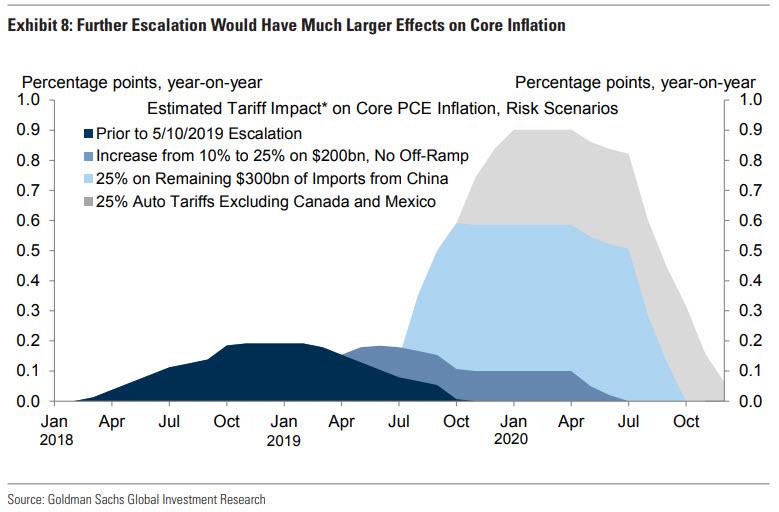

Nearly three weeks ago, when Goldman calculated that the imminent impact of even more tariff hikes (back then Trump's intention to slap Mexico with tariffs wasn't known yet) would be to sharply boost inflation as imposing 25% tariffs on roughly $300bn of remaining Chinese imports would have a peak effect of 0.5pp on core PCE, while auto tariffs would have a roughly 0.3pp peak effect...

... we said that "the unspoken risk here is clear: stagflation. Indeed, further escalation of the trade war could result in a hit to GDP as large as 0.4%, and if trade tensions sparked a major sell-off in the equity market the growth impact could worsen considerably, as virtually nobody is prepared for a stagflationary outcome.

Now, in his latest note to clients after a 1 week travel to Asia hiatus, Nomura's Charlie McElligott writes that the mood/ overall market sentiment is anecdotally approaching “max bearish” on both global economic prospects- and risk-assets-, with investors certain that the “trade war” is going to worsen in coming-months, with no relief in-sight and expecting a “long war” with China playing hard-ball into the US Election:

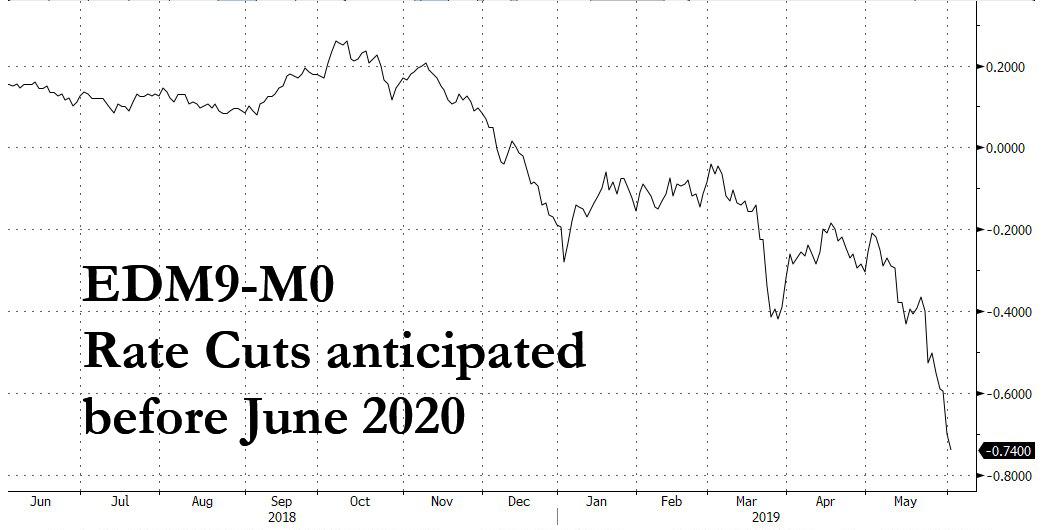

The good news, according to McElligott, is that his Treasury curve steepening view keeps bull steepening, with now greater than 3 Fed cuts implied before next June 2020, "as the market has moved from “growth scare”- to now “outright recession”- pricing on the new multi-fronted trade war & tariff escalation."

The "perverse" news? This is where the Nomura strategist reminds us of what we said in mid-May, namely that the risk is that with the market now fully positioned for a deflationary shock, the outcome will be diametrically opposite. Here's Charlie:

Despite this obvious “end-of-cycle growth scare escalating into recession” bullish catalyst for the crowded “Receiving Rates / Long Duration / USTs” trade & hedge (ED$ continues to act as the best hedge on the board for risk assets, just as stated here a month ago), there is simultaneously the growing risk of an “inflation impulse” NEGATIVE shock to the trade, via the cumulative impact of 1) the *expected* fourth tranche of China tariffs on top of the prior announced tariff impact and 2) the *assumed* full-impact of the Mexican tariffs (going all the way to 25%) which per Lew Alexander’s US Econ team would add upwards of an additional +0.75 to US Core PCE by 1Q20—setting-up the potential for a “stagflation-lite” type of environment

Why did Nomura suddenly reassess that stagflation is the biggest risk? McElligott cites new academic research published recently by the NY Fed's economic blog, showing a nearly 100% pass-through of the 2018 tariff costs into domestic prices of imports, to wit:

“The magnitude of these costs depends on how a tariff affects the prices charged by foreign exporters and the U.S. demand for imported goods. Studies, including our own, have found that the tariffs that the United States imposed in 2018 have had complete pass-through into domestic prices of imports, which means that Chinese exporters did not reduce their prices. Hence, U.S. domestic prices at the border have risen one for-one with the tariffs levied in that year. Our study also found that a 10 percent tariff reduced import demand by 43 percent.”

According to McElligott, the dangerous for markets implication is that "even as the Rates market continues to press “Fed policy cut” bets to new (unprecedented) levels—the Fed might in-fact be relatively “constrained” in the sense that they cannot cut to the same extent which the market is attempting to price, due to the Committee’s awareness of the impact that the tariffs will have on import prices—so the risk is that this inability for the Fed to keep pace with market pricing could in-fact create a de facto “hike” relative to VERY extended cutting expectations and risk generating a Rate Vol event into a market that’s been structurally/systematically shorting Rate Vol for years."

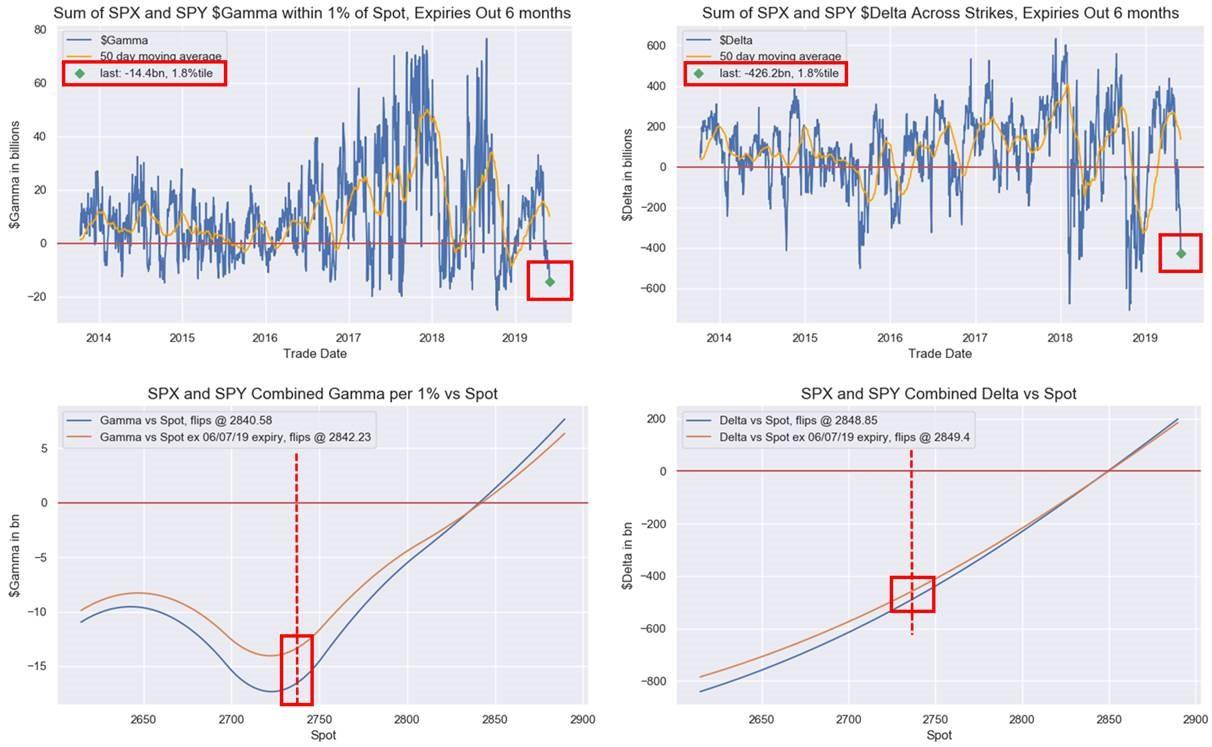

Whether Goldman is right about the coming inflationary spike (it would assume that intermediaries can, in fact, pass prices through instead of suffering a margin hit), and Nomura's fears about imminent stagflation come true, as of this moment US stocks extreme negative net Delta- and Gamma- positions, "thus almost certain to create “lunge-y” price-action from Dealer- and Client- hedging activity":

- SPX / SPY consolidated options ‘net Delta’ is -$426B (1.8%ile since 2013)

- SPX / SPY consolidated options ‘Gamma’ is -$14.4B (also just 1.8%ile since 2013)

- QQQ consolidated options ‘net Delta’ is -$14.5B (3.2%ile since 2013)

- QQQ consolidated options ‘Gamma’ is -$353mm (6.6%ile since 2013)

Finally for those traders wondering why the VIX remains "utterly contained" despite the ongoing equity selloff (today's intraday reversal aside), McElligott has there is a "pretty simple" explanation:

The broad-based US Equities “under-positioning” dynamic seen across various investor types YTD (recently extreme lows in “Beta to SPX” for HF L/S- and Macro- Funds, while the Risk Parity model shows gross-exposure to US Eq sits near 27 month lows) shows that there is not a lot of hedging “need” out there from the get-go because investors aren’t particularly “long”

- Equities single-stock shorts are doing their jobs and adding performance on the downside move, with “Crowded Shorts” hammered -12.7% QTD / “1Y Momentum Shorts” -11.3% QTD / “2018 Worst Performers” -10.9% QTD / “Most Shorted” -10.6% QTD as “Net Exposure” has been reduced by “grossing-up” Shorts

- Additionally, already over-weighted “Defensives” (i.e. low volatility “bond proxies”) are protecting as you’d expect into this Duration / Fixed-Income rally (REITS +0.3% QTD, Utes -0.4% QTD, Staples -1.7% QTD all versus SPX -2.9% QTD)

- There too is an already “Net Long Vega” investor position in the market (i.e. “no short vol to squeeze,” as notional net-Vega position from VIX ETN “longs” offsets the Non-Comm VIX Futures notional net-Vega “short” position)

- Skew overall is already extremely flat and continues going lower (SKEW index -2SD dating-back to 2009)

- Duration / USTs / Rates / Receiving have collectively insulated risk-assets as a hedge on the “other side” for investors (i.e. 60/40 Target Allocation proxy still +8.6% YTD)

[SITE INDEX -- MATA: DRIVERS - INFLATION]

READERS REFERENCE (SUBSCRIBERS-RESEARCH & PUBLIC ACCESS )

MATA: DRIVERS - INFLATION

MATASII RESEARCH ANALYSIS & SYNTHESIS WAS SOURCED FROM:

SOURCE: 06-03-19 - - "The Market's Biggest Risk: A Stagflationary Shock"

FAIR USE NOTICEThis site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a 'fair use' of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond 'fair use', you must obtain permission from the copyright owner.

NOTICE Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. MATASII.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility.