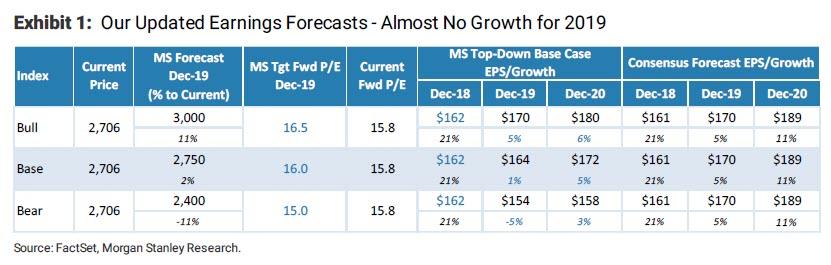

One month ago, Morgan Stanley whose chief US equity strategist Michael Wilson had long been one of the biggest bears on Wall Street, said that the US is headed for an earnings recession not just in Q1 2019, but perhaps for the entire year, as consensus earnings estimates for 2019 were just too high. And, in a concession to Morgan Stanley's more bullish clients, Wilson cut his full year EPS forecast for 2019 from 4.3% to a token 1.0%, just barely above calling the entire year a wash from an earnings perspective (although he did bump up his PE multiple assumptions).

And while Wilson was ahead of the curve in calling roa recession, it now appears that Morgan Stanley may also be calling the inflection point, when in its Sunday Start note, the bank's chief economist and global head of economics, Chetan Ahya, wrote that he is increasingly "inclined to believe that our house forecast of growth bottoming out in 1Q19, aided by a recovery in growth outside the US, is coming to fruition" as a result of easing on three key fronts:

- Trade tensions easing,

- China’s monetary easing starting to work,

- The Fed’s flexibility and patience, leading to easing in global financial conditions, all support our view that 1Q19 will mark the trough in this mini-cycle.

To Ahya, this "easing trio is helping to reverse the global economy’s downward trajectory" and explained:

For starters, the Fed began to signal flexibility on its policy rate path and acknowledged the market’s concerns about its balance sheet normalization plans. Second, trade tensions eased, as the spectre of further tariffs gave way to trade talks. Finally, the step-up in China’s easing and the latest confirmation that broad credit growth picked up in January (a sign that easing is filtering through) has helped to rekindle optimism about China’s growth outlook.

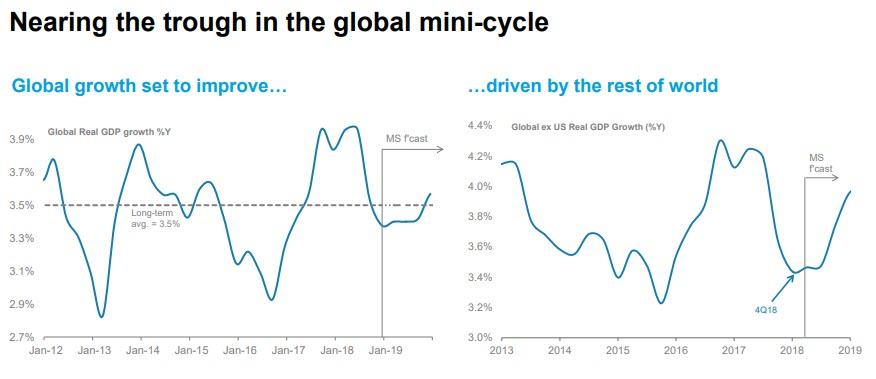

Of course, none of this is news to the markets which have staged a memorable recovery from the December lows, recovering most of the post-Sept all time high losses, as the S&P is once again back over 2,800. However, as Morgan Stanley notes, "as financial markets have already taken note of these positive developments, the onus is now on the economic indicators to play their part by confirming our expectations of this growth rebound." Morgan Stanley also thinks that "investors looking for this recovery should focus outside the US and towards emerging markets in particular. "

Of course, as Goldman warned earlier, the seeds of the current recovery predetermine its own destruction, and even though Morgan Stanley is "increasingly confident that 1Q19 will mark the trough of this global growth mini-cycle", the risks to the bank's view are that labor market tightness leads to stronger wage growth, "forcing DM central banks to tighten sooner than we expect", or if we’re wrong on the improvement in China and other emerging markets."

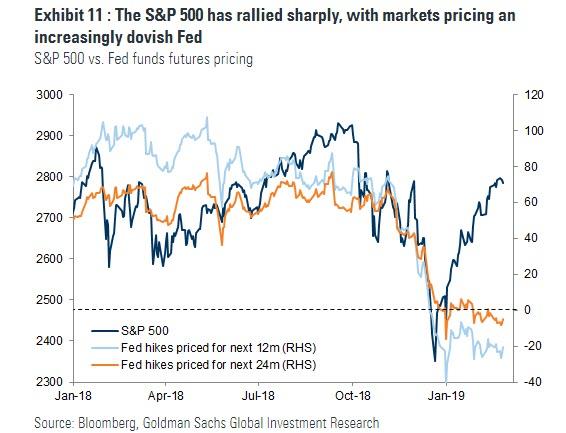

This is precisely what Goldman meant when it said that "there is now a material disconnect between Fed pricing and the S&P 500" and as noted in the chart below, not only are markets pricing no hikes in the next 12 months, but they are pricing a cut in the next 2 years." In other words, either the Fed will be forced to admit it was wrong in its dovish reversal in December/January once the global economy rebounds from the current episode, and resume tightening, or stocks will rollover if and when the Fed throws in the towel, and ease, signifying that a recession is in the immediate future, if not already here.

Chetan Ahya's full note is below:

An Easing Trio

Call it confirmation bias, but I am increasingly inclined to believe that our house forecast of growth bottoming out in 1Q19, aided by a recovery in growth outside the US, is coming to fruition. The evidence? Easing on three fronts. Trade tensions easing, China’s monetary easing starting to work, and the Fed’s flexibility and patience, leading to easing in global financial conditions, all support our view that 1Q19 will mark the trough in this mini-cycle.

Looking back, it was precisely this trio of factors that caused growth outside the US to slow significantly, from a peak of 4.2%Y in 1Q18 to just 3.4%Y in 4Q18. Escalating trade tensions over much of 2018 led to increased business uncertainty. While most economists, including us, focused on the direct impact on trade growth from higher tariffs and the spillover impact from supply chain linkages, the transmission channel was actually via heightened business uncertainty and tighter financial conditions, which affected capex decisions and exerted a drag on global growth. This impact was felt most keenly in China, compounding the challenges of its own tightening cycle and triggering a sharp slowdown in demand in 4Q18. The Fed’s policy stance completed the negative feedback loop – seemingly staying on a preset tightening path despite mounting external headwinds. This caused further tightening in global financial conditions, creating significant headwinds to global growth.

Fast forward to today, and the easing trio is helping to reverse the global economy’s downward trajectory. For starters, the Fed began to signal flexibility on its policy rate path and acknowledged the market’s concerns about its balance sheet normalisation plans. Second, trade tensions eased, as the spectre of further tariffs gave way to trade talks. Finally, the step-up in China’s easing and the latest confirmation that broad credit growth picked up in January (a sign that easing is filtering through) has helped to rekindle optimism about China’s growth outlook.

Moreover, we think that recent developments confirm the easing trends. The latest dispatches from Fed speakers continue to have a dovish bias, as they affirm the Fed’s vigilance on the risk that inflation expectations could become anchored at a lower level, and highlight the symmetry of the inflation target. For instance, on February 22, New York Fed President Williams commented that “we must be equally vigilant that inflation expectations do not get anchored at too low a level”. Fed Chair Powell, in his semi-annual testimonies to the Senate and Congress on February 26 and 27, commented on the symmetry around the inflation target and its impact on expectations, “so that inflation kind of averages around 2 percent rather than only averaging 2 percent in good times and then averaging way less than that in bad times, which would drag expectations down”.

On the trade front, tangible progress is evident, as the March 1 tariffs have been delayed. Reports indicate that a trade agreement is in sight and that the presidents of the US and China could meet in the coming weeks to sign it. A further positive surprise could materialise if the existing 10% tariffs were removed. Moreover, even though trade tensions may be easing, we believe that policy-makers in China will keep up the intensity of their easing measures. Our chief China economist Robin Xing expects that upcoming steps, such as an announcement of cuts to VAT and firms’ social insurance contribution rates, plus accelerating infrastructure project approvals and loosening of property restrictions, will cement the growth recovery from 2Q19 onwards.

As financial markets have already taken note of these positive developments, the onus is now on the economic indicators to play their part by confirming our expectations of this growth rebound. However, we think that investors looking for this recovery should focus outside the US and towards emerging markets in particular.

The bottom line is we are increasingly confident that 1Q19 will mark the trough of this global growth mini-cycle. The risks to our view are that labor market tightness leads to stronger wage growth, forcing DM central banks to tighten sooner than we expect, or if we’re wrong on the improvement in China and other emerging markets.