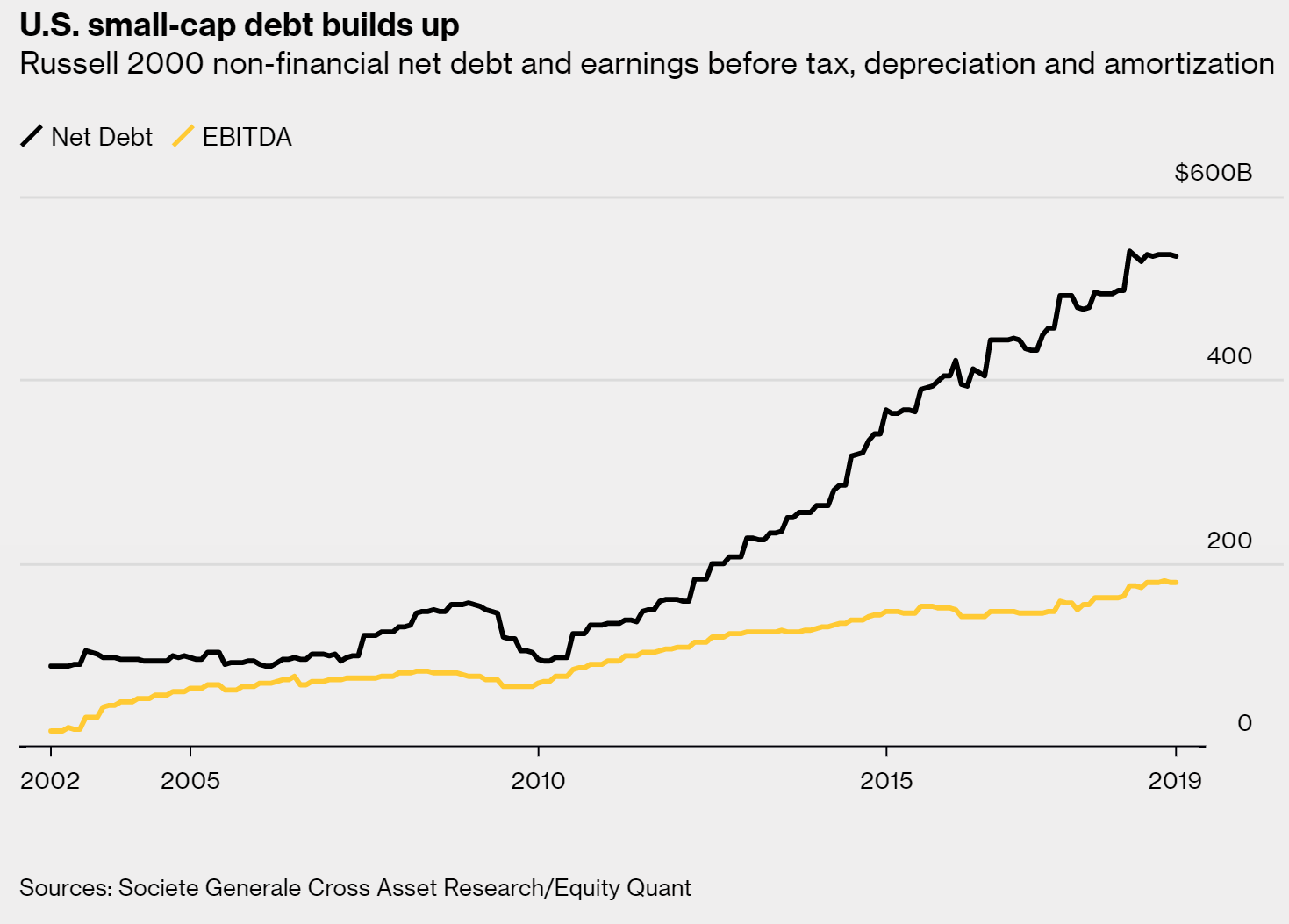

- It is the diminishing marginal utility of debt.

- In this case, more and more debt is required to add what looks like less and less profit.

- Inflation has become the counterfeiting of credit. It’s a fraud, where the lender often does not know or approve of giving credit—and more importantly the borrow lacks the means and intent to repay.

- It may not be inevitable for growth to shrink, but as the sun rises in the east, debt borrowed without means to repay will be defaulted.

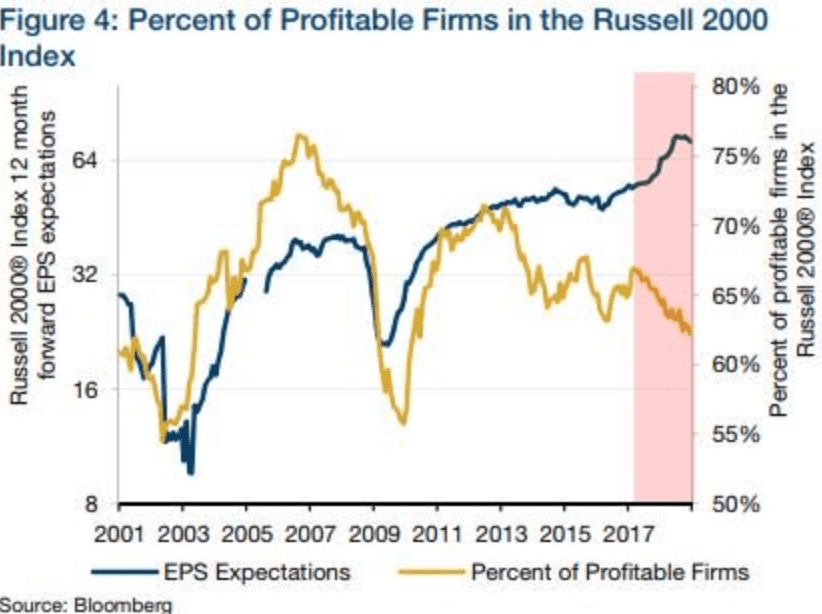

- Analysts expect rising profits while the percentage of firms that actually generate a profit is falling.

- This graph shows a symptom of the Fed’s incredible misallocation of credit.

- We are in an economy that all acclaim to be “strong” and “healthy”. Debt is rising, as is GDP and employment. Yet a shrinking proportion of small cap stocks (weighted average market cap is over $2B) actually generate a profit.

- Despite the free flow of credit-effluent, despite the incredible boost to GDP of incredible central bank fueled debt, more and more of these companies cannot generate a profit.

- And if this downturn in the profitable proportion of the index is durable, observe that the peak is lower than prior to the last bust.

The spending of one company is the revenues of another. Close to four in ten of these companies now fail to generate earnings despite a variety of ways to consume capital and report it as earnings (Such as neglecting employee training and cutting back on preventative maintenance).

- We won’t speculate how many of these firms will be unprofitable in the next bust cycle, other than to note that in the last one, it was about 45%. In the next one, this number will be worse.

- The Fed and other central banks have caused a misallocation of credit of enormous proportions.

- The Fed has induced speculators to bid up the shares of money-losing companies.

The return they expect will not come from operating the business. Their gain will be provided by the next speculator. It may sound crazy, but it has worked brilliantly since 2009.

- It cannot work forever, because a money-losing company is, well, losing money.

- Some may get acquired by larger firms in an attempt to find synergies or at least cost savings. However, in a world of falling interest rates, there will always be another competitor who finds it attractive to jump into your business on the next rate downtick. And the interest rate trend remains downward.

- It has to otherwise interest expense will quickly spiral out of control. Not just for the marginal company in the Russell 2000, but for everyone.

- And Uncle Sam will be last to fall.

[SITE INDEX -- MATA - FUNDAMENTALS - EARNINGS]

READERS REFERENCE (SUBSCRIBERS-RESEARCH & PUBLIC ACCESS )

MATA: FUNDAMENTALS - EARNINGS

MATASII RESEARCH ANALYSIS & SYNTHESIS WAS SOURCED FROM:

SOURCE: 04-11-19 - Monetary Metals - "Debt and Profit in Russell 2000 Firms"

FAIR USE NOTICE This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a 'fair use' of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond 'fair use', you must obtain permission from the copyright owner.

NOTICE Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. MATASII.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility.