"YEAR OF THE RIGHT SHOULDER - MORE PROOF!

Sven Henrich of NorthmanTrader.com posted the following which gives further proof to our previous labeling of 2019 as "The Year of the Right Shoulder". The S&P 500 appears to be the exception with a Double Top (the Right Shoulder was pushed too high to qualify) before falling back.

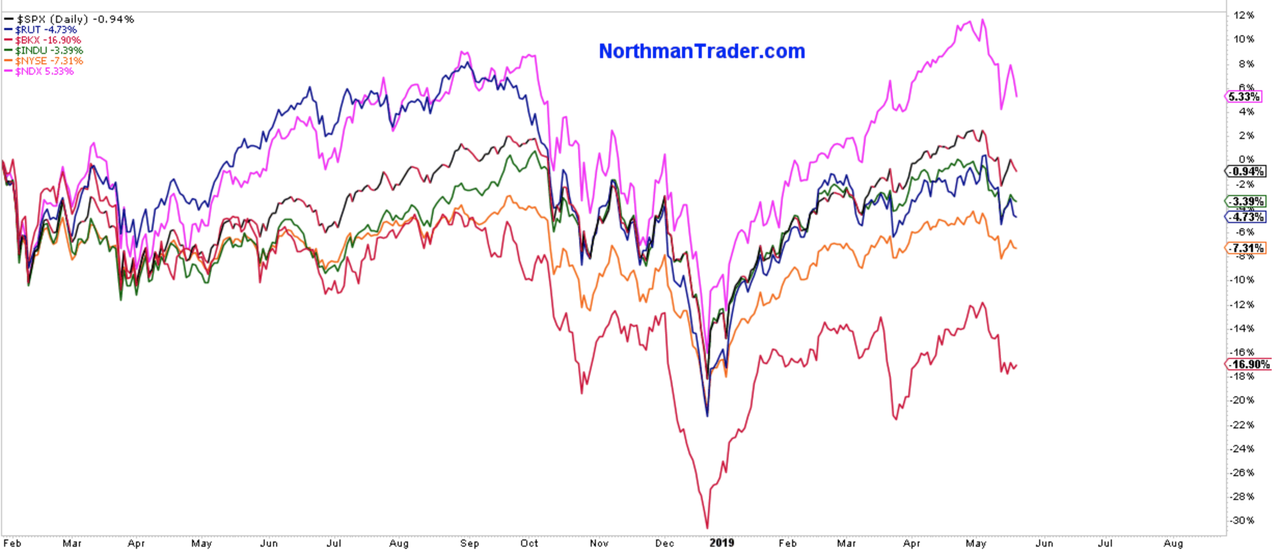

On an equal weight basis the 2019 rally was the weakest of the last 3 rallies. By far.

Firstly, what is equal weight? Look no further than the $XVG, the value line geometric index. $XVG tracks the median moves its components using the assumption that each stock has an equal amount (for example, $1,000) invested in them. The daily average moves of stocks are then calculated geometrically (rather than arithmetically). In basic terms, the Value Line Geometric Index eliminates an illusion created by cap-weighted index components. Heavily weighted stocks within a cap-weighted index can pull it higher even as the majority of the stocks within the index are not following along. For example, in a cap-weighted index like the S&P 500, it’s possible for the top 100 weighted stocks to carry the index higher while the remaining 400 stocks lose value. As an investor, it might be helpful to identify when this is happening.

- Well it just happened in 2019 and in a big way.

- Compare the $XVG readings in 2019 to the readings of 2018 when $SPX made its previous highs

- Didn’t even get close.Which implies that the broader market did not follow some of the big cap names to new highs, hence the recent headlines of new market highs were very deceiving.

- And now that $SPX has fallen below the January 2018 highs again this broader market under-performance is very visible.

- Big bull market? Where? Negative returns since the January 2018 highs, except select tech.

- Why is all this potentially critically important? Well, simply because we’ve seen this movie before.

- After all the market highs in the fall of 2007 came in a weakening $XVG:

- New highs on weakening equal weight have been the hallmark of major previous tops before (see also 2000) as investors piled into the select winners and ignored the message of the larger market beneath.

[SITE INDEX -- MATA - PATTERNS]

READERS REFERENCE (SUBSCRIBERS-RESEARCH & PUBLIC ACCESS )

MATA: PATTERNS

MATASII RESEARCH ANALYSIS & SYNTHESIS WAS SOURCED FROM:

SOURCE: 05-20-19 - Sven Henrich via NorthmanTrader.com - "All Things Being Equal..."

FAIR USE NOTICE This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a 'fair use' of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond 'fair use', you must obtain permission from the copyright owner.

NOTICE Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. MATASII.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility.