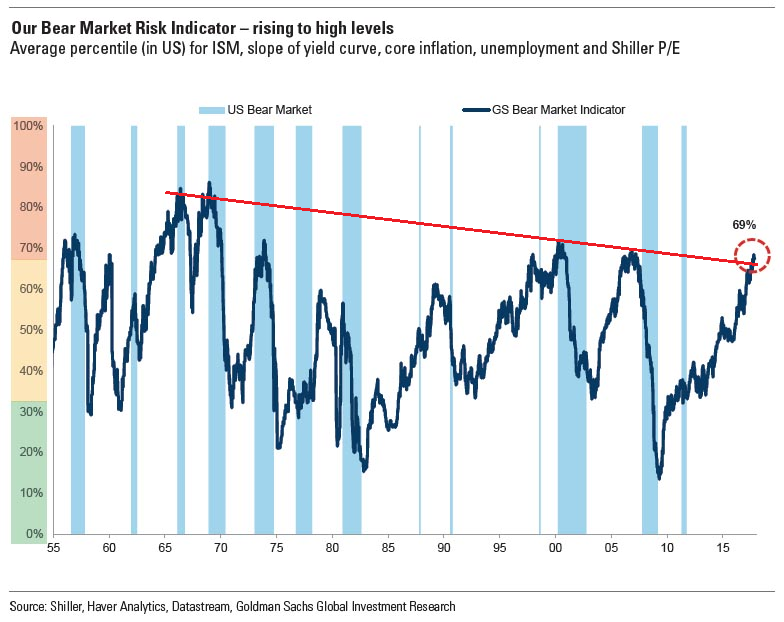

GOLDMAN'S BEAR MARKET RISK INDICATOR SCREAMING "BEAR MARKET AHEAD"!

Goldman is also quick to explain that since equity bull markets do not die of old age, its own bull/bear market indicator is at levels that preceded both the dot com and the 2007 global financial crisis – should be largely ignored:

Economic cycles and equity bull markets do not generally die of old age. Our work on bear markets shows that major draw-downs require triggers. The most severe type of bear market – the ‘structural’ bears – are a consequence of the unwinding of major economic imbalances and, typically, a financial bubble. These risks are low currently given that many of the pre-crisis imbalances have been reduced or shifted to the official sector and to central banks. Meanwhile, ‘cyclical’ bear markets are a function of the economic cycle and are nearly always triggered by a tightening of monetary policy in response to inflation pressure. While our bull/bear market indicator (Exhibit 6) is at elevated levels, this mainly reflects the strength of the current economic cycle, low unemployment and high valuations. Importantly, two of the other factors that are included in this indicator are not at elevated levels. Inflation is low and stable and, as a consequence, the yield curve remains upward-sloping. Without higher inflation, it is unlikely that we have the conditions for a recession and, therefore, a bear market.

MATASII NOTE >> EXACTLY THE TRIGGER - AN INFLATION SHOCK

READ MATASII POSTS:

-

INFLATION IS ABOUT EXPECTATIONS – THEY ARE CHANGING GLOBALLY!

-

RAGING ASSET INFLATION OR RISING PRICE INFLATION – ITS ALL THE SAME PROBLEM!