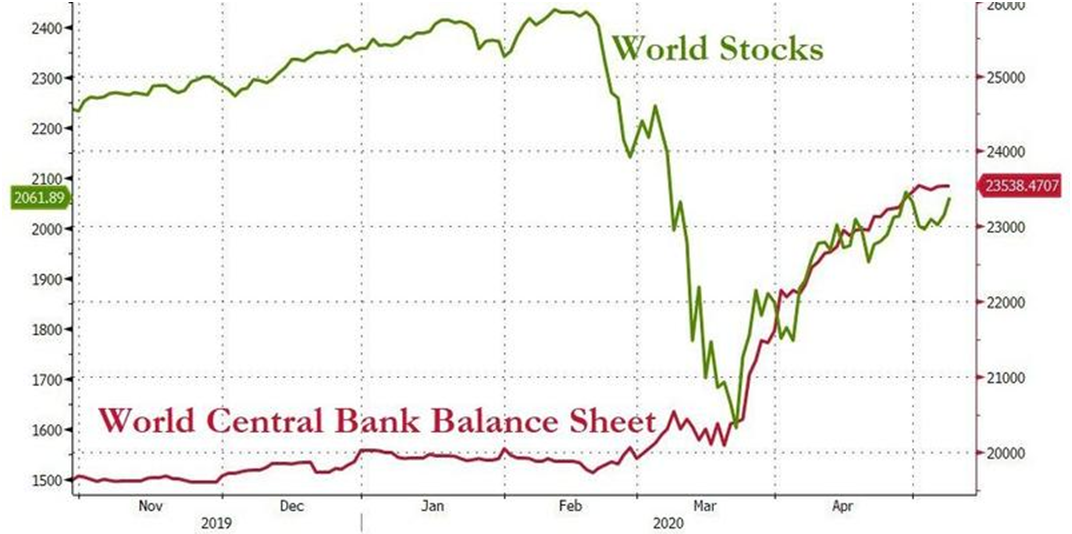

What we have witnessed since the launch of central bank policies such as QE and QT is that the moment the rate of increase of liquidity injections by the Federal Reserve slows the markets weaken and if reduced the market experiences severe dislocations until the rate is re-established and at higher levels. Currently after historic increases in liquidity by the Federal Reserve the US equity markets only regained 61.8% of its Q1 CoronaVirus losses and as the liquidity injections currently level off the market gains have once again flattened. How much must the next rate increase be to sustain rising markets and is that realistically possible?

What we have witnessed since the launch of central bank policies such as QE and QT is that the moment the rate of increase of liquidity injections by the Federal Reserve slows the markets weaken and if reduced the market experiences severe dislocations until the rate is re-established and at higher levels. Currently after historic increases in liquidity by the Federal Reserve the US equity markets only regained 61.8% of its Q1 CoronaVirus losses and as the liquidity injections currently level off the market gains have once again flattened. How much must the next rate increase be to sustain rising markets and is that realistically possible?

FAIR USE NOTICE This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.

NOTICE Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. MATASII.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility.