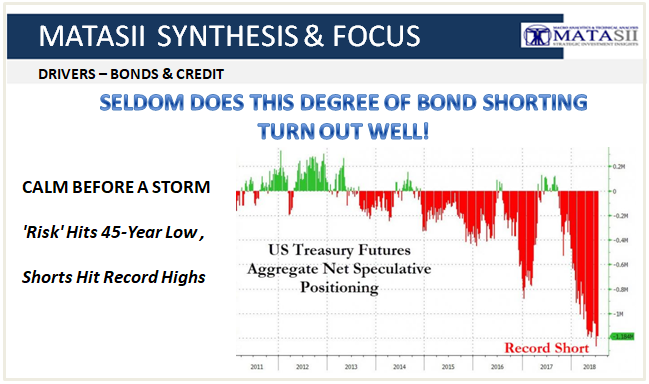

SELDOM DOES THIS DEGREE OF BOND SHORTING TURN OUT WELL!

-- SOURCE: 07-20-18 - "Calm Before The Storm? Treasury 'Risk' Hits 45-Year Low As Shorts Hit Record Highs" --

Having killed the Japanese bond market, some are wondering if central bank interference has finally slayed the US Treasury market, as its numbness to news suggests a zombie-market-walking.

The 10-year Treasury yield has moved less than 9 basis points so far in July. After retreating from its May 17th high of 3.1261%, the benchmark yield has hovered between 2.8053% and 2.8950% in July...

Putting it on course for its smallest monthly range since 1973....

In price-terms, the realized volatility of 10Y US Treasury Futures prices for the last 30 days is the lowest since 1998!

As Bloomberg notes, Ian Lyngen, a strategist at BMO Capital Markets, said in a note this week that he’s fascinated with how unresponsive the yield has been to new information and “our sense is that something dramatic is nearing on the horizon.”

And given the fact that there has never been a bigger speculative short position across the Treasury complex...

We suspect the max-pain trade would be a yield collapse.

We wonder if the catalyst will somehow be China?