WELL RESPECTED BOND EXPERT, LACY HUNT LAYS MMT BARE

I have interviewed and talked to Lacy Hunt many times over the years. There are few out there with his depth and understanding of Monetary Policy. What he has to say on MMT (Modern Monetary Theory) needs to be carefully considered. First let's read what Lacy Hunt had to say before we analyse some salient points:

Excerpted from Hoisington Investment Management's Latest Quarterly Review,

The parallels to the past are remarkable, but there appears to be one fatal similarity – the Fed appears to have a high sensitivity to coincident or contemporaneous indicators of economic activity, however the economic variables (i.e. money and interest rates) over which they have influence are slow-moving and have enormous lags.

In the most recent episode, in the last half of 2018, the Federal Reserve raised rates two times, by a total of 50 basis points, in reaction to the strong mid-year GDP numbers. These actions were done despite the fact that the results of their previous rate hikes and monetary deceleration were beginning to show their impact of actually slowing economic growth.

The M2 (money) growth rate was half of what it was two years earlier, signs of diminished liquidity were appearing and there had been a multi-quarter deterioration in the interest rate sensitive sectors of autos, housing and capital spending.

Presently, the Treasury market, by establishing its rate inversion, is suggesting that the Fed’s present interest rate policy is nearly 50 basis points too high and getting wider by the day. A quick reversal could reverse the slide in economic growth, but the lags are long.

It appears that history is being repeated – too tight for too long, slower growth, lower rates."

Full letter below...

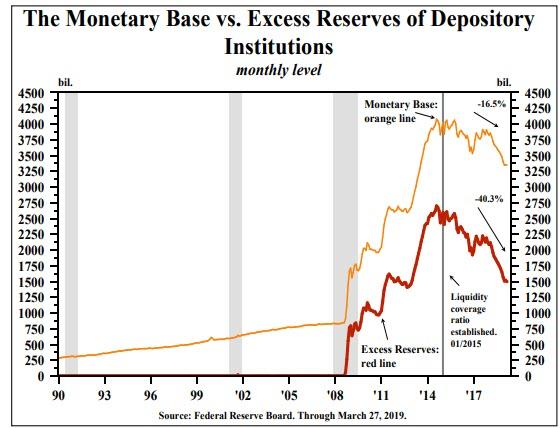

MMT Leads to Hyperinflation

Under existing statutes, Fed liabilities, which they can create without limits, are not permitted to be used to pay U.S. government expenditures. As such, the Fed’s liabilities are not legal tender. They can only purchase a limited class of assets, such as U.S. Treasury and federal agency securities, from the banks, who in turn hold the proceeds from this sale in a reserve account at one of the Federal Reserve banks. There is currently, however, a real live proposal to make the Fed’s liabilities legal tender so that the Fed can directly fund the expenditures of the federal government – this is MMT – and it would require a change in law, i.e. a rewrite of the Federal Reserve Act.

This is not a theoretical exercise. Harvard Professor Kenneth Rogoff, writing in ProjectSyndicate.org (March 4, 2019), states “A number of leading U.S. progressives, who may well be in power after the 2020 elections, advocate using the Fed’s balance sheet as a cash cow to fund expansive new social programs, especially in view of current low inflation and interest rates.” How would MMT be implemented and what would be the economic implications? The process would be something like this: The Treasury would issue zero maturity and zero interest rate liabilities to the Fed, who in turn, would increase the Treasury’s balances at the Federal Reserve Banks. The Treasury, in turn, could spend these deposits directly to pay for programs, personnel, etc. Thus, the Fed, which is part of the government, would be funding its parent with a worthless IOU. In historical cases of money printing, the countries were not the reserve currency of the world, as the U.S. is today. Thus, the entire global system could be destabilized in very short order if this were to occur.

There would be no real increase in services or money since very little time would lapse before people realized increasing inflation was not increasing real purchasing power. If the government responded by issuing more central bank legal tender, the inflationary process would become self-perpetuating, and as was the case in numerous historical instances this would lead to hyper-inflation. Moreover, the central bank would have no capability of reducing the money supply. All they could offer would be the zero maturity, zero interest liabilities of the government, but there would be no buyers. This would mean that hyper-inflation would be difficult to stop.

Rates Too High Already

Presently, the Treasury market, by establishing its rate inversion, is suggesting that the Fed’s present interest rate policy is nearly 50 basis points too high and getting wider by the day. A quick reversal could reverse the slide in economic growth, but the lags are long. It appears that history is being repeated – too tight for too long, slower growth, lower rates.

1- VELOCITY

Mish makes some observations here that few have recently written about and need to be considered in the thoughtful manner that Mish does.

In the article, Lacy also touched on the velocity of money. While I agree with Hunt that velocity has generally been falling, the equation itself is useless.

As I have pointed out, velocity can rise or far with rising or falling GDP. It is not an independent variable that can be tracked.

Velocity = Value of transactions/supply of money. This expression can be summarized as: V = P(T/M) , where V stands for velocity, P stands for average prices, T stands for volume of transactions, and M stands for the supply of money.

This expression can be further rearranged by multiplying both sides of the equation by M. This in turn will give the famous equation of exchange: M(V) = P(T).

Many economists employ GDP instead of P(T), thereby concluding that: M(V) = GDP = P x (real GDP).

Velocity Does Not Have an Independent Existence

Contrary to mainstream economics, velocity does not have a “life of its own.” It is not an independent entity–it is always value of transactions P(T) divided into money M, i.e., P(T/M). On this Rothbard wrote: “But it is absurd to dignify any quantity with a place in an equation unless it can be defined independently of the other terms in the equation.” (Man, Economy, and State, p. 735)

Since V is P(T/M), it follows that the equation of exchange is reduced to M(PxT)/M = P(T), which is reduced to P(T) = P(T), and this is not a very interesting truism. It is like stating that $10=$10, and this tautology conveys no new knowledge of economic facts.

The above paragraphs are excerpts from Fran Shostak's Is Velocity Like Magic?

For further discussion, please see Velocity of Money Picks Up: Inflation Coming? Stagflation? How About Deflation?

Case for Hyperinflation

Mish is absolutely right here!! MMT is at its core about Congress taking control of US Monetary Policy. This can only lead to one outcome!

In regard to hyperinflation, I have been asked many time what it would take for me to change my mind on that happening in the US. My response, has been unchanged for years: Give Congress Control of Money Supply.

MMT does precisely that. There is no project that could not be funded including AOCs absurd Green New Deal which might cost as mush as $200 trillion.

It would not stop there. Guaranteed "living wages" and "guaranteed jobs would finish it off. The amount needed to have a living wage could never be met. Prices would soar along with the guarantee.

What About Rate Cuts

I partially disagree with Mish on the following. Mish is correct that the world is headed towards a DEFLATIONARY Bust. However, the US has a different problem to be overlayed on this outcome. The massive and unfundable US debt is funded by foreigners!!! As a result the US will experience high levels of Inflation in the coming years before the US and Global economies experience together a "Fiat Currency Collapse"! Effectively the US will be the last to ultimately fail.

Hunt says interest rates are 50 basis points too high. In relation to the Fed's mandate, I believe Hunt is correct.

If one wants to factor in asset bubbles the Fed isn't. Alternatively, the Fed should have started hiking in 2010 or 2011 and be cutting rates now.

The Fed is constantly chasing its own tail. I believe that is what Hunt means when he speaks of lags. If so, we are in agreement on that point as well.

Regardless, because of Fed actions and the lags, I am certain we are headed for another very deflationary asset bubble bust.

The next deflationary bust could easy last for years, perhaps even without the job losses like we saw in 2008-2009. I discussed the job setup in Zombified Economy: What Will the Next Recession Look Like?

[SITE INDEX -- MACRO - US - FISCAL & MONETARY POLICY]

READERS REFERENCE (SUBSCRIBERS-RESEARCH & PUBLIC ACCESS )

MACRO; US FISCAL & MONETARY POLICY

MATASII RESEARCH ANALYSIS & SYNTHESIS WAS SOURCED FROM:

SOURCE: The Hoisington Investment Quarterly Outlook for the first quarter of 2019

SOURCE: 04-11-19 - Zero Hedge - "Lacy Hunt: "The Fatal Similarities To The Past Are Remarkable""

SOURCE: 04-12-19 - Mish Shedlock - "Lacy Hunt Blasts MMT and Speaks of Hyperinflation If Implemented"

FAIR USE NOTICE This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a 'fair use' of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond 'fair use', you must obtain permission from the copyright owner.

NOTICE Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. MATASII.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility.